Analyst Raghuram Selvaraju of Rodman & Renshaw is bullish on both Valeant Pharmaceuticals Intl Inc (NYSE:VRX) and Synergy Pharmaceuticals Inc (NASDAQ:SGYP), though for very different reasons. The analyst assures the recent uproar surrounding Valeant is overblown, downplaying the impact of the company possibly reposting earnings. On the other hand, he remains bullish on Synergy as the company has several potential catalysts in store for 2016. Let’s take a closer look.

Valeant Pharmaceuticals Intl Inc

Selvaraju believes that investor fears surrounding Valeant’s accounting restatement are overdone. Earlier this week, news surfaced that Valeant will likely restate its recent earnings report following an internal review that raised some eyebrows concerning its accounting practices. This announcement leaves investors sighing, not again, as this tops off a year of public debacles for the company.

Selvaraju attempts to mitigate concerns, explaining, “recent reactions to the accounting restatements being made by Valeant have been overblown, given the fact that these are solely related to Valeant’s classification of sales through the Philidor specialty pharmaceutical distribution channel.” The analyst explains that the restatements will most likely reduce 2014 GAAP EPS by 10 cents and increase 2015 GAAP EPS by about 9 cent, marking a 3.7% adjustment to historical numbers. Despite the outcry, the analyst reiterates that Valeant has been cooperative and transparent while dealing with fraud accusations relating to Philidor.

The analyst concludes, “While we acknowledge the need for Valeant to demonstrate to the investment community that the fallout from the Philidor affair has been conclusively addressed, and the fact that the accounting restatements have cast a pall over the stock, we believe that the recent backlash against Valeant has been overblown in light of the limited nature of the restatements involved.”

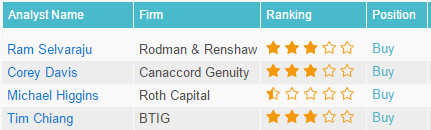

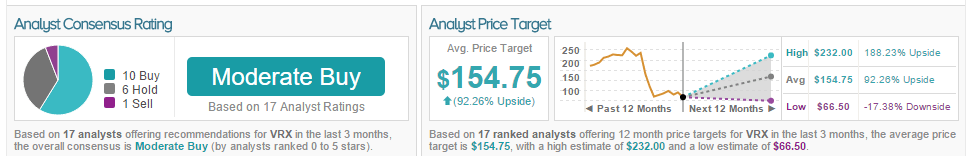

Selvaraju reiterates a Buy rating on the stock with a $150 price target. According to TipRanks, 10 analysts remain bullish on Valeant while 6 are on the sidelines. Only 1 analyst recommends selling the stock. The average 12-month price target between these 17 analysts is $154.75, marking a 94% potential upside from current levels.

Synergy Pharmaceuticals Inc

Selvaraju also weighed in on Syngery Pharma, acknowledging that the decision on its New Drug Application, NDA, for plecanatide to treat chronic idiopathic constipation in the U.S. is approaching. The analyst is optimistic that the NDA will be accepted by the end of March. The potential NDA acceptance would mark a “significant derisking milestone for Synergy and would provide a clear timeline for the company to reach the market with its first product.”

Aside from this NDA, the analyst points out several potential catalysts for the company in 2016. Selvaraju anticipates data from Phase 3 trials of plecanatide in constipation-predominant irritable bowel syndrome to be released this year. The analyst also points to the company’s recent collaboration with BIND Therapeutics to create a treatment for gastrointestinal tract malignancies. The analyst elaborates, “Although this is a comparatively early-stage initiative, we are encouraged by Synergy’s clear intent to leverage its proprietary uroguanylin-based platform into areas beyond constipatory disorders.”

In light of these future catalysts, Selvaraju reiterated a Buy rating on Synergy Pharma with a $20 price target.