And I say this as an investor with skin in the game. Not only am I long Prospect Capital both personally and in client accounts, I also have reputational capital at risk: I chose Prospect Capital as my entry in InvestorPlace’s Best Stocks for 2015 contest. As of this writing, I am suffering the humiliation of being in seventh place.

So, just how hated is Prospect Capital these days?

The stock is down 34% from its 52-week high and trades at a 30% discount to book value. To put that in perspective, the median business development company trades at a 6% discount to book value.

When a stock trades for just 70 cents on the dollar, it tells you that investors are questioning the reported book value. And there have been some well-publicized incidents in which Prospect Capital did indeed list identical assets at higher values than their peers, which partially explains investor hostility toward the company. Investors have also never forgiven Prospect Capital for slashing its dividend last year, even though the reduction was necessary given the de-risking of the company’s portfolio and the lower investment income that came with that de-risking.

My view has consistently been that, at the wide discounts to book value we’ve seen over the past six months, we have a wide margin of safety. According to Prospect Capital’s latest investor presentation, 75% of its portfolio is invested in secured first and second lien debt. The portion of the portfolio under the most scrutiny — the CLO equity tranches — makes up only 16% of the portfolio. If you were to write the entirety of the CLO equity to zero — which not even the most bearish of bears would do — Prospect Capital would still be trading at a deep discount to book value.

I spoke with Chief Operating Officer Grier Eliasek this week to get management’s take on Prospect’s recent share-price slide. Mr. Eliasek was very open with me and shared a set of slides that, until now, have not been released to the general public (see Prospect Capital Corporation Investor Presentation). Don’t worry, it’s ok to read them. They are based on public, reported numbers and are being reproduced with permission.

The usual caveats apply here. The data was prepared by Prospect Capital, and while I believe it to be factually accurate, I have not independently verified all of the data. And you should always assume that management has its own motives for sharing any data with the public.

So with that said, let’s jump into the presentation.

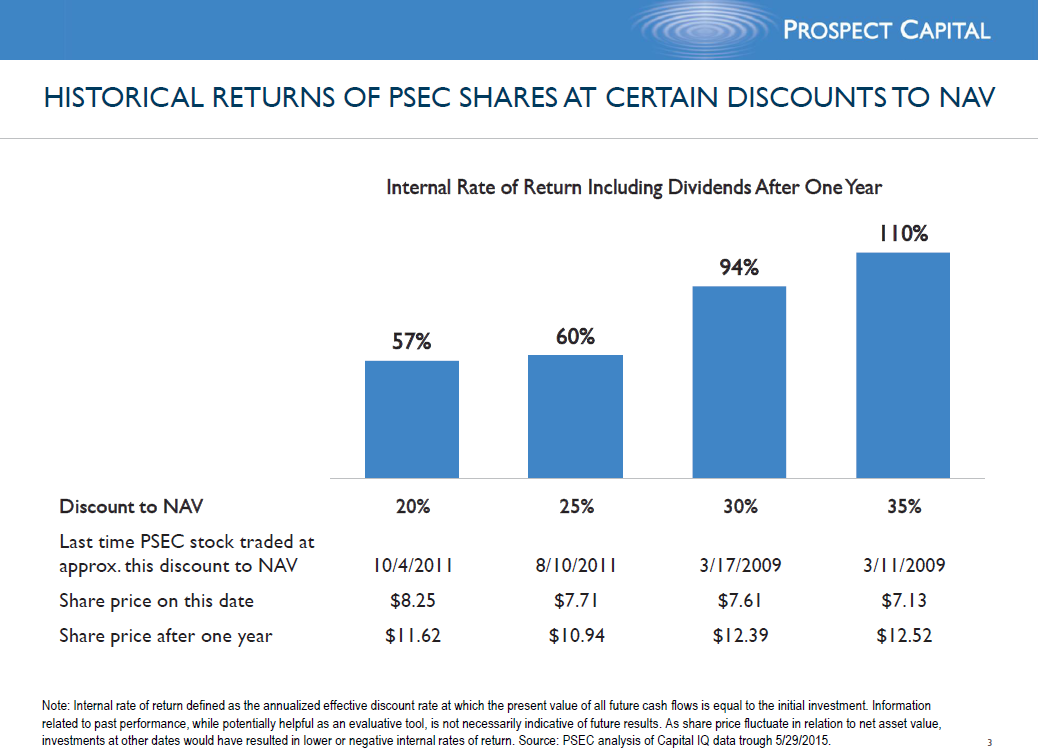

Figure 1 comes pretty close to stock touting, but it is instructive nonetheless. This chart shows the subsequent total returns (capital gains + dividends) that investors experienced the last time Prospect Capital traded at deep discounts to book value. On March 17, 2009, Prospect Capital traded at a 30% discount to book value, just as it does today. And over the 12 months that followed, the stock returned 94%.

Can we expect those kinds of returns over the next 12 months? Probably not. March 2009 marked the beginning of one of the greatest bull markets in history, and a rising tide lifts all boats. That’s not our situation today, although I do believe total returns of 40%-50% are possible and very likely.

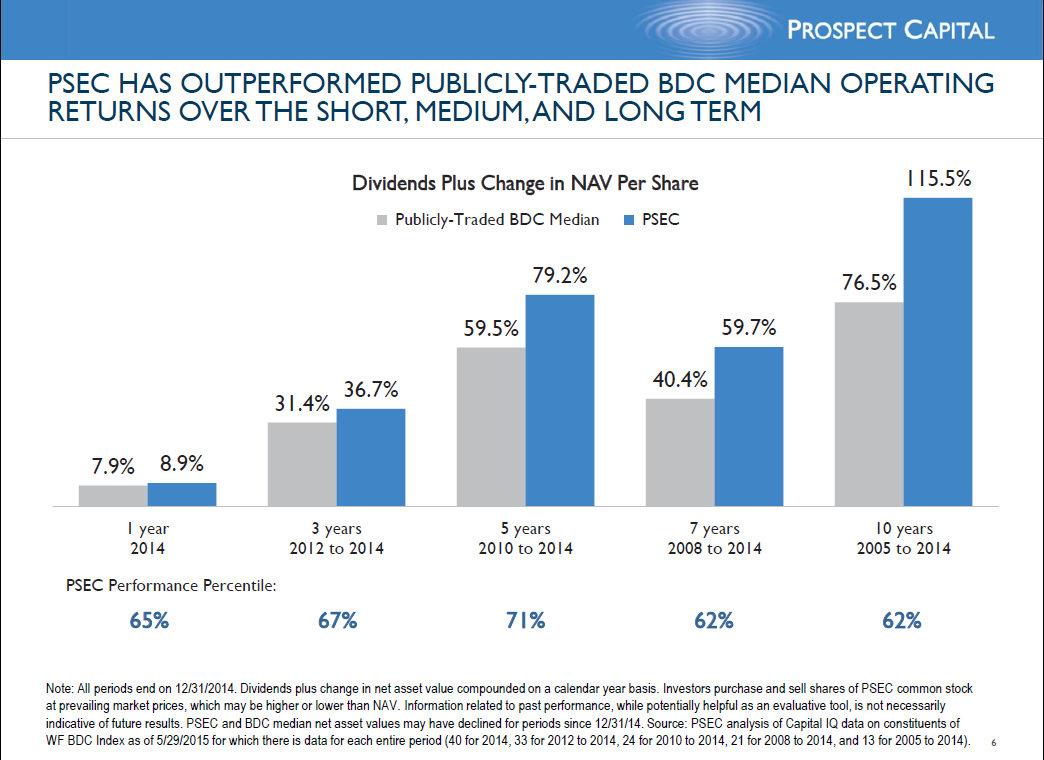

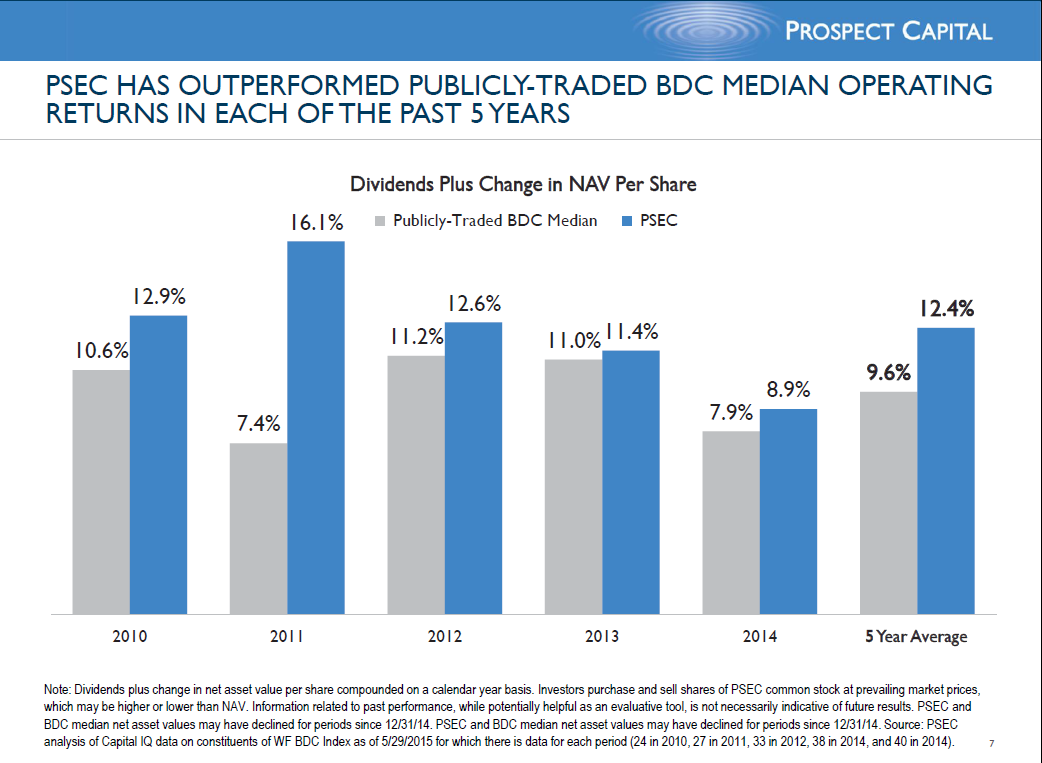

The next two slides will be somewhat controversial to anyone sitting on large capital losses, but it is instructive nonetheless. It also happens to be very close to how Warren Buffett has traditionally measured his success at Berkshire Hathaway.

Figures 2 and 3 measure Prospect Capital’s “Operating Return,” defined here as change in book value plus dividends. The thinking here, as with Mr. Buffett, is that management has no direct control over the share price. That is the prerogative of Mr. Market. But management does have control over the underlying investments, which show up in the company’s book value.

In recent years, most of Prospect’s returns have come from its dividend, though its total operating return has outperformed its peers in the BDC sector.

I agree that these returns are distinctly not what investors have realized in the stock. But just as Warren Buffett has asked to be judged by his growth of Berkshire’s book value, I think the same logic applies here. This hinges on book value being reliable, of course. And I raised that question with Mr. Eliasek:

Sizemore: “A lot of investors seem to be questioning Prospect Capital’s accounting these days. How would you respond to those who say that your book value estimates are overly aggressive?”

Eliasek: “We actually consider our book value accounting to be a major source of strength. We don’t value the portfolio ourselves. Our third-party valuation firms start with a blank piece of paper every quarter and value our portfolio from scratch. And our auditors approve.”

Sizemore: “How does this compare to your peers?”

Eliasek: “We consider ourselves to be among the most conservative. Some BDCs ‘self value’ or ask a third-party valuation firm to simply confirm in-house company estimates. We were one of the first BDCs to insist on truly arms-length, third-party valuation.”

Can a valuation firm be “encouraged” by management to inflate asset values? Of course. There are natural conflicts of interest when the company whose portfolio is being reviewed is the one doing the paying. We saw the same conflicts of interest with bond ratings agencies in the aftermath of the 2008 mortgage meltdown. But I would still consider the third-party valuation firms to be more reliable than an in-house valuation, and I have no reason to believe that Prospect Capital’s asset values are systematically more inflated than their peers.

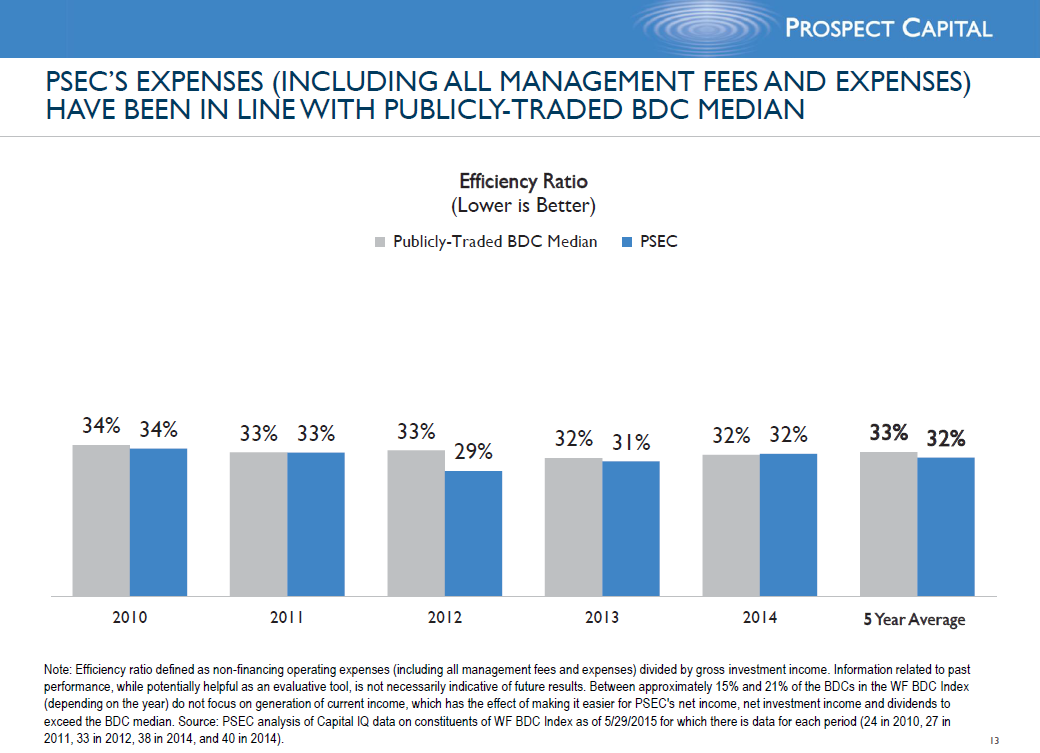

When a stock is doing well, investors tend to ignore executive compensation. But when a stock is lagging, investors look at it with a much more critical eye. A consistent criticism I read about Prospect Capital is that its management team is overcompensated.

Is this true? Well, let’s look at the numbers.

According to Figure 4, Prospect Capital’s expenses — the largest of which are the management and incentive fees used to compensate management — are almost exactly in line with their peers. Yes, I realize that depending on numbers provided by Prospect Capital itself is a little like allowing the fox to guard the hen house. And as an externally-managed BDC, Prospect does not disclose the compensation of its individual officers. But I see nothing here that would indicate that Prospect’s management team is uniquely overpaid by industry standards.

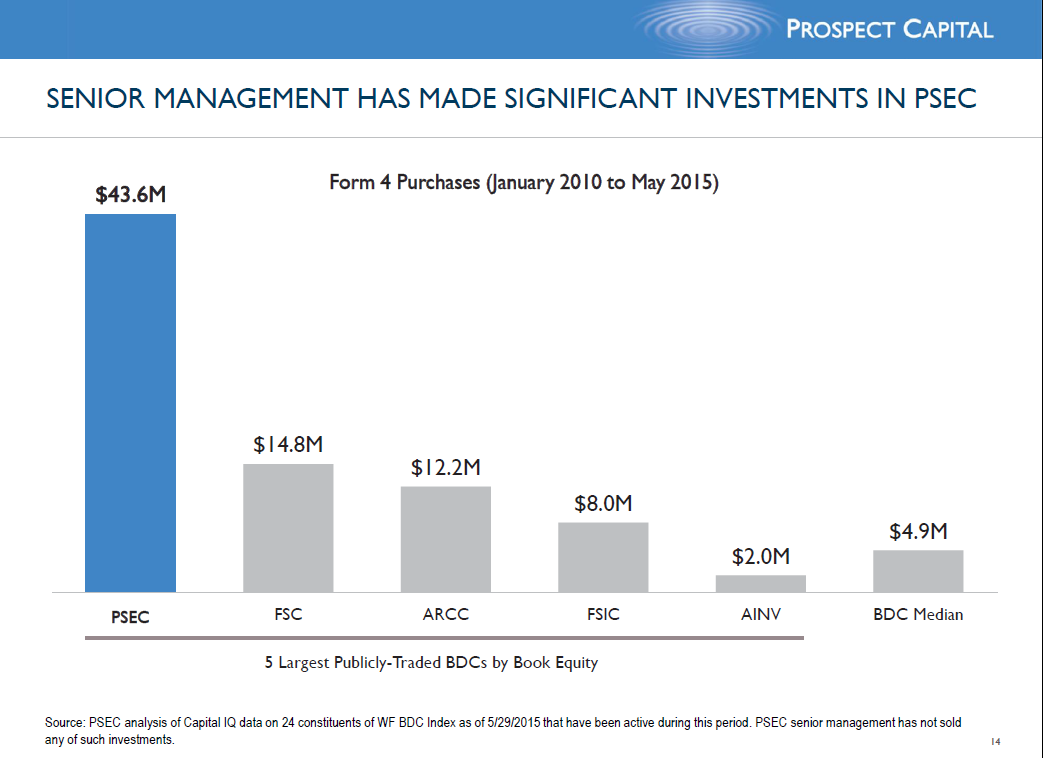

And finally, it is only fair to note that Prospect Capital’s directors and officers eat their own cooking. The insiders are very aggressive buyers of the stock on the open market. And to clarify, these are real, open-market purchases that the executives are making with their own money. These are not executive stock option grants or other forms of stock-based compensation. Six 2010, six company officers have been responsible for buying a cumulative $43.6 million in Prospect Capital stock.

Let’s take a look at some of the more recent purchases, courtesy of GuruFocus:

| Insider |

Position |

Date |

Buy/Sell |

Shares |

Trade Price |

Cost |

Shares Owned Following This |

| John F Barry |

CEO |

6/5/2015 |

Buy |

131,060 |

$7.58 |

$993,434 |

5,300,786 |

| M Grier Eliasek |

COO |

5/8/2015 |

Buy |

30,000 |

$8.00 |

$240,000 |

302,196 |

| Eugene S Stark |

Director |

5/8/2015 |

Buy |

2,000 |

$8.00 |

$16,000 |

28,000 |

| Eugene S Stark |

Director |

2/11/2015 |

Buy |

1,000 |

$8.50 |

$8,500 |

26,000 |

| Eugene S Stark |

Director |

12/12/2014 |

Buy |

4,000 |

$8.20 |

$32,800 |

250,00 |

| M Grier Eliasek |

COO |

12/9/2014 |

Buy |

25,000 |

$8.31 |

$207,750 |

272,196 |

| Brian H Oswald |

CFO |

12/9/2014 |

Buy |

63,500 |

$8.35 |

$530,225 |

375,000 |

| John F Barry |

CEO |

12/8/2014 |

Buy |

132,200 |

$8.46 |

$1,118,412 |

4,833,410 |

| M Grier Eliasek |

COO |

12/2/2014 |

Buy |

50,000 |

$9.10 |

$455,000 |

247,196 |

| Brian H Oswald |

CFO |

12/2/2014 |

Buy |

162,500 |

$9.12 |

$1,482,000 |

311,500 |

| John F Barry |

CEO |

12/1/2014 |

Buy |

115,000 |

$9.08 |

$1,044,200 |

4,701,210 |

| John F Barry |

CEO |

11/10/2014 |

Buy |

110,000 |

$9.57 |

$1,052,700 |

4,535,544 |

| Eugene S Stark |

Director |

11/10/2014 |

Buy |

1,512 |

$9.40 |

$14,212 |

21,000 |

| M Grier Eliasek |

COO |

11/10/2014 |

Buy |

5,000 |

$9.56 |

$47,800 |

197,196 |

| John F Barry |

CEO |

9/16/2014 |

Buy |

100,000 |

$10.17 |

$1,017,000 |

4,329,941 |

| M Grier Eliasek |

COO |

9/16/2014 |

Buy |

5,000 |

$10.10 |

$50,500 |

192,196 |

| M Grier Eliasek |

COO |

8/29/2014 |

Buy |

20,000 |

$10.26 |

$205,200 |

187,196 |

| Eugene S Stark |

Director |

8/28/2014 |

Buy |

4,000 |

$10.32 |

$41,280 |

19,488 |

| Brian H Oswald |

CFO |

8/27/2014 |

Buy |

27,300 |

$10.40 |

$283,920 |

149,000 |

| John F Barry |

CEO |

6/13/2014 |

Buy |

100,000 |

$10.37 |

$1,037,000 |

4,110,959 |

| Brian H Oswald |

CFO |

6/12/2014 |

Buy |

30,000 |

$10.25 |

$307,500 |

121,700 |

| Eugene S Stark |

Director |

6/12/2014 |

Buy |

1,000 |

$10.27 |

$10,270 |

15,488 |

| John F Barry |

CEO |

6/12/2014 |

Buy |

100,000 |

$10.33 |

$1,033,000 |

4,010,959 |

| M Grier Eliasek |

COO |

6/12/2014 |

Buy |

24,000 |

$10.28 |

$246,720 |

167,196 |

| John F Barry |

CEO |

3/20/2014 |

Buy |

100,000 |

$10.86 |

$1,086,000 |

3,793,385 |

| Eugene S Stark |

Director |

2/6/2014 |

Buy |

1,000 |

$11.10 |

$11,100 |

14,488 |

Through June 9, CEO John Barry owned 5.3 million shares worth over $38 million. And most of these shares were purchased at prices far higher than today’s. CFO Brian Oswald owned 375,000 shares, and COO Grier Eliasek owned 272,196. All three men have made major new purchases in the past six months.

Given the amount of money they have personally invested in the stock, the picture in the financial press of a greedy management team looting the company for its own gain doesn’t quite hold water.

So, with all of this said, is Prospect Capital a buy?

As a value investor, I would answer that question with an emphatic yes. We have a wide margin of safety in the large discount to book value, and a management team that, while taking criticism from investors these days, has a lot of skin in the game. We’re also being paid generously to wait for the market’s mood to shift, as Prospect sports a current dividend yield of almost 14%.

Additional dividend cuts may be in the cards if the company continues to de-risk or if there is an uptick in non-performing loans. But I consider the current dividend safe for at least the next 9-12 months.