Tesla Motors Inc (NASDAQ:TSLA) is falling over 11% in pre-market trading following news that the electric car marker will purchase SolarCity Corp (NASDAQ:SCTY) for $2.8 billion. The company aims to access Solar City’s distribution networks and technology, all under the Tesla brand. This raises a conflict of interest as Musk is the chairman of SolarCity and the largest shareholder of the company. As a result, Musk, as well as his cousin and Solar CEO, Lyndon Rive, have recused themselves from voting on the deal.

Investors are worried that finances will shift away from Tesla, which needs capital to fund its various projects and delivery estimates. Related, Solar City has posted consistent quarterly losses, decreasing close to 60% YTD.

Following the announcement, Robert W. Baird analyst Ben Kallo reiterated an Outperform rating on the stock with a $338 price target. He states, “We believe TSLA shares could face pressure in the near term as the news is digested and due to potential arbitrage opportunities, although we continue to believe TSLA offers significant upside potential for long-term investors.”

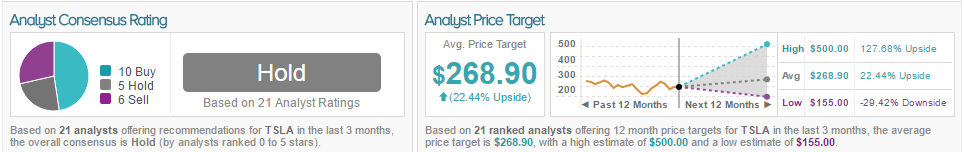

According to TipRanks’ statistics, out of the 21 analysts who have rated the company in the past 3 months, 10 gave a Buy rating, 6 gave a Sell rating, and 5 remain on the sidelines. The average 12-month price target for the stock is $268.90, marking a 22% upside from where shares last closed.

Pluristem Therapeutics Inc. (NASDAQ:PSTI) is up close to 11% in pre-market trading after the company presented positive data showing that preclinical studies of its PLX-PAD cells effectively treat Duchenne muscular dystrophy. The results demonstrated that in mice, PLX-PAD cells reduced CPK, a marker of muscle degeneration, by 50% compared to the placebo. CEO Zami Aberman stated, “Because PLX-PAD cells have already displayed efficacy in muscle regeneration in a Phase II muscle injury study, we believe our cell therapy may potentially be beneficial in Duchenne muscular dystrophy in human clinical trials.”

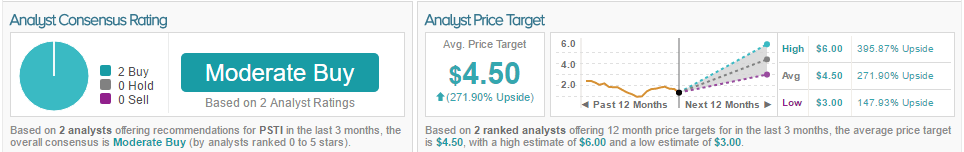

According to TipRanks, 2 analysts have rated the company in the past 3 months, both with a Buy rating. The average 12-month price target for the stock is $4.50, marking a 272% upside from where shares last closed.

Adobe Systems Incorporated (NASDAQ:ADBE) is down 4% in premarket trading after the company released Q2:16 earnings yesterday after market close. The company posted revenues of $1.4 billion, in line with consensus, and adjusted earnings per share of $0.71. However, investors were more focused on Q3 guidance, as the company expects revenues of between $1.42 bill and on $1.47 billion, with earnings ranging from 69 to 79 cents. This is slightly below consensus guidance estimates of $1.47 billion in revenue and in-line with earnings estimates of 71 cents per share. While the company expects to reach its 2016 targets, slightly weak Q3 guidance takes into account seasonality in cloud product sales.

Analyst Brent Thill of UBS weighed in on the stock following earnings, reiterating a Buy rating and price target of $122. He states, “Marketing Cloud has been choppy, and with CRM scooping up the top e-commerce asset, some investors are asking if ADBE needs another major Cloud to drive L-T growth.” He continued, “We still like ADBE’s prospects… but stock could trade sideways in the S-T after the Q1 euphoria was deflated by a more normal Q2, and investors look for excitement in the 2H.”

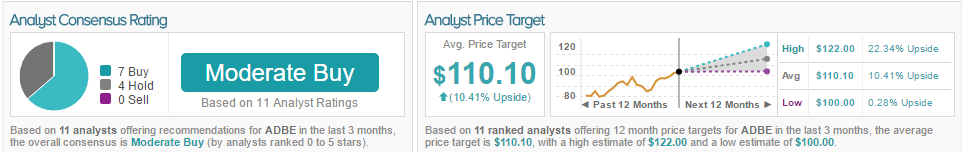

According to TipRanks, out of the 11 analysts who have rated the stock in the last 3 months, 7 gave a Buy rating and 4 remain on the sidelines. The average 12-month price target for the stock is $110.10, marking a 10% upside from where shares last closed.