Agilent Technologies will pay $550 million in cash to buy Resolution Bioscience and an additional $145 million contingent upon achieving future performance milestones. Resolution Bioscience develops next-generation sequencing (NGS)-based precision oncology solutions.

The deal is sought to complement and expand Agilent’s (A) business portfolio in NGS-based cancer diagnostics to further penetrate the precision medicine market. Agilent manufactures instruments and develops software for the life sciences and diagnostics market.

The acquisition is expected to be “slightly dilutive” to Agilent’s non-GAAP earnings per share (EPS) in FY21 and FY22 but improve in the following years.

Agilent’s CEO Mike McMullen said, “By adding Resolution Bioscience’s liquid biopsy-based diagnostic technologies to our portfolio, we are strengthening Agilent’s offering to our biopharma customers and boosting the growth of our diagnostics and genomics business. This also accelerates our strategy to broaden access to precision oncology testing for patients worldwide through distributed NGS-based diagnostic kits. We look forward to Resolution Bioscience joining with us to expand our work in the fight against cancer.”

The deal is expected to close in April this year.

Resolution Bioscience’s liquid biopsy assay platform is non-invasive, enabled by its Clinical Laboratory Improvement Amendments (CLIA)-certified lab and serves both the biopharma customers and the clinical oncology diagnostic testing market. The company had revenues of $35 million last year and is expected to generate revenues of between $50 million to $55 million this year. (See Agilent stock analysis on TipRanks)

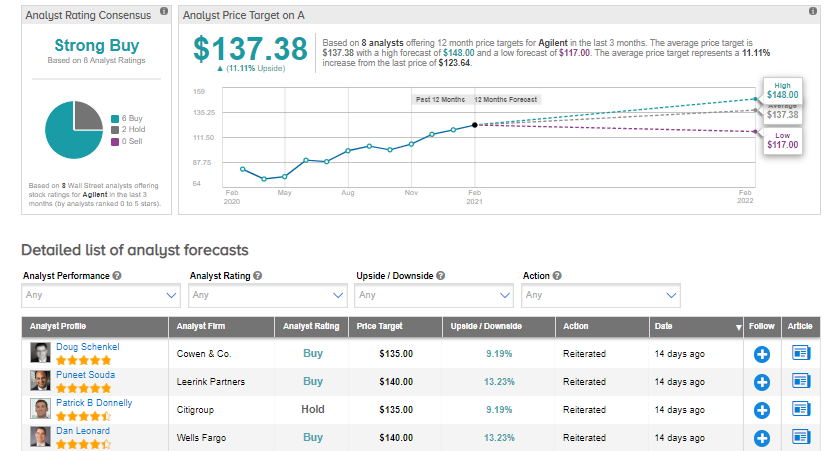

Last month, Wells Fargo analyst Dan Leonard raised the stock’s price target from $120 to $140 and reiterated a Buy rating. Leonard believes that the current growth challenges for the company are temporary and “growth should reaccelerate in 2021 and beyond, with Agilent’s strong quarter and modestly improved outlook”.

The rest of the Street is bullish on the stock with a Strong Buy consensus rating based on 6 Buys and 2 Holds. The average analyst price target of $137.38 implies around 11% upside potential to current levels.

Related News:

Urban Outfitters 4Q Sales Fall Due To COVID-19; Shares Slip

FuboTV Posts Wider-Than-Feared 4Q Loss; Shares Drop 4.5% Pre-Market

Beyond Meat To Raise $979.4M From Debt Sale