Rumor by the Wall Street grapevine has it that Teva Pharmaceutical Industries Ltd (ADR) (NYSE:TEVA) may push back to 2019 plans for a massive layoff raring to hit its workforce; all part of new Danish CEO Kare Schultz’s tough-as-nails cost cutting plan to try to save this beleaguered Israeli biotech giant from the debt swamp.

Cantor analyst Louise Chen caught up with the TEVA management this morning, where the corporate team has left the analyst feeling that there is “no change to the dialogue,” and yet, “noise makes it hard to hear.”

Yet, though playing it cautious, Chen appreciates Schultz’s ideas for “a comprehensive restructuring plan to significantly reduce its cost base, unify and simplify its organization and improve business performance, profitability, cash flow generation and productivity;” a plan this biotech giant sorely needs, even as its employees protest the aftermath.

“We believe that further cost cuts and upside to EPS from them are forthcoming over time,” writes the analyst, who adds that Schultz has done well to fill challenging shoes thus far in turning around a troubled company: “So far, we think Kare has been an effective leader, by making the tough decisions needed to right the ship at Teva.”

Additionally, “We would also note that Teva announced the exclusive launches of generic versions of Viread and Reyataz in December. These are good opportunities for Teva, and the timing is in line with our expectations,” highlights Chen, who is sidelined until share value can be “unlocked.” After all, “it will take time for new leadership to return the business to growth,” even if Schultz is rolling all the right dice forward.

Early this month, the new CEO has plans to meet with investors. Looking ahead, TEVA is poised to release its financial outlook for the year no later than its fourth quarter earnings call.

For now, the analyst reiterates a Neutral rating on TEVA stock with an $18 price target. (To watch Chen’s track record, click here)

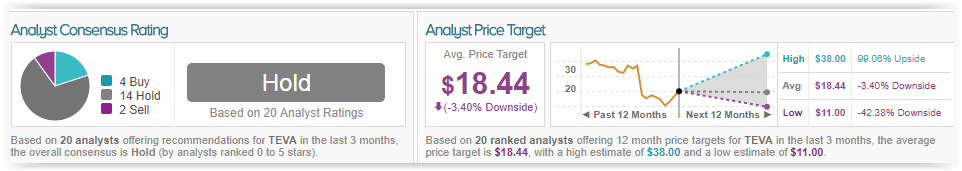

TipRanks illustrates a largely cautious analyst consensus backing Chen’s vote to hedge bets on Teva stock. Based on 20 analysts polled by TipRanks in the last 3 months, 4 are bullish on TEVA stock, 14 remain sidelined, while 2 are bearish on the stock. With a loss potential of 3%, the stock’s consensus target price stands at $18.44.