Abercrombie (ANF) delivered solid third-quarter results on the back of robust growth in the U.S market. Revenue and earnings topped consensus estimates, as the company benefited from strong digital sales growth. Nevertheless, ANF shares fell 12.59% to close at $41.12 on November 23.

Abercrombie is a retailer that specializes in apparel, personal care products, and accessories. Its product line includes knit tops, woven shirts, sweaters, and jeans. It also deals in personal care products for men and women.

Q3 Results

Net sales in Q3 grew 10% year-over-year to $905 million, exceeding consensus estimates of $896.86 million. Digital net sales, which accounted for 46% of total sales, grew 8% year-over-year to $413 million. The increase can be attributed to strong growth in the U.S., where sales grew 17% year-over-year.

Abercrombie delivered adjusted non-GAAP earnings of $0.86 a share, an improvement from $0.76 a share delivered the same quarter last year. In addition, earnings topped consensus estimates of $0.66 a share. (See Top Smart Score Stocks on TipRanks)

During the quarter, Abercrombie repurchased 2.7 million shares, bringing the total repurchases for the year to $235 million. The board of directors has since approved a new $500 million repurchase program, replacing the February 2021 share repurchase program of 10 million shares. The previous program had 3.9 million shares remaining.

According to CEO Fran Horowitz, the holiday season has been on a roll, with customers coming out early to shop. In addition, Abercrombie continues to manage the supply chain constraints that threaten to trigger production and delivery delays, as well as elevated costs.

Stock Rating

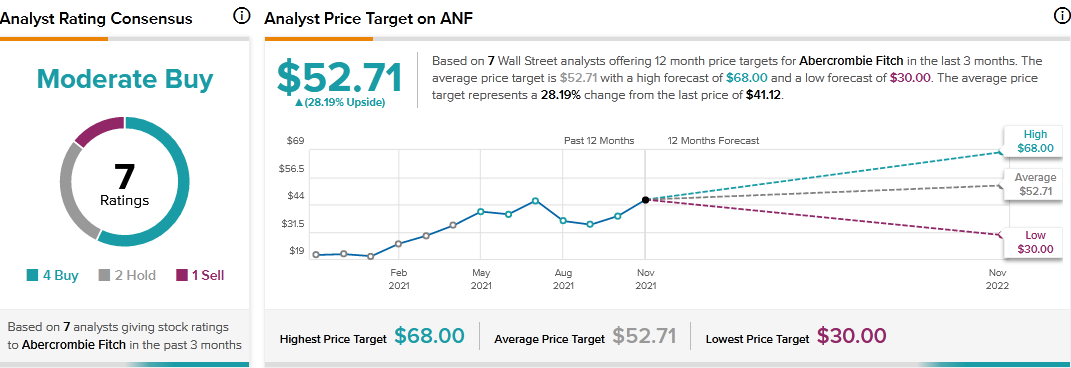

Yesterday, Citigroup analyst Paul Lejuez reiterated a Buy rating on the stock with a $60 price target, implying 45.91% upside potential to current levels. According to the analyst, the risk-reward on Abercrombie is attractive, going by the solid momentum in business. Also, management is on track to buy back 15% of the market cap in stock. The recent pullback, according to the analyst, is significantly “overdone.”

Consensus among analysts is a Moderate Buy based on 4 Buys, 2 Holds and 1 Sell. The average Abercrombie price target of $52.71 implies 28.19% upside potential to current levels.

Related News:

VMware’s Q3 Results Beat Expectations

Plug Power Concludes Buyout of Applied Cryo Technologies

BlackBerry, L-SPARK Announce Third Phase of Accelerator Program