Abbott Laboratories (ABT) announced on Monday that it has reached an agreement with Edwards Lifesciences Corp. (EW) to settle all outstanding patent disputes related to heart valve medical devices or so-called transcatheter mitral and tricuspid repair products.

As part of the agreement, Abbott will receive a one-time payment and ongoing payments based on sales of Edwards’ Pascal transcatheter valve repair system through 2025 as well as a potential sales milestone payment in 2026. Further details of the settlement are confidential, the two companies said.

The dispute centered around whether Edwards’ Pascal transcatheter system infringed on Abbott’s patents by being similar to its transcatheter MitraClip valve repair system.

The agreement results in the dismissal of all pending cases or appeals in courts and patent offices worldwide, and includes a provision that the parties will not litigate patent disputes with each other in the field of transcatheter mitral and tricuspid repair and replacement products for the 10-year duration of the agreement. In addition, the injunctions currently in place against the sale of Edwards’ transcatheter mitral and tricuspid repair system are lifted.

Shares in Edwards rose 2% in Monday’s extended market trading after the California-based company said in a separate statement that the agreement is a “positive development”. As a result, it will record a one-time settlement expense in the quarter ended June 30 and incur royalty expenses through May 2024.

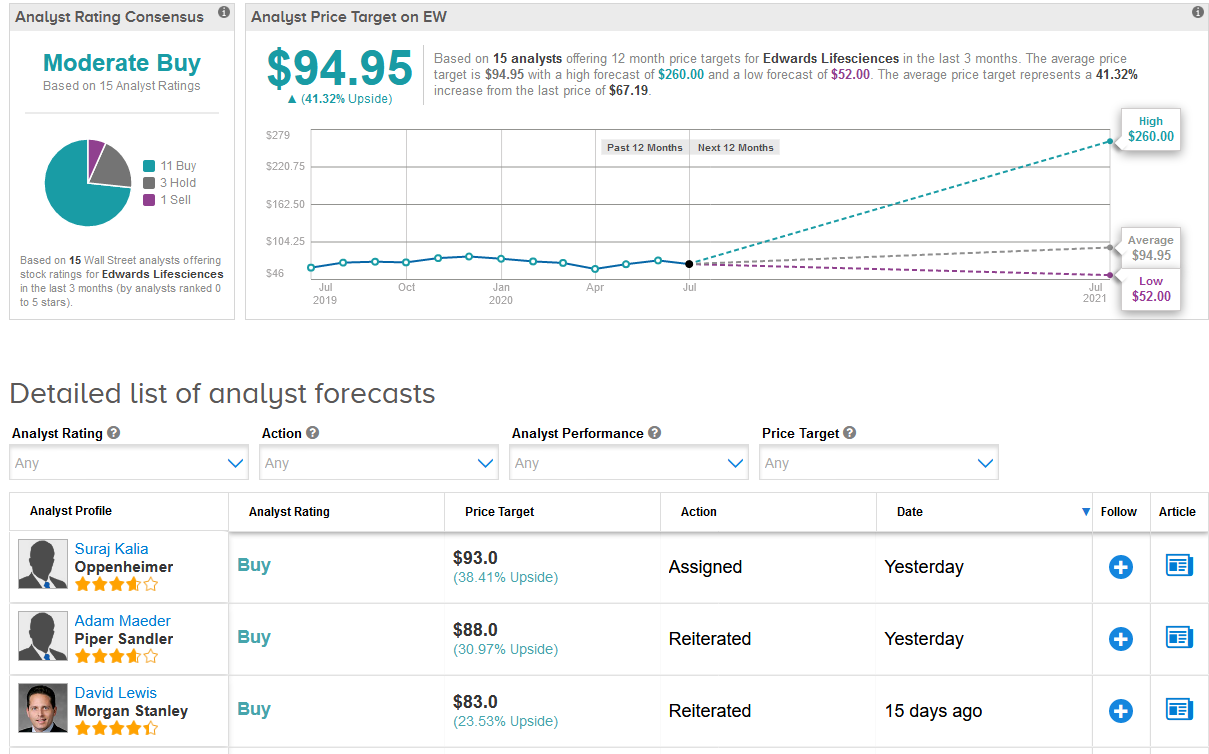

Commenting on the settlement, Piper Sandler analyst Adam Maeder maintained a Buy rating on the stock with a $88 price target (31% upside potential), saying that the agreement for which the company will take a pre-tax charge of $368 million in Q2, will remove an overhang from the shares.

Maeder added that while data is still premature, Edwards’ Pascal device appears to be “highly competitive” with Abbott’s latest generation of MitraClip devices.

Turning to other Wall Street analysts, the rating outlook on the stock is cautiously optimistic. The Moderate Buy consensus breaks down into 11 Buys versus 3 Holds and 1 Sell. With shares down 14% this year, the $94.95 average price target implies a promising 41% upside potential over the coming year. (See EW stock analysis on TipRanks)

Related News:

Aldeyra Spikes 10% In Pre-Market On New Perceptive Stake

Equillium Explodes 260% On Positive Covid-19 Results; India Approval

Gilead Reveals Covid-19 Treatment Remdesivir Reduces Mortality Risk