BlackBerry Ltd (NASDAQ:BBRY) and Neurocrine Biosciences, Inc. (NASDAQ:NBIX) are rattling the market today with massive wins in their favor that have investors putting their hands together for the smartphone maker and the biotech firm. Blackberry just beat out Qualcomm in a case with $815 million on the line, and one of Wall Street’s best analysts is out with a bullish note, boosting the price target. In the other corner, there is Neurocrine, making waves in the biotech sector with the first approval of its kind in the indication of tardive dyskinesia, leaving Oppenheimer all the more confident on the stock’s successful future ahead. Let’s explore:

BlackBerry Wins Big Against Qualcomm

BlackBerry shares are soaring 16% on the heels of the software maker’s arbitration victory to the tune of $815 million from a contention with Qualcomm over licensing.

Top analyst Michael Walkley at Canaccord chimes in on Blackberry’s prospects, surprised, but cheering BBRY’s meaningful triumph over Qualcomm in court.

On back of binding arbitration award from Qualcomm, which the analyst sees as an “unexpected” move in the smartphone maker’s advantage, he reiterates a Hold rating on shares of BBRY while lifting the price target from $8.00 to $9.50, which represents a just under 7% increase from where the stock is currently trading.

Providing some back story behind the arbitration, the analyst elaborates, “Back in 2010, BlackBerry had a very strong smartphone franchise and believed strong BlackBerry device sales would continue for the long term.” At the time, the smartphone maker saw fit to enter an agreement with Qualcomm that was non-refundable for fixed royalty payments that applied to device sales between 2010 and 2015. Yet, BlackBerry struggled with weak handset sales and made a winning case that the guaranteed payments to Qualcomm had overshot the mark.

“With BlackBerry planning to invest for growth in its software businesses, the surprising arbitration award and $815M in cash from Qualcomm will bolster BlackBerry’s balance sheet and increase the likelihood of acquisitions to augment growth. We continue to monitor BlackBerry’s success in selling its EMM platform into non-regulated industries, and look for additional disclosure regarding this highly competitive market segment with management adjusting segment disclosure within the next couple quarters. In addition, we believe the timing and success of the device licensing program remains uncertain, and we continue to use conservative assumptions in our model,” Walkley concludes.

Michael Walkley has a very good TipRanks score with a 66% success rate and a high ranking of #25 out of 4,560 analysts. Walkley has a 66% success rate and realizes 19.4% in his annual returns. When recommending BBRY, Walkley yields 25.9% in average profits on the stock.

TipRanks analytics show BBRY as a Buy. Out of 5 analysts polled by TipRanks in the last 3 months, 2 are bullish on BlackBerry stock while 3 remain sidelined. With a loss potential of nearly 3%, the stock’s consensus target price stands at $8.63.

Neurocrine Biosciences Gets First Approval in Treating TD

Neurocrine shares are rising almost 23% after Ingrezza, the biotech firm’s treatment for adults with tardive dyskinesia (TD) garnered a green light from the FDA, the first drug to achieve approval for TD to date. Oppenheimer analyst Jay Olson sings the praises of the biotech firm, taking this homerun in stride.

In reaction, the analyst reiterates an Outperform rating on NBIX with a price target of $60, which represents a close to 18% increase from where the shares last closed.

Moreover, the analyst believes NBIX competitors do not stand a chance to topple the firm, underscoring, “The label does not contain a black-box warning and cites only that Ingrezza may cause somnolence or QT prolongation, which we see as a key benefit in communicating with physicians and patients. Potential competitors have a black-box warning for suicidality.”

“Ingrezza becomes the first FDA-approved treatment option for TD, which is a growing area of unmet need due to increased antipsychotic use. We see Ingrezza as bestin-class due to its efficacy profile, safety, once-daily dosing, data package with concomitant medication, and absence of black-box warning. Mgmt presented a commercialization strategy based on five pillars: best-in-class molecule, physician targeting, differentiation, payor engagement, and patient support. Pricing will be made public in May, and mgmt has reaffirmed guidance toward the $20-60K/year range. We will update our model after pricing is announced and point to our catalysts note, where we forecasted an upside of $8 upon approval,” Olson concludes.

According to TipRanks, which measures analysts’ and bloggers’ success rate based on how their calls perform, three-star analyst Jay Olson is ranked #1,704 out of 4,560 analysts. Olson has 47% success rate and earns 4.7% in his yearly returns. However, when recommending NBIX, Olson loses 1.5% in average profits on the stock.

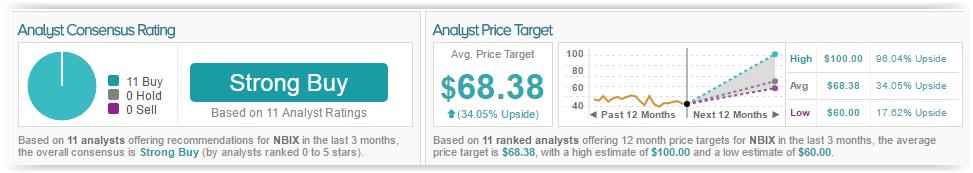

TipRanks analytics indicate NBIX as a Strong Buy. Based on 11 analysts polled by TipRanks in the last 3 months, all 11 rate a Buy on Neurocrine stock. The 12-month average price target stands at $68.38, marking a 34% upside from where the stock is currently trading.