Shares in CyberArk Software (CYBR) fell more than 6% after the company warned that more “cautious” buying decisions by its customers will impact sales and cash flow in the near-term.

The stock declined 6.3% to $102.80 in morning U.S. trading. The cybersecurity company said profit in the first quarter dropped to 50 cents per share from 56 cents in the year-earlier period, while beating the consensus estimate by 16 cents. Total revenue in the first three months of the year increased 11% to $106.8 million year-on-year, which was $21 million above market estimates.

“Given the weakened economic environment due to Covid-19, we expect customers to make more cautious purchasing decisions which will impact our revenue and cash flow from operations in the near term,” said Josh Siegel, CyberArk Chief Financial Officer. “We believe deal close rates, particularly for new business and in certain verticals, will be less predictable and have therefore decided to withdraw our full year 2020 guidance.”

The cybersecurity company however still provided financial guidance for the second quarter. Total revenue is expected to decline to a range of $95 million-$105 million, which is below market consensus of $109.7 million. Diluted earnings per share in the second quarter are estimated to fall in a range of 17 cents-35 cents versus market consensus of 40 cents.

“We were pleased to deliver results in line with or exceeding all guided metrics for the first quarter,” said Udi Mokady, CyberArk Chairman and CEO. “Privileged Access Management (PAM) is even more critical today with attackers exploiting the sudden and dramatic change in enterprise IT created by remote work environments. In this higher threat environment, our level of engagement with customers has increased as they look to better secure their extended enterprise by expanding their PAM programs.”

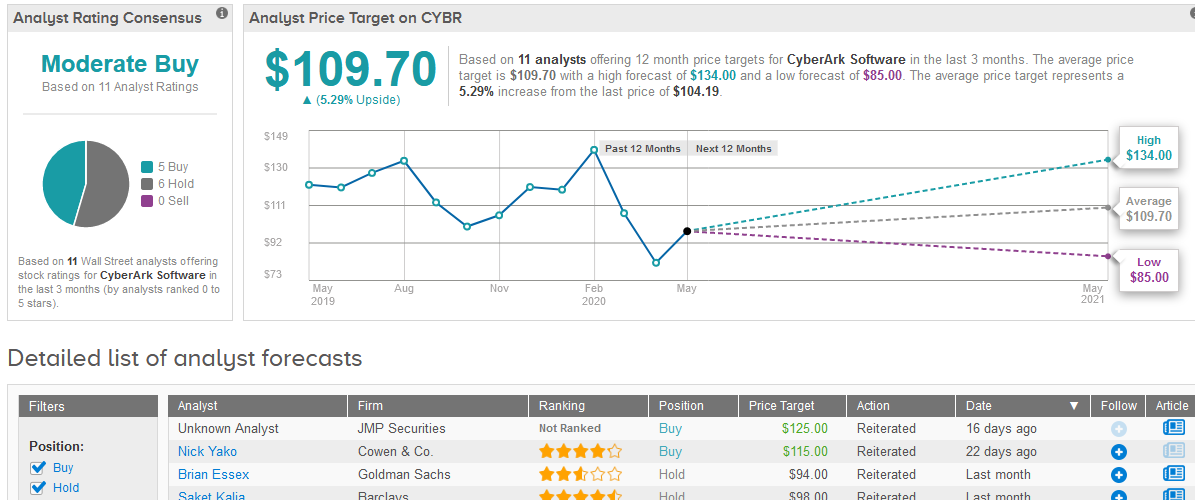

Turning now to Wall Street, analysts take a cautious stance on the company’s stock. The Moderate Buy consensus splits into 6 Holds and 5 Buys. The $109.70 average price target indicates 5.3% upside potential in the shares in the coming 12 months. (See CyberArk stock analysis on TipRanks).

Looking ahead, CyberArk plans to manage expenses for the full year to better align with its top line, while also making investments and hire for key roles.

In a separate statement, the company announced the acquisition of identity security company Idaptive in a $70 million cash deal.

In the first quarter, CyberArk generated $33.8 million in net cash provided by operating activities, down from $45.9 million year-on-year. As of March 31, it had $1.2 billion in cash, cash equivalents, marketable securities and short-term deposits. This compares with $509.7 million in cash, cash equivalents, marketable securities and short-term deposits during the same period last year.

Related News:

Tesla’s California Auto Plant Gets Go-Ahead to Reopen Next Week

Intel, Taiwan Semiconductor Said to Be in Talks with Trump to Build U.S. Plants

Uber Announces $750M Notes Offering, As GrubHub Takeover Reports Swirl