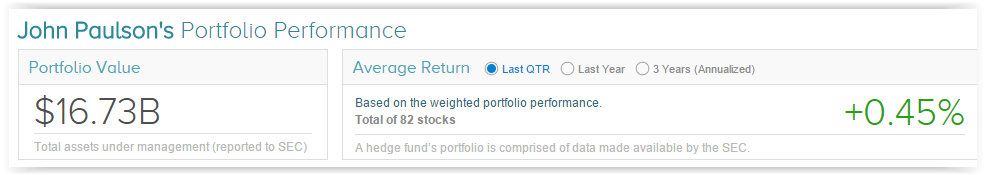

John Paulson, a billionaire a New York native, manages Paulson & Co Inc, his successful hedge fund. The $16.3 billion dollar fund generated a return of 0.45% to investors during the fourth quarter. Some of Paulson’s fourth quarter activity includes Valeant Pharmaceuticals Intl Inc (NYSE:VRX), Etsy Inc (NASDAQ:ETSY) and Allergan plc shares (NYSE:AGN)

Valeant Pharmaceuticals Intl Inc

Paulson increased his holdings in Valeant Pharma by 49.22% in the fourth quarter, now owning $1.35 billion worth of the company, contributing to over 8% of his total holdings. This quarter, the company entered a 20 year deal with Walgreens, offering some of its drugs at a discount through the pharmacy, in order to gain investor trust after its ended its relationship with Phildor due to fraud allegations. Like other big pharma companies, Valeant was involved in a U.S senate involving outrageously high life-saving drug prices. Paulson was probably more focused on the approval and successful launch of its cystic fibrosis drug Orkambi in the U.S. as well as its announced approval in Europe.

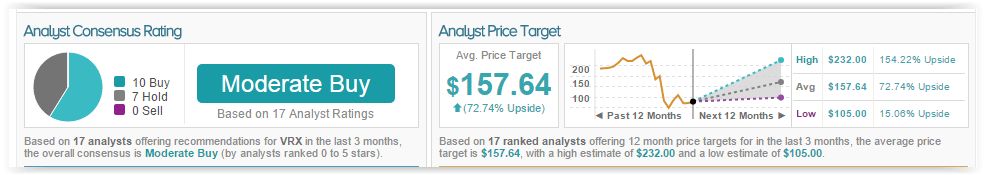

Paulson and analysts mostly agree on Valeant, as 10 out of 17 analysts who have rated the company in the past 3 months on TipRanks gave a Buy rating.

Etsy Inc

Paulson added Etsy to his portfolio in the fourth quarter, purchasing more than 435,000 shares worth a total of $3.61 million, though only comprising .02% of his portfolio. The fourth quarter was a tough one for Etsy, as the stock fell 39%. When the company released earnings in early November, analysts were more focused on weak guidance and missing revenue and EPS instead of the climb in active sellers and buyers. Shares declined once again due to competition from Amazon, as they also launched a handmade store.

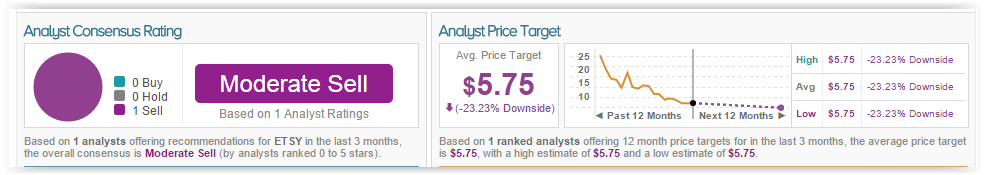

While Paulson increased his shares, the one analyst who has rated the stock in the past 3 months on TipRanks gave a Sell rating.

Allergan plc Ordinary Shares

Paulson reduced his shares of Allergan in the fourth quarter by 23%, now representing 10.33% of his total holdings. The most notable even of the third quarter was the company’s acquisition announcement with Pfizer, where the latter would pay Allergan $160 billion and move its headquarters to Ireland to avoid U.S. taxes. While this move received criticism from the government, analysts love this deal. The deal is aimed to expand the pipeline, as both companies have over 100 drugs in each. The deal makes the combined companies the world’s biggest pharmaceutical company. Allergan also acquired AqueSys, a company involved in glaucoma treatment, for $300 million. The company beat estimates in its Q3 earnings due to high sales and deals and nearly doubled its y/y revenue. It is important to note that while Paulson reduced his Allergan shares, he added over 630,000 share of Pfizer to his portfolio in the fourth quarter.

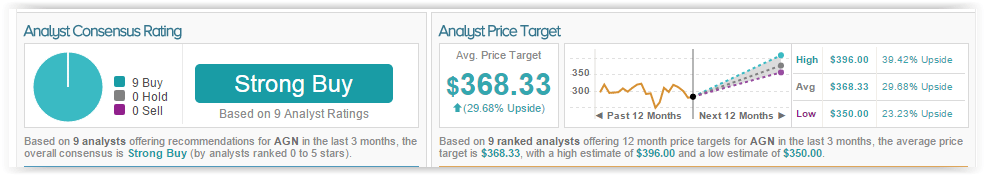

Analysts and Paulson disagree on Allergan, as all 9 analysts who have rated the company in the past 3 months gave a Buy rating, according to TipRanks.