William Blair analysts were out with favorable reports on industrial giant General Electric Company (NYSE:GE) and online payment giant Paypal Holdings Inc (NASDAQ:PYPL). While General Electric has generated a bullish outlook due to efficacy in key driving factors as well as progress in new product developments, PayPal also received a bullish analyst recommendation following a fruitful investor day. Let’s take a closer look:

General Electric Company

William Blair analyst Nicholas Heymann recently weighed in on General Electric, reiterating an Outperform rating on the stock with a $38.00 price target.

Heymann explains that GE remains on track with its “accelerated integration and assimilation” of Alstom Energy. The analyst also mentions the company’s exit from GE Capital’s business has progressed rapidly, and the introduction to three critical new products in 2016 are developing efficiently. The new products include aviation’s LEAP next generation small thrust engine, power’s H turbine, and wind turbines.

The analyst seems especially confident regarding GE’s H turbines, explaining the company has already reduced the cost of manufacturing by 30%. Heymann expects manufacturing to “rapidly come down the production cost curve over the next few quarters so that it can break even on the cost of producing its 12th turbine later this quarter.”

Additionally, Heymann notes that GE’s quarterly earnings for the second half of 2016 are expected to improve in operating performance, as well as benefit from “stronger organic revenue growth, meaningfully higher operating profitability, and much more positive fundamental earnings gains.” The analyst explains the first half of 2016 witnessed a slow start to organic revenue, but he is confident that the second half of 2016 will prove successful due to new product launches. The analyst elaborates, and mentions “GE expects organic sales to rise to 5% or more in the second half of this year, allowing it to still achieve its 2%4% organic revenue growth target for 2016.”

GE anticipates closing the sale of its appliance business next month to Haier. Heymann expects the sale will deliver $3.2 billion after tax gains on the appliance sale, thereby enabling the “originally unoffset $0.8 billion Alstom Energy restructuring in 2017 and the $0.3 billion projected for 2018 to be accelerated forward and fully offset by mid2017.” The analyst explains that if this is achieved, “it could add about $0.08 to GE’s EPS, with the majority (and possibly all) of this likely to be realized in 2017.”

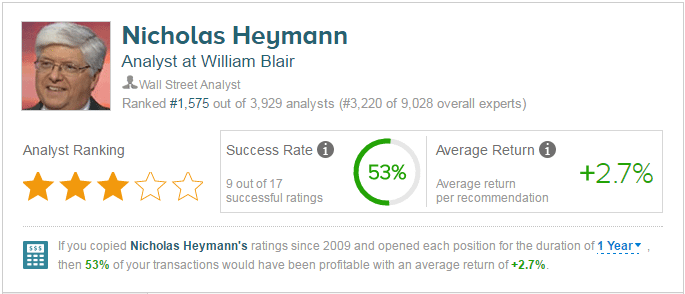

According to TipRanks, Heymann’s predictions succeeded 53% of the time, ultimately delivering a one-year return per recommendation of 2.7%.

Out of the 15 analysts polled by TipRanks, 9 rate General Electric stock a Buy, 5 rate the stock a Hold and 1 recommends a Sell. With a return potential of 12%, the stock’s consensus target price stands at $33.14.

Paypal Holdings Inc

William Blair analyst Robert Napoli recently attended PayPal’s first investor day in San Jose. He left with a fortified outlook in terms of the company’s success and performance in the market, as well as the company’s upper-hand against competitors. He explains, “We believe PayPal will remain a key beneficiary of the secular shift to electronic payments and e-commerce.”

Napoli elaborates on key takeaways from the investor day, specifically noting his confidence in PYPL’s management. Napoli explains that management holds a competitive advantage due to its “two-sided, scaled network of over 170 million consumers and over 14 million merchants,” something the analyst believes is beneficiary because “the market will support multiple winners.”

To bolster his stance on management even further, Napoli describes management’s promising medium-term financial targets. These targets include a “mid-20% foreign-exchange-neutral TPV growth, about 15% foreign-exchange-neutral revenue growth, stable to growing adjusted operating margin (versus 21.4% in 2015), and free cash flow growth in line with revenue growth (at least $2.1 billion expected in 2016).”

The analyst notes a key focus for management will be improving customer engagement, which remains a long-term opportunity for PayPal. He elaborates on this, explaining, “Management’s aspiration is to increase average PayPal usage from two to three times per month toward two to four transactions per week, which if accomplished could drive accelerating, high-margin growth.”

Further, Napoli points to the company’s resilient Peer-2-Peer (P2P) payments platform, which represents a key growth driver for PayPal, according to the analyst. He states, “Management estimates the average P2P customer is 67% more engaged and has double the lifetime value relative to a traditional PayPal customer.”

Robert Napoli reiterated an Outperform rating on PYPL, in line with consensus, though he did not provide a price target.

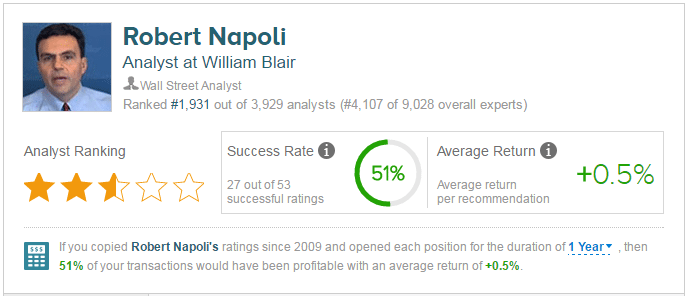

According to TipRanks, Napoli’s prediction succeeded 51% of the time, ultimately delivering a one-year return per recommendation of 0.5%.

The average analyst consensus for PayPal is Moderate Buy, with 58% of analysts bullish, 38% of analysts neutral, and 4% of analysts bearish. All recommendations amounted to a 12-month average price target of $45.40, marking a 20.97% upside from where shares last closed.