Ignyta Inc (NASDAQ:RXDX) shares are firing up 72% like a cannon through the market after the drug maker gave its investors a nice “pre-holiday gift:” Swiss healthcare giant Roche is primed to takeover the smaller domestic cancer drug maker in an all-cash deal for $1.7 billion, or $27 per share.

In a definitive merger agreement that comes at a 74% premium to the last close price, Cantor analyst Mara Goldstein notes the deal likewise comes at a 17% premium to her 12-month target expectations for the biotech company, and is a move that makes strategic, logistical “sense.”

On the heels of the news that has raced through the Street with bullish frenzy, the analyst maintains an Overweight rating on RXDX stock with a $23 price target that is currently under review. (To watch Goldstein’s track record, click here)

For context, Ignyta’s lead asset entrectinib is an investigational drug with preliminary antitumor activity, designed as a selective tyrosine kinase inhibitor (TKI), and one that has gained Breakthrough Therapy Designation from the FDA to treat neurotrophic tropomyosin receptor kinase (NTRK) fusion-positive, locally advanced or metastatic solid tumors in adult and pediatric patients who have either progressed following prior therapies or who have no acceptable standard therapies.

Goldstein writes, “The deal makes sense given RXDX’s pipeline of targeted drugs, and data generated thus far for lead asset entrectinib in ROS1+ and NTRK fusion cancers, and ROG.VX’s strength in oncology.”

Additionally, the timing is clever, as the analyst elaborates: “With LOXO’s announcement of commencement of rolling NDA submission for larotrectinib and a recent marketing deal with Bayer (BAYN.ETR(NC), the timing of RXDX’s deal with ROG.VX makes sense, in our view.”

“ROG.VX currently sells alectinib (Alecensa) for ALK+ NSCLC, and RXDX’s dose hit ALK, though RXDX previously announced that it would not pursue ALK as a target, leading us to believe that this transaction will proceed,” adds Goldstein.

With Ignyta’s lead asset under evaluation in the ongoing pivotal Phase II trial for the treatment of tumors with ROS1 and NTRK fusions, where ROS1 interim data has been revealed, the analyst looks ahead to early next year for NTRK data, expecting ROS1 data later in 2018.

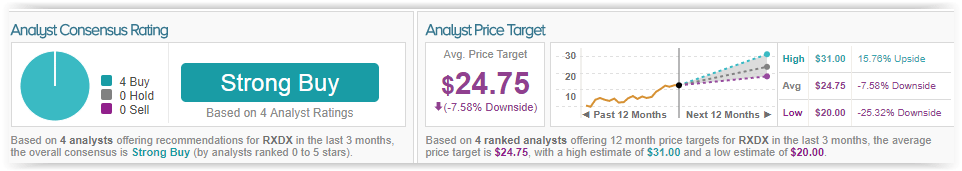

TipRanks highlights a strong bullish analyst consensus for Ignyta, with all 4 analysts polled in the last 3 months unanimously rating a Buy on the biotech stock. However, is this stock overvalued or undervalued taking under account these analyst’s expectations? As the stock gained a massive amount of value today on back of the Roche deal buzz, there is a loss potential of nearly 8%, with the 12-month average consensus price target standing at $24.75.