Altria Group posted stronger fourth quarter sales than analysts had forecasted largely driven by the stay-at-home smoking habits of its customers amid the coronavirus pandemic.

Altria’s (MO) net revenues for Q4 increased 4.9% year-on-year to $6.3 billion, which topped analysts’ forecasts of $5 billion. Full-year revenues increased by 4.2% year-on-year to $26.1 billion.

EPS in Q4 jumped by more than 100% year-on-year to $1.03, while adjusted diluted EPS declined by 2% to $0.99. Analysts were expecting $1.02 per share. Full-year earnings grew to $2.40 per share.

The company also announced a $2 billion share repurchase program that it expects to complete by June 30, 2022.

“Altria delivered outstanding results in 2020 and managed through the challenges presented by the COVID-19 pandemic,” said Altria’s CEO Billy Gifford. “Our tobacco businesses were resilient and we made steady progress toward our 10-year Vision to responsibly transition adult smokers to a noncombustible future.”

Altria sees earnings growth of between 3% and 6% in 2021 driven by market and industry trends including stay-at-home practices, unemployment rates, COVID vaccines and stimulus cheques. Analysts are projecting 2021 full-year adjusted EPS of between $4.49 and $4.62 (See Altria stock analysis on TipRanks)

Bernstein analyst Callum Elliott initiated a Buy rating on MO last week, setting a price target of $53. This implies upside potential of around 24% from current levels.

Elliott believes U.S. regulatory developments over the past 18 months have halted the progress of the vaping industry and have extended the lifetime of established cigarette brands.

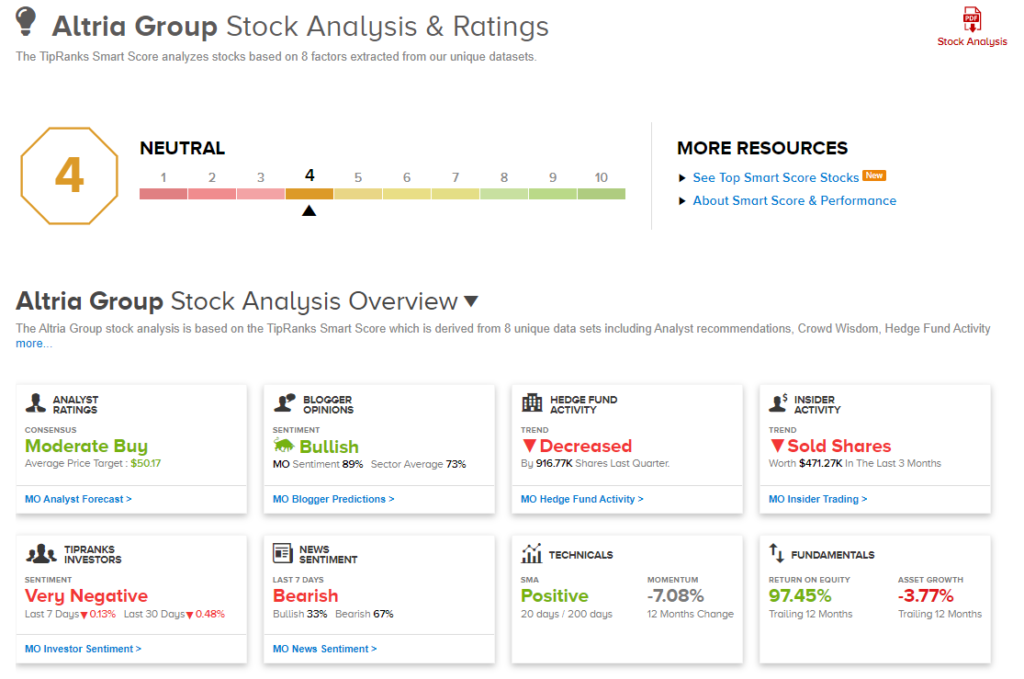

Altria receives a Moderate Buy consensus rating based on 4 Buys and 3 Holds. The average analyst price target of $50.17 suggests upside potential of around 18% over the next 12 months.

Altria scores a Market Neutral 4 out of 10 on TipRanks’ Smart Score which implies that the stock is likely to perform in line with market expectations.

Related News:

Skyworks Pops 15% After-Hours As 1Q Sales Beat Analysts’ Estimates

Juniper’s 4Q Sales Top Street Estimates; Shares Dip

Mondelez’s 4Q Profit Beats Analysts’ Estimates; Street Is Bullish