Analyst Geoff Porges from Leerink weighs in on pharmaceutical giants Gilead Sciences, Inc. (NASDAQ:GILD) and Celgene Corporation (NASDAQ:CELG) ahead of the American Society of Clinical Oncology (ASCO) meeting, which will begin next week in Chicago. At the highly anticipated event, several biotech companies at the forefront of cancer research will convene to share trial data and pipeline updates.

Gilead Sciences, Inc.

All eyes will be on Gilead’s pipeline drug GS-5745 for gastric cancer at this year’s ASCO meeting. The drug is currently in Phase 3 testing. Porges calls the drug “one of the more intriguing un-heralded assets in the company’s early to mid-stage development portfolio.”

GS-5745 is a MMP inhibitor, which in general have had “limited clinical success with more than 50 different inhibitors failing trials for various cancers,” according to the analyst. In this trial of 40 patients, a handful of the patients experienced tolerable adverse effects. Specifically, 18% experiences neutropenia and 10% experienced nausea. Thirty of the 40 patients were chemo-naïve and Porges points to the median PFS (progression free survival) of 12 months in the 30 chemo-naïve patients, compared to the 7.4 month PFS of the whole cohort. Porges describes the 12 month PFS as “an impressive result.”

The Phase 3 study for GS-5745 in gastric cancer is now underway. The analyst comments, “Given the history of the class, we maintain our healthy skepticism about this drug’s potential. The results of the trial are enough to justify some careful optimism about a molecule that could add considerable, unexpected upside to GILD’s stock in a therapeutic area where the company has recently struggled.”

Despite recent news that Gilead is ending all clinical trials of Zydelig, a drug approved in the US and EU to treat several forms of cancer, in frontline settings due to safety concerns. Porges notes that this will only have a “minor near-term” impact on the company, but it “does not have an impact on future revenue.”

Porges rates GILD stock an Outperform, with a price target of $123, marking a 48% upside.

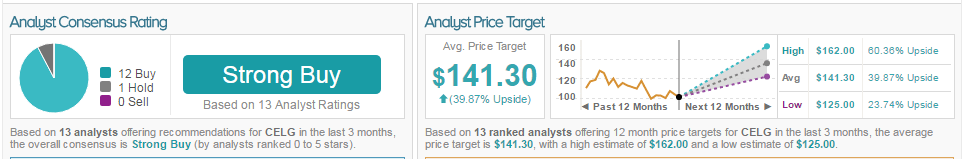

According to TipRanks.com, which measures analysts’ and bloggers’ success rate based on how their calls perform, analyst Geoff Porges has a yearly average return of -2.9% and a 31% success rate. Porges has a -7.5% average return when recommending GILD, and is ranked #2969 out of 3929 analysts.

Out of the 23 analysts polled by TipRanks, 17 rate Gilead Sciences stock a Buy, while 6 rate the stock a Hold. With a return potential of 38.2%, the stock’s consensus target price stands at $115.17.

Celgene Corporation

In addition, Porges comments on the investigator-sponsored study of Celgene’s nab-paclitaxel vs. paclitaxel in the neoadjuvant setting of HER2-negative breast cancer. The analyst explains that the study “failed to show a statistically meaningful difference,” thus eliminating “the potential for incremental revenue in this indication.”

However, Porges qualifies that this should “not materially threaten Abraxane’s current revenue base.” Abraxane is approved to treat specific forms of lung cancer, pancreatic cancer, and breast cancer. He explains, “We view this negative result has having limited impact on CELG, since in this setting duration of treatment is short and does not represent a significant opportunity for Abraxane.”

The analyst notes that the abstract of atezolizumab in combination with nab-paclitaxel in metastatic triple negative breast cancer “does not provide new data.” However, this data could serve as a “‘placeholder’ abstract with potential new data presented at the meeting itself.”

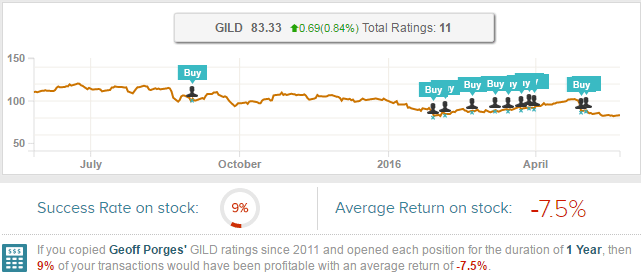

According to TipRanks, 92% of analysts covering Celgene are bullish on the company while 8% remain neutral. The average 12-month price target is $141.30, marking a 40% potential upside from current levels.