Amazon.com Inc. (AMZN) has launched a free and fast grocery delivery in London this week and plans to expand the service to the rest of the UK by the end of the year in a move to tap the increasing demand for online food sales accelerated by the coronavirus pandemic.

From Tuesday this week, Amazon Prime members in London can get the grocery delivery service at no cost from Amazon Fresh. The service includes members in around 300 postcodes across Greater London and the South East who will be able to do their weekly shop online and choose from a selection of products, including meat, seafood, produce, snacks and household essentials, with options for fast one-and two-hour delivery windows.

Previously, Amazon’s Fresh service was available to Prime members for an additional monthly charge.

“Grocery delivery is one of the fastest growing businesses at Amazon and we think this will be one of the most-loved Prime benefits in the UK,” said Amazon Fresh UK Country Manager Russell Jones. “We will keep improving the grocery shopping experience so by the end of the year, millions of Prime members across the UK will have access to fast, free delivery of groceries.”

In addition, same-day delivery will be available for orders placed before 9pm in most areas. Amazon Prime has over 150 million paid members worldwide. The e-commerce company launched Amazon Fresh back in 2016.

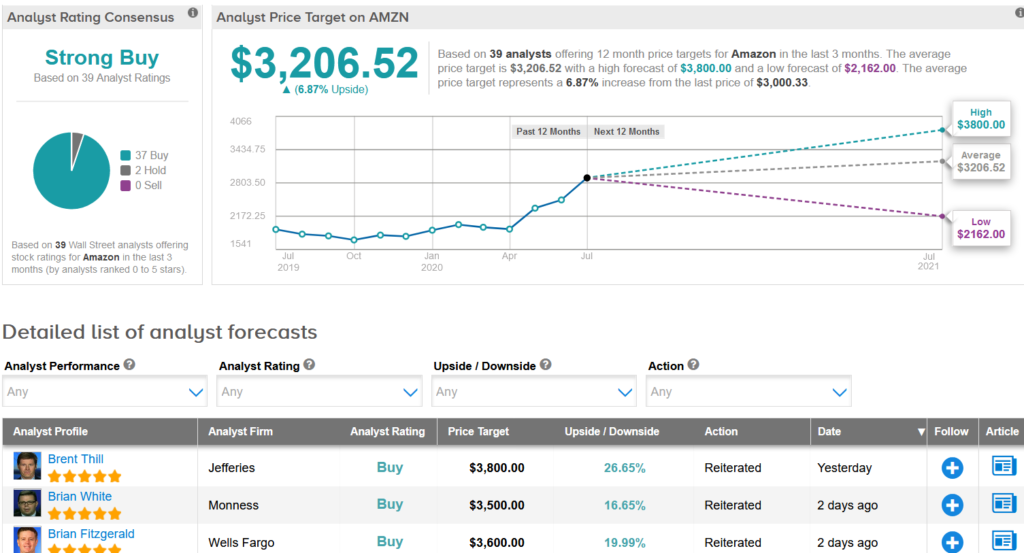

Shares in Amazon have been on a steady winning streak jumping 62% so far this year, with the $3,206.52 average analyst price target implying another 6.9% upside potential is lying ahead in the coming 12 months. (See Amazon stock analysis on TipRanks).

In the run-up to the e-commerce giant’s quarterly results on July 30, Jefferies analyst Brent Thill, says the bar is set high on the Street, but he views the company being well positioned to perform given the acceleration in broader e-commerce growth and its track-record of gaining share.

Thill added that historically Amazon has reported sales above the mid-point of guidance every quarter since 2017 and topped analyst consensus in all but two quarters during that period.

The analyst, who maintained a Buy rating on the stock with a $3,800 price target (27% upside potential), believes that Amazon is more focused on recent changes in consumer behavior looking to benefit from the attractive long-term opportunities they present for the company.

TipRanks data shows that overall Wall Street analysts are in line with Thill’s bullish outlook. The Strong Buy consensus boasts 37 Buys versus 2 Holds.

Related News:

Shopify Files For $7.5B Mixed Shelf Offering Ahead Of Earnings

Visa Pulls Back On Revenue Miss; RBC Reiterates Buy Call

Starbucks Spikes 6% After-Hours As Earnings Top Estimates