Seadrill Ltd (NYSE:SDRL), a world leader in offshore deepwater drilling, announces its fourth quarter results for the period ended December 31, 2015.

Highlights

- Revenue of $959 million

- EBITDA1 of $513 million

- 93% economic utilization

- Reported Net Income of $279 million and diluted earnings per share of $0.58

- Cash and cash equivalents of $1.04 billion

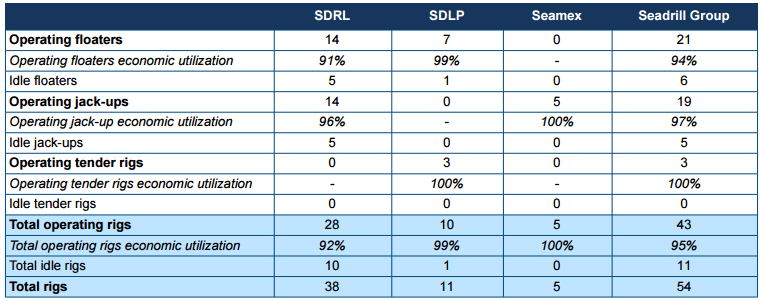

- The Seadrill Group4 achieved 95% economic utilization

- Seadrill Group orderbacklog of approximately $10.7 billion

Commenting today, Per Wullf, CEO and President of Seadrill Management Ltd., said: “During the fourth quarter we experienced our best operational quarter of the year, while continuing to reduce our cost base. Safe and efficient operations remain at the heart of what we do as we continue to drive down costs.

Revenues of $959 million for the fourth quarter 2015 were down compared to $985 million in the third quarter of 2015 primarily due to additional idle units:

- The West Venture was idle for the entire quarter

- The West Phoenix was stacked during the winter period at the customers request

- The Sevan Driller contract was suspended effective December 1, 2015 while commercial negotiations are ongoing

- The West Telesto completed its contract in November

The reductions to revenue were partially offset by higher utilization across the remaining floaters in operation.

Reported net operating income for the quarter was $223 million. Excluding non-recurring items, underlying net operating income was $316 million after adjusting for a $93 million loss on disposal, primarily for the West Rigel, compared to underlying net operating income of $354 million in the preceding quarter. The decrease in underlying net operating income primarily reflects lower revenues in the quarter.

Net financial and other items for the quarter resulted in a credit of $127 million compared to an expense of $301 million in the previous quarter, excluding the impairment of investments of $1.3 billion. The main changes relate to the revaluation of the derivative hedge book and Seadrill’s share in results of associated companies.

Income taxes for the fourth quarter were $71 million, an increase of $37 million from the previous quarter primarily due to a one-off non-cash deferred tax charge recognized on unremitted foreign earnings.

Reported net income for the quarter was $279 million representing basic and diluted earnings per share of $0.58. Excluding nonrecurring items and non-cash mark to market movements on derivatives, underlying net income was $282 million and basic and diluted earnings per share was $0.54.

Balance sheet

As of December 31, 2015, total assets were $23.5 billion, a decrease of $214 million compared to the previous quarter.

Total current assets decreased to $2.9 billion from $3.1 billion over the course of the quarter, primarily driven by a decrease in the value of marketable securities related to Seadrill Partners.

Total non-current assets were $20.5 billion, approximately in line with the preceding quarter. The main changes were an increase in investment in associated companies related to an increase in Seadrill Partners net income, offset by a decrease related to the loss on disposal recognized on the reclassification of the West Rigel as an asset held for sale.

Total current liabilities decreased to $3.5 billion from $3.6 billion primarily due to the maturity of a $350 million bond and a decrease in the unrealized mark to market loss on derivatives, largely offset by the maturity profile of outstanding debt.

Long-term external interest bearing debt decreased to $9.1 billion from $9.3 billion over the course of the quarter, and total net interest bearing debt decreased to $9.9 billion from $10.2 billion compared to the previous quarter. The decrease was primarily due to the repayment of a $350 million bond due in October and normal quarterly installments, partially offset by a $200 million drawdown on a revolver associated with the $400 million jack-up facility.

Total equity increased to $10.0 billion as of December 31, 2015 from $9.8 billion as of September 30, 2015, primarily driven by the net income in the period.

Cash flow

As of December 31, 2015, cash and cash equivalents were $1.0 billion, a decrease of $137 million compared to the previous quarter

Net cash provided by operating activities for the twelve month period ended December 31, 2015 was $1.8 billion and ne

Cash Savings Program

During 2015, the Group achieved $832 million in cash savings primarily by reducing or postponing spending in operating expense, G&A and capex.

Approximately one quarter of the $832 million represents reductions in operating costs across the Group coming from headcount reductions, insurance savings, supplier discounts, travel costs and compensation adjustments which we will continue to receive the benefit of in future years.

During the year total headcount reduced from 9,450 to 7,103. The reduction was comprised of 1,817 (24%) offshore and 530 (31%) onshore. The year end onshore total stood at 1,189 and the offshore total at 5,914.

35% of the cash savings program relates to to deferments in capex and long term maintenance as classing and maintenance is not performed on idle units. We expect these expenditures to return when idle units come back into service.

The remaining 40% of the 2015 cash savings program relates to the deferment of newbuilds. While final yard installments are excluded from our calculation, operation preparations and other progress payments that would have been incurred had we taken delivery on the original schedule are included.

Newbuilding Program

During the quarter, North Atlantic Drilling Ltd. reached a standstill agreement effective until June 2016 with Jurong Shipyard for the delivery of the sixth generation harsh environment semi-submersible drilling rig, the West Rigel. During the standstill period until June 2016, NADL will continue to market the Unit for an acceptable drilling contract and the Unit will remain at the Jurong Shipyard in Singapore. Jurong and NADL can also consider other commercial opportunities for the Unit during this period.

In the event no employment is secured and no alternative transaction is completed when the standstill period concludes, NADL and Jurong have agreed to form a Joint Asset Holding Company for joint ownership of the Unit to be owned 23% by NADL and 77% by Jurong. NADL will continue to market the Unit for the Joint Asset Holding Company.

As a result the West Rigel has been removed from our newbuildings and future capex, and is now classified as an asset held for sale.

Operations

The fourth quarter of 2015 was one of our strongest operating periods to date. The current status and performance of the Group’s delivered rig fleet is as follows:

Commercial Developments

During the fourth quarter, no new contracts were secured, renegotiated or terminated.

Since the year end, we have secured a new contract in Angola for the West Eclipse expected to commence in the second quarter of 2016. The contract is for a firm period of 2 years and adds backlog of about $285 million inclusive of mobilization. As part of this agreement, the backlog for the West Polaris has been decreased by about $95 million.

The net effect of this agreement is an increase of approximately $190 million in total backlog.

Seadrill’s order backlog as of February 24th, 2016 is $5.1 billion, comprised of $3.9 billion for the floater fleet and $1.2 billion for the Jack-up fleet. The average contract duration is 18 months for floaters and 13 months for Jack-ups.

For the Seadrill Group, total order backlog is $10.7 billion.

Commercial contract renegotiation discussions continue to advance with some customers and the Company continues to look toward finding commercial agreements that are beneficial to both parties in order to be better positioned for future contract awards.

Market Development

The offshore drilling market continues to be oversupplied with multiple drilling rigs chasing the few opportunities that are available. Contracting activity is at the lowest levels since the 1980’s. Oil company capital expenditures are expected to decline further in 2016, following two consecutive years of decline. We continue to believe that the majority of rigs with contracts expiring in 2016 will be unable to find suitable follow on work, many are likely to be idle for a protracted period and consequently cold stacking and scrapping activity will accelerate.

Oil companies continue to work on managing their existing rig capacity. They are in many cases overcommitted based on reduced activity levels and there is very little appetite for adding new units. Near term budgetary constraints are the primary focus of many of our customers, with short term cash conservation ranking ahead of long term value generation. However, the near term cost cutting needed to support dividend payments can be expected to negatively impact the long term production profiles of existing development projects.

Although the industry fundamentals are currently subdued, Seadrill is positive on the long term outlook for the industry and the Company. At today’s oil prices the full cycle cost of many of the hydrocarbon provinces globally are uneconomic. Asupply response is inevitable, however it may take some time due to the high degree of sunk costs in producing projects. When also considering the eventual demand response to low prices we can expect to see a rebalancing in the oil markets. Offshore oil fields represent a material portion of most major oil company’s reserves and their production remains a cost competitive source of hydrocarbons. When the cycle turns we see a strong future for Seadrill’s modern, high specification fleet and highly regarded operational track record.

Board Directorships

Dr. Charles Woodburn has decided to resign as a Director of Seadrill Limited given his recent appointment to join BAE Systems Plc. Dr. Woodburn was appointed to the Board in January 2015. We thank him for his service and wish him well in his future pursuits.

Mr. Per Wullf has been appointed as a Director of the Company. Mr. Wullf has been President and CEO of Seadrill Management Ltd. since July of 2013 and also serves on the Board of Sevan Drilling. He will continue to hold these positions following his appointment to the Board.

2016

Financing

The company is currently working with its advisers to evaluate alternatives in light of industry and capital market conditions. We aim to communicate our financing plans during the first half of this year.

Cost savings

We made significant progress in 2015 in reducing capital and operating expenditures. Total onshore and offshore headcount reduced from 9,450 to 7,103 during the year. In 2016 we have identified a further $260 million of sustainable cost savings relative to levels achieved in 2015 as we continue to focus on headcount reductions, insurance savings, supplier discounts, travel costs and compensation adjustments.

Newbuilds

In January 2016, we reached an agreement with DSME to defer the delivery of two ultra-deepwater drillships, the West Aquila and West Libra, until the second quarter of 2018 and first quarter of 2019 respectively, with no further payments to the yard until delivery.

The Company is in dialog with Dalian regarding deferral of the 8 jack-ups and we do not plan to take delivery of any rigs during 2016.

First Quarter 2016 Guidance

- Increased idle time on the following units relative to the fourth quarter:

- Sevan Driller – full quarter of idle time

- West Telesto – rig off contract in January 2015

- Dayrate renegotiations taking effect in the first quarter:

- West Polaris – reduction in contingent consideration received

- Offset by improved operations on the following units:

- West Orion – SPS completed in fourth quarter and returning to normal operations in the first quarter

- West Eclipse – Lower operating cost in the first quarter (preparing for warm stack in the fourth quarter)

- paring for warm stack in the fourth quarter) W

Operationally, performance in the first quarter is strong with 96% utilization quarter to date. (Original Source)

Shares of Seadrill closed yesterday at $1.82. SDRL has a 1-year high of $15.44 and a 1-year low of $1.57. The stock’s 50-day moving average is $2.07 and its 200-day moving average is $5.22.

On the ratings front, Seadrill has been the subject of a number of recent research reports. In a report issued on January 28, Morgan Stanley analyst Ole Slorer downgraded SDRL to Hold, with a price target of $2.50, which represents a potential upside of 37.4% from where the stock is currently trading. Separately, on January 19, Deutsche Bank’s Mike Urban maintained a Hold rating on the stock and has a price target of $9.

According to TipRanks.com, which ranks over 7,500 financial analysts and bloggers to gauge the performance of their past recommendations, Ole Slorer and Mike Urban have a total average return of -7.0% and -57.2% respectively. Slorer has a success rate of 34.5% and is ranked #3248 out of 3666 analysts, while Urban has a success rate of 33.8% and is ranked #3665.

Overall, 2 research analysts have rated the stock with a Sell rating, 2 research analysts have assigned a Hold rating and . When considering if perhaps the stock is under or overvalued, the average price target is $1.00 which is -45.1% under where the stock closed yesterday.

Seadrill Ltd provides drilling & well services to the offshore industry. It has a fleet of drilling units that is outfitted to operate in shallow water, mid-water and deepwater areas, in benign & harsh environments.