Alibaba is planning to raise as much as $8 billion by selling US dollar-denominated bonds as early as next week, according to reports by Reuters and Bloomberg. Shares declined 1.7% in Wednesday’s pre-market session.

The e-commerce giant seeks to tap at least $5 billion from international debt markets through a multi-tranche offering but could increase its bid depending on demand, Bloomberg and Reuters have learnt. The tenure is likely to be 10 years, while marketing documents were planned to be available as soon as next week, Reuters reported.

The debt offering, should it go ahead, is likely to be watched closely and could be seen as a test of confidence in Alibaba (BABA), which has been facing regulatory scrutiny. Back at home, Chinese officials have been hard on Alibaba’s businesses, suspending Ant Group’s $37 billion initial public offering and introducing new regulations to clamp down on anticompetitive behavior of internet companies.

What’s more, amidst all this regulatory havoc, Jack Ma, Alibaba’s billionaire founder has reportedly disappeared, and hasn’t been seen in public for more than two months, which does not add to investor sentiment.

The Chinese e-commerce giant has served investors well during the coronavirus pandemic as stay-at-home mandates and the work-at-home trend forced more and more people to shop online and change their purchase preferences. (See Alibaba stock analysis on TipRanks).

However, the stock has shed almost 20% over the past three months amid investor concern that anti-monopoly guidelines drafted by China’s market regulators could have a negative impact on the e-commerce giant’s operations.

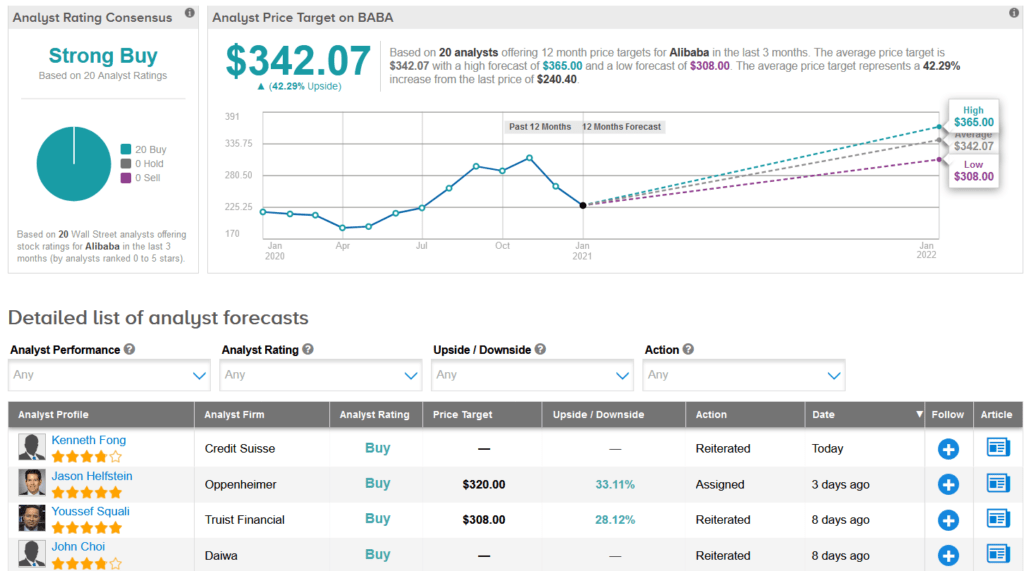

Meanwhile, Truist analyst Youssef Squali remains a big fan of BABA, while he also cautions that the regulatory issues do present a “key risk for the stock in 2021.” Bottom-line though, Squali maintains a Buy rating on the stock and a $308 price target (28% upside potential).

“Regulators are likely to use BABA as a way to regulate the online industry as a whole,” the analyst wrote in a note to investors. “While altering BABA’s business practices may be negative for the company short-term, we believe that consumers and merchants, if given a choice, will always gravitate toward the largest marketplaces with the most liquidity.”

Turning to other Wall Street analysts, the bulls have it. The Strong Buy consensus boasts 20 unanimous Buy ratings. That’s with an average price target of $342.07, indicating that a promising 42% upside potential lies ahead.

Related News:

Moderna’s Covid-19 Vaccine Gets Green Light From Israel; Shares Gain

McDonald’s Craves a Larger Share Of the Chicken Sandwich Market – Report

ATN To Take Alaska Private In $332M Deal; Raymond James Sticks To Buy