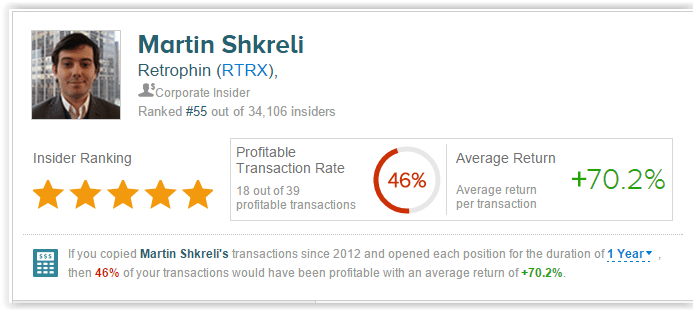

KaloBios Pharmaceuticals Inc (NASDAQ:KBIO) plunged 53% in pre-market trading this morning to $11.03 after CEO Martin Shkreli was arrested earlier today on security fraud charges. According to Bloomberg, Shkreli was charged with illegally taking stock from previous company Retrophin to pay off debts for his failed hedge fund, MSMB Capital Management, which lost millions. He is accused of setting up sham consulting arrangements where he made secret payoffs. Evan Greebel, a New York lawyer, was also arrested as Shkreli’s partner in the scheme. According to TipRanks’ statistics, Martin Shkreli has a 46% profitable transaction rate and a 70.2% average return per recommendation.

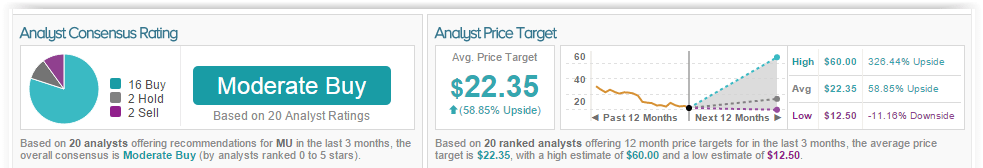

Micron Technology, Inc. (NASDAQ:MU) rose 4% in pre-market trading this morning to $14.63 following an upgrade from analyst Joseph Moore of Morgan Stanley. The analyst upgraded the company to Overweight from Equalweight and raised his price target to $18 from $16. Although near term fundamentals concerns the analyst, he believes now is a compelling entry point for shares as sentiment and valuation are low. Meanwhile, he believes the company’s industrial structural improvements and high value of its memory assets will prevent shares from falling under a certain price. Despite worse than expected 2015 DRAM declines, Moore states that recent news has been positive and believes supply and demand will balance out in the upcoming year.

According to TipRanks’ statistics, out of the 20 analysts who have rated MU in the last 3 months, 16 gave a Buy rating, 2 gave a Sell rating, and 2 remain on the sidelines. The average 12-month price target for the stock is $22.35, marking a 59% upside from where shares last closed.

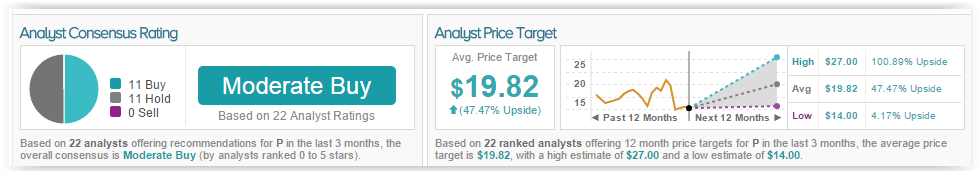

Pandora Media Inc (NYSE:P) is up nearly 20% in pre-market trading to $16.07 after the company confirmed Copyright Royalty Board ruling, stating that artists and record labels will see a 15% increase in Pandora royalties. Pandora investors see this ruling as a win as the new rate of $0.0017 of royalty per song is well below the demand of $0.0025. Furthermore, the rate per subscription was lowered from $0.0025 to $0.0022. In light of the ruling, Richard Tullo of Albert Fried upgraded the stock to Overweight and raised his price target to $20, from $11. The analyst commented, “It’s a win,” regarding the CRB ruling; “Any number below 20 cents was good for the company.” As of this writing, analysts on TipRanks are split on Pandora, with 11 recommending the company as a Buy and 11 staying on the sidelines. The current 12-month average price target between these 11 analysts is $19.82, marking a 47% potential upside from current levels.

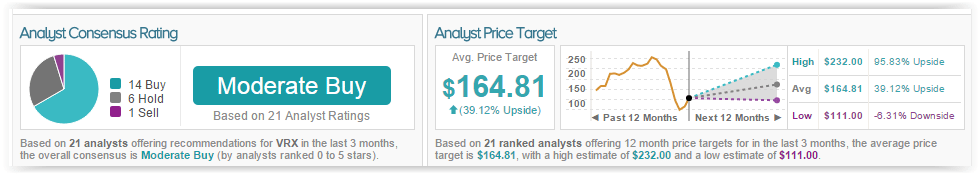

Valeant Pharmaceuticals Intl Inc (NYSE:VRX) slipped more than 2% in pre-market trading to $116 after the cut company cut earnings guidance. Fourth quarter adjusted earnings were slashed from $4-$4.20 down to $2.55-$2.65. The company decreased revenue estimates from $3.25 billion-$3.45 billion down to $2.7 billion to $2.8 billion. This decrease in guidance comes as the company struggles to recover from fraud allegations associated with a specialty pharmacy, though a recent deal struck with Walgreens is expected to recoup recent loses. Analyst Irina Rivkind Koffler of Mizuho Securites downgraded the company from Outperform to Neutral and cut her price target from $130 to $110, commenting, “there is now less certainty about Valeant ‘crushing the numbers’ each quarter and we struggle to identify a near-term catalyst.” According to the 21 analysts polled by TipRanks, 14 are bullish on Valeant, 1 is bearish, and 6 remain neutral. The 12-month average price target for the stock is $164.81, marking a 39% increase from where shares last closed.