UBS Analyst Stephen Chin chimed in on chip giants Advanced Micro Devices, Inc. (NASDAQ:AMD) and Micron Technology, Inc. (NASDAQ:MU) as both companies are at risk of underperforming as they face weak PC demand. Let’s take a closer look.

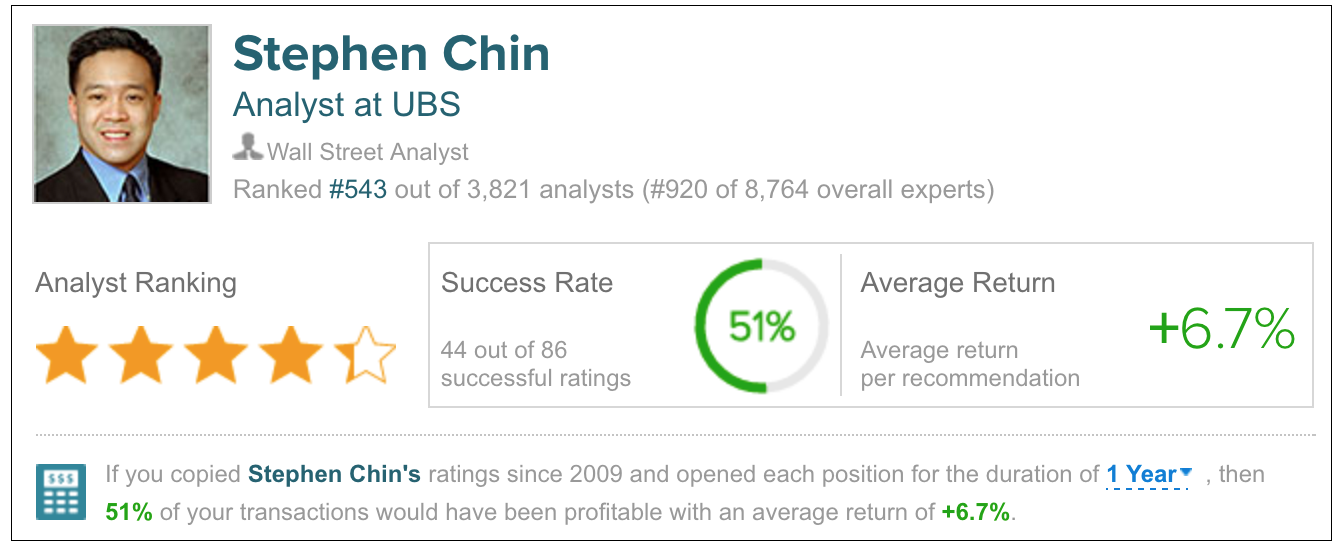

According to TipRanks which measures analysts’ and bloggers’ success rate based on how their calls perform, analyst Stephen Chin has a yearly average return of 6.7% and a 51% success rate. White is ranked #543 out of 3765 analysts.

Advanced Micro Devices, Inc.

UBS analyst Stephen Chin reiterated a Sell rating on shares of AMD, while raising the price target to $1.75 (from $1.50). Chin is lowering his estimates on AMD in light of weak PC demand, however, he sees better visibility on VR upside.

Chin remains cautious on AMD as he lacks near-term conviction that the stock can return to profitability and positive cash flow given the poor PC industry demand trends. Chin believes that AMD’s previously set profitability target for 2H is at risk and estimates that 25% revenue growth is needed for 2H16 vs 1H16 with 32% or better gross margin is additionally needed. The 2H16 revenue recovery, according to Chin, “depends on PC demand improving, strong game console seasonality, uptake of virtual reality goggle, and the ramp of a new semi-custom customer.” After UBS Global team’s Asia Tech tour, Chin expects weaker PC shipments in 2016 and 2017, which could lead to sales trending “towards the lower end of expectations near term.”

AMD’s Capsaicin event at the Game Developer Conference in 2016 encouraged Chin as partnerships with gaming and VR developers could boost momentum in GPUs. Processor/GPU exposure in the untethered Sulon Q VR/AR headset, according to Chin, Is a “unique opportunity” although performance could be “modest compared to Oculus and HTC,” which are connected to high-end gaming PC.

AMD disclosed the Vega (approx. 1H17) and Navi (2018) products that take advantage of new memory technologies and continue to improve performance/watt by an estimated 50% per generation. Further, a recent Bloomberg article highlighted that Intel could be in talks to License AMD’s graphics IP. This deal, which Chen is uncertain will happen, could improve the “stock sentiment.”

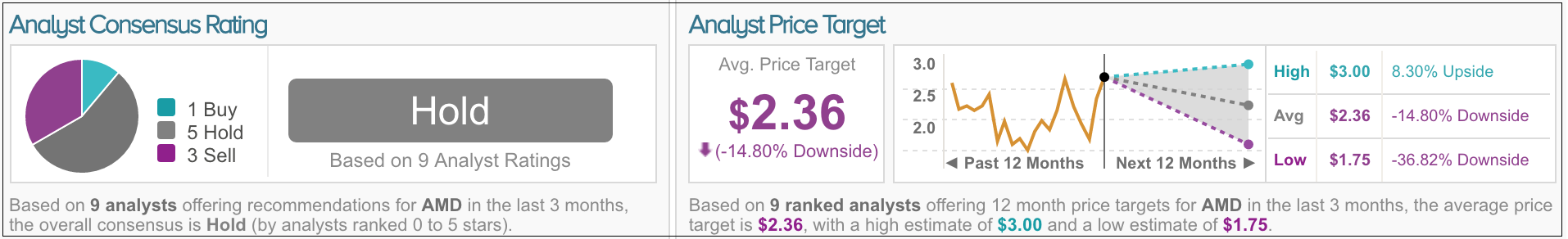

As of this writing, of the 9 analysts polled by TipRanks (in the past 3 months), 1 analyst rates the stock a Buy, 5 rate the stock a Hold, and 3 analysts rate the stock a Sell. The average price target for MU is $2.36, which represents a 14.80% downside.

Micron Technology, Inc.

Chin also reiterated a Buy rating on shares of Micron, while lowering the price target to $16.50 (from $15.00) and reducing F16 estimates on the back of lower pricing and margin assumptions.

Chin maintains his rating on Micron as industry supply checks “suggest DRAM [dynamic random access memory] industry bit supply growth could moderate further in C16 and is trending to 22% YoY in response to weaker demand from PC OEMs and some slowing in mobile.” Chin believes this could assist in normalizing prices in 2H, which would help the sentiment around the stock along with margin benefits from the Inotera transaction and cost reductions from 20nm DRAM and TLC NAND for SSD.

According to Chin, the weaker PC and mobile demand backdrop as well as a stable server suggest “Micron’s DRAM and NAND flash prices likely saw another steep decline in Feb ’16 quarter. “Chin believes that hitting cost reduction milestones will be Micron’s main focus this year as they ramp up 3D NAND output near term as well as increase 16nm TLC supply for SSD products. The 1xNM DRAM development will also be “critical” for FY17.

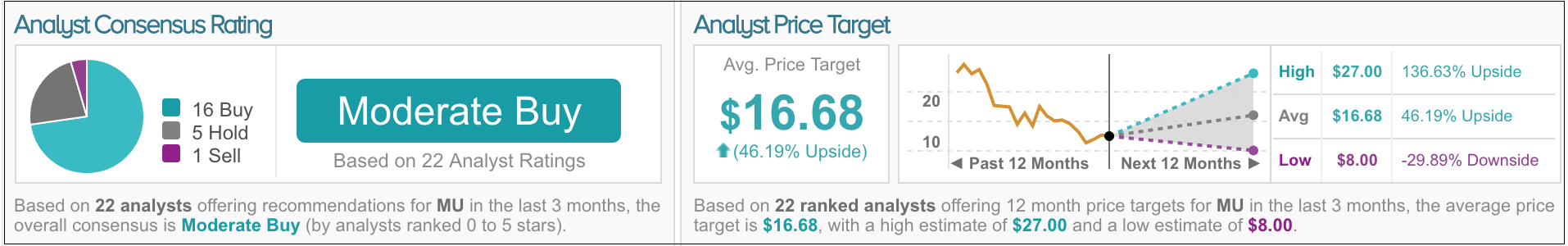

As of this writing, of the 22 analysts polled by TipRanks (in the past 3 months), 16 analysts are bullish on MU stock, 5 are neutral on the stock, and 1 is bearish on the stock. The average price target for MU is $16.68, which represents a 46.19% upside.