Equity offering from Tesla Motors Inc (NASDAQ:TSLA) and positive segment data from Amazon.com, Inc. (NASDAQ:AMZN) generate buzz from Merrill Lynch analysts. While one believes Amazon Business segment represents a compelling global market opportunity, the other is unsure whether Tesla can sustain its new Model 3 production target without hurting shareholders.

Tesla Motors Inc

Merrill Lynch analyst John Murphy weighed in on Tesla after the company announced a common stock offering worth around $2 billion, of which $1.4 billion would be used to fund the ramp of its Model 3 production, scheduled July of 2017, to help reach its newly increased target of 500k units by 2018, as well as other general corporate purposes. The analyst believes this offering “comes as little surprise” as the company stated in a shareholder letter than it is increasing production and would need additional capital.

In its 1Q16 earnings call, the company indicated they would increase its Model 3 vehicle target from 500k vehicles by 2020 to 2018. The analyst expresses doubt that the company will easily achieve its goal. He states, “While this announcement may be sufficient to support the stock for now, the actual achievement of this goal may prove very challenging”, pointing to past issues regarding its Model S and Model X launches. The analyst believes the updated target is “aggressively optimistic at best” and believes the company will only delivery around 200k units by 2018.

The analyst expresses concern regarding the company’s rate of cash burn relative to its additional equity raise. Although the $1.4 billion and $400 million from Model 3 reservations “are good steps and likely buy additional time for the company”, the analyst notes that it is not enough to adequately finance the company’s operations through 2018. According to the analyst, the additional capital raised alongside with the company’s cash burn run rate of -$(400) million will only fund operations through 2017. The analyst believes that the company will need to raise an additional 1 billion worth of capital in both 2017 and 2018 through either debt or equity.

Murphy questions whether this new capital serves shareholders best interest. He explains that although company is taking steps to achieve its mission of bringing its revolutionary vehicles to market as soon as possible, he is unsure “whether this mission comes at the expense of shareholders, who have in the past funded TSLA’s ambitious programs.” The analyst is unsure of how long investors will be willing to stay by Tesla’s side. He explains, “if the company fails to turn the corner on free cash burn in the near term, which we view as unlikely, support for the stock may dissipate.” According to Murphy, the company must do a better job balancing investments while returning capital to shareholders. He states, “Ultimately, while we recognize that TSLA is a growing business, we think it is unlikely that investors would continue to supply the company with incremental low cost capital into perpetuity if investments fail to generate returns.”

The analyst maintains an Underperform rating on TSLA with a $155 price target.

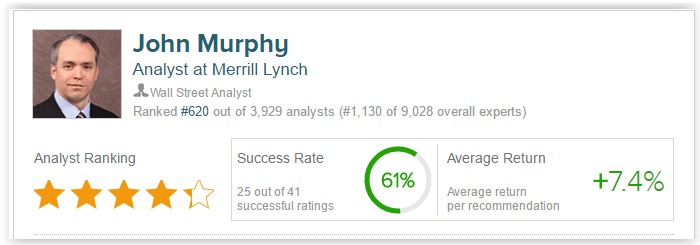

According to TipRanks.com, which measures analysts’ and bloggers’ success rate based on how their calls perform, analyst John Murphy has a yearly average return of 7.4% and a 61% success rate. Murphy has a -5.5% average return when recommending TSLA, and is ranked #620 out of 3929 analysts.

Out of all the analysts who have rated Tesla in the past 3 months, 55% are bullish, 30% are bearish, and 15% remain on the sidelines. The average 12-month price target for the stock is $278.05, marking a 28% upside from where shares last closed.

Amazon.com, Inc.

Merrill Lynch’s Justin Post commented on Amazon after the company announced that its Amazon Business segment reached $1 billion in sales and served 300,000 customers in its first year, displaying 20% y/y growth. Amazon Business, re-branded from Amazon Supply in 2015, “combines positive attributes of Amazon’s consumer marketplace – selection, convenience and value – with features, and benefits tailored to businesses, government organizations and the education sectors.” The analyst believes the segment’s vast product selection represents “a bigger opportunity than the Street realizes.” In order to sustain its recent success and growth, the analyst claims the company will have to build additional procurement platforms and customer service applications to stay competitive.

The analyst also points to a massive B2B market opportunity for the company in the coming years. He states, “Amazon Business is a nascent global initiative that significantly increases Amazon’s addressable market.” According to market research firm Frost & Sullivan, the global B2B commerce should reach 6.7 trillion in 2020 and the U.S B2B ecommerce market is expected to reach $1 trillion by 2018, the latter more than double his own estimates. The analyst notes that even if the U.S. B2B ecommerce market does not experience any long term growth, just 5-10% of market share going to Amazon will result in a $50-$100 billion GMV opportunity in the U.S. alone. The analyst notes that by 2016 the segment will reach $3.25 billion GMV and predicts more than $25 billion GMV for the company by 2020. He states, “We think B2B provides significant runway for growth, which could help Amazon sustain its growth rates and premium valuation for many years.”

The analyst maintains a Buy rating on AMZN with an $840 price target.

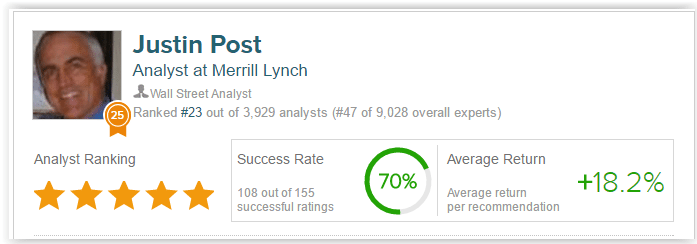

Justin Post is ranked #23 out of 3,929 analysts on TipRanks. He has a 70% success rate recommending stocks with an average return of 18% per recommendation.

According to TipRanks, out of all the analysts who have rated AMZN in the last 3 months, 90% are bullish while 10% remain on the sidelines. The average 12-month price target for the stock is $806.17, marking a 16% upside from where shares last closed.