Wal-Mart Stores, Inc. (NYSE:WMT) is up 8% in premarket trading after the company posted solid Q1:16 earnings. The company posted better than expected revenues of $115.9 billion, compared to consensus estimates of $1113.2 billion, and earnings of $0.98, compared to consensus estimate of $0.88 for the quarter. The company attributed this win by its $2.7 billion investment to improve its workforce by raising entry level wages and increased training, resulting in higher customer service scores and increased store visit. The company was able to post a 0.09% q/q increase in revenue despite a stronger dollar which reduces its impact overseas. Management also credited growth in eCommerce sales for the quarter’s success.

CFO Brett Biggs stated, “Overall a pretty strong quarter.” He continued, “We are very pleased with the traffic increases, and I think that goes along with what we are seeing with customer experience scores that continue to improve.”

Cowen analyst Oliver Chen noted, “We’re encouraged traffic was positive for the 6th straight quarter at +1.5% on top of LY’s +1.0% and accelerating from the +0.7% y/y seen in 4Q. Mgmt. noted in the pre-recorded earnings call that the strong WMT US comps and positive traffic speak to the real improvement the company has made in the store experience. Sam’s Club comps were +0.1% ex. fuel, above our -0.2% estimate, the Street’s -0.1% est., and modestly ahead of mgmt.’s guide of Flat. Lastly, International sales of $28.08B or -7.2% y/y came in ahead of our $27.55B -90% y/y estimate as 10 out of WMT’s 11 markets comped positive.”

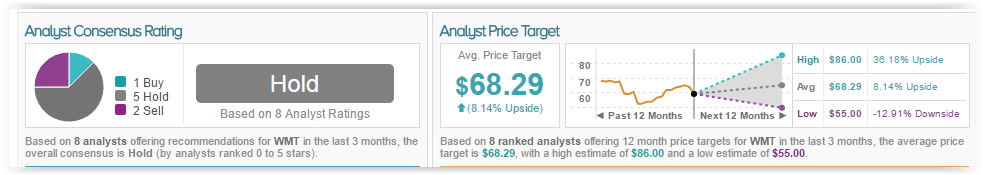

According to TipRanks’ statistics out of the 8 analysts who have rated the company in the past 3 months, 1 gave a Buy rating, 2 gave a Sell rating, and 5 remain on the sidelines. The average 12-month price target for the stock is $68.29, marking an 8% upside from where shares last closed.

Tonix Pharmaceuticals Holding Corp (NASDAQ:TNXP) is up 22% in pre-market trading after the company announced positive topline results from a phase 2 study of TNX-102 SL in PTSD. The study reached its primary endpoint of a 12-week mean change from the baseline severity of PTSD symptoms when treated with the 5.6 mg dose (vs the 2.8 mg dose). The drug was also well tolerate by patients. Following the results, Seth Ledermand, M.D., CEO of Tonix stated “We are pleased to have established a dose-response relationship of TNX-102 SL in this Phase 2 PTSD study and identified the 5.6 mg dose as appropriate for Phase 3 development” and indicated plans to meet with the FDA to discuss a clinical program. He continued, “The results of the AtEase Study not only support the development of TNX-102 SL 5.6 mg towards commercialization, but also help to better understand PTSD, a serious and disabling condition affecting many veterans who have served our country.”

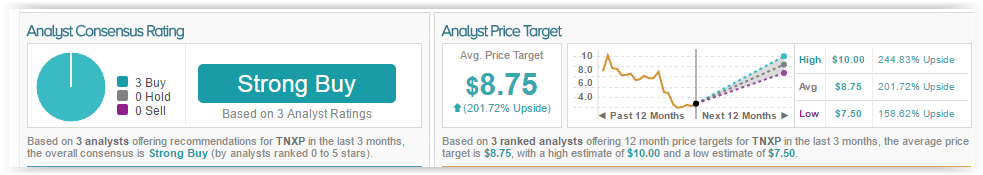

According to TipRanks, all 3 of the analysts who have rated the company in the past 3 months gave a Buy rating. The average 12-month price target for the stock is $8.75, marking a 201% upside from where shares last closed.

Repros Therapeutics Inc (NASDAQ:RPRX) is up 30% in pre-market trading after the company reported positive clinical data for Oral Proellex, a drug used to treat several menstrual bleeding due to uterine fibroids. The study met its primary end point of induction of amenorrhea (cessation of menses) compared to the placebo. The study indicated that 100% of patients reported a reduction in diary reports of menstrual bleeding product usage. The study also indicated a statistically significant reduction in fibroid size compared to the placebo. The company plans to request an end of phase 2 meeting with the FDA, also discussing plans for phase 3, once both 18 week course treatments complete.

Halcon Resources Corp (NYSE:HK) is down a staggering 79% following the announcement that the company will file for prepackaged chapter 11 bankruptcy in order to restructure and to resolve $1.8 billion worth of debt. HK joins the list of over 60 oil companies that had to file for bankruptcy due to low crude prices hindering cash flows. The company stated it reached an agreement with some debt holders, planning to seek funds from additional lenders. The restructuring will absolve $222 million of preferred equity and reduce $200 million worth of annual interest payments.