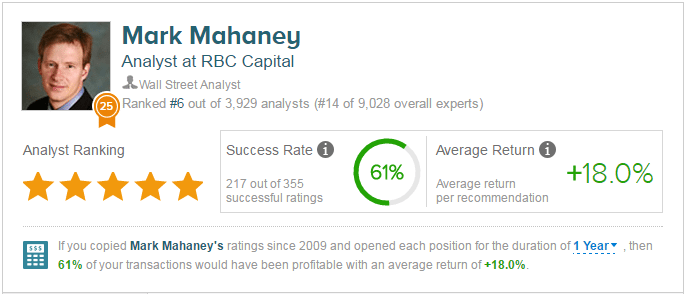

Mark Mahaney, a prominent Internet analyst with RBC Capital, is one of the top 10 analysts rated (out of 3,929 analysts) on TipRanks. Today, Mahaney commented on two names in his coverage universe, video streaming leader Netflix, Inc. (NASDAQ:NFLX) and internet search giant Alphabet Inc (NASDAQ:GOOGL). Below are the comments along with his current ratings and price targets.

Netflix, Inc.

In a research note issued Tuesday, Mahaney highlighted takeaways from its hosted visit with Netflix’s VP of Financial Planning & Analysis Mark Yurechko, and VP of Finance & Investor Relations Spencer Wang, as part of the RBC 2016 Silicon Valley Investor Bus Tour.

Mahaney wrote, “Forecastability of the U.S. Market Remains Consistent – Although Original Content releases have created “wildcards” in the ability of Netflix to forecast its Subscriber Additions, the company generally feels confident in its ability to forecast Sub Adds, being able to draw on years of data and insights into secular and seasonal trends. Original Content releases like “Orange Is The New Black Season 4,” which is scheduled for June 17th, can boost Net Adds, with their predictability greater if they are part of successful series.”

Furthermore, “While there has been increased media discussions of Netflix distribution deals with Charter and Comcast, the company had nothing to disclose. Netflix does believe that these types of deals can be material, depending on the MSO, and has had good experiences with them in Europe.”

“All in, we continue to recommend NFLX and believe our Long thesis is very much intact. This is our #1 Long idea in the Large Cap ‘Net sector,” Mahaney concluded.

Mahaney rates Netflix shares an Outperform with a price target of $140, which implies an upside of 56% from current levels.

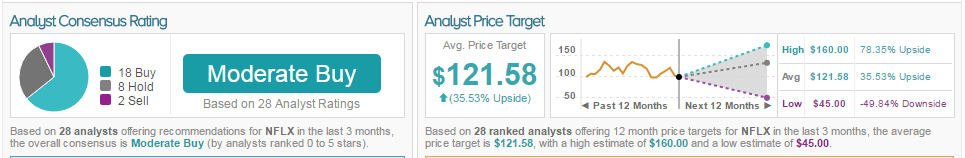

Out of the 28 analysts polled by TipRanks (in the past 3 months), 18 rate Netflix stock a Buy, 8 rate the stock a Hold and 2 recommend a Sell. With a return potential of 35.5%, the stock’s consensus target price stands at $121.58.

Alphabet Inc

In addition, Mahaney reiterated an Outperform rating on shares of Google’s parent Alphabet, with a price target of $1000, after attending day one of Google’s 2016 I/O conference, which focuses on the Android and Chrome platforms, as opposed to core Search and YouTube.

Mahaney noted, “As he has done at prior conferences, Sundar Pichai MC’ed the Keynote Address at this year’s Google I/O. Notable announcements included: (1) Google Home Device. (2) Google Assistant with Voice Control. (3) Allo & Duo Communication Tools. 4) Android N. (5) Instant Apps. (6) Virtual Reality with Daydream. (7) Android Wear and (8) Firebase Refresh.”

“We heard the following datapoints during the conference: (1) Chrome on Mobile now has more than 1B MAUs – how’s that for Mobile-first thinking? (2) More than 50% of queries are now performed on Mobile, and in the U.S. about 20% of Mobile queries are performed via voice. (3) Cumulatively, 25MM Chrome Casts have been sold – up from 17MM last year. (4) Google Translation now works in over 100 languages, with more than 140B words translated daily; further capabilities include being able to use your device’s camera to translate text in the world. (5) In the past year, there were more than 65B installs from the Google Play store.” the analyst continued.

Mahaney concluded, “We continue to believe Google is investing smartly for the long-term and building competitive fly-moats.”

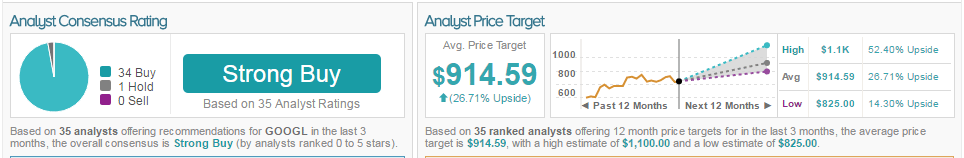

Out of the 35 analysts polled by TipRanks, 34 are bullish on Alphabet stock, while only 1 is neutral. With a return potential of 27%, the stock’s consensus target price stands at $914.59.