As the earnings season winds down, analysts are now hailing some of the last reporters, which are Ulta Salon, Cosmetics & Fragrance, Inc. (NASDAQ:ULTA) and Ambarella Inc (NASDAQ:AMBA). Lets take a look and see what the analysts have to say about ULTA and AMBA.

Ulta Salon, Cosmetics & Fragrance, Inc.

In a research report issued today, Piper Jaffray analyst Stephanie Wissink reiterated an Overweight rating on shares of Ulta Salon, while raising the price target to $185 (from $170), after the company posted robust third quarter earnings results, pushing it to boost its guidance for the year. The company had $1.11 in earnings per share (EPS) on $910.7 million in revenue, compared to consensus of $1.05 in EPS on $880.00 million in revenue.

Wissink commented, “We see potential for continued earnings outperformance on a steady growth-supported multiple on FY2 earnings. Q3 results were very strong across all the measures that matter for a retail growth company: comps +12.8%, total sales +22%, e-com +54%, loyalty +20%, and new unit performance ahead of plan. While investment spend spiked in the quarter creating margin deleverage, EPS of $1.11 bested consensus by $0.06 and our estimate by $0.09 due to sales strength. The guide was inline with models and slightly better than feared, although we note the 300-400bps step down sequentially in comp was what we had expected. For investors that can own into 2016, we maintain a positive bias and see ULTA as well positioned to continue to gain share in the beauty industry.”

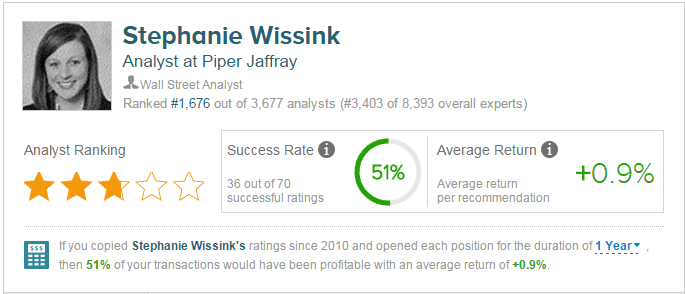

According to TipRanks.com, which measures analysts’ and bloggers’ success rate based on how their calls perform, analyst Stephanie Wissink has a total average return of 0.9% and a 51.4% success rate. Wissink has a 5.8% average return when recommending ULTA, and is ranked #1676 out of 3631 analysts.

Out of the 11 analysts polled by TipRanks, 9 rate Ulta Salon Cosmetics & Fragrance stock a Buy, while 2 rate the stock a Hold. With a return potential of 10.5%, the stock’s consensus target price stands at $180.40.

Ambarella Inc

In addition, Needham analyst Quinn Bolton reiterated a Hold rating on shares of Ambarella, after the semiconductor company posted its fiscal third-quarter results, providing soft revenue outlook for its current quarter.

Bolton noted, “AMBA reported stronger than expected F3Q16 results led by strength in IP security, automotive and flying cameras. However, softer than expected sell-through and high inventory levels at lead sports camera customer GoPro has resulted in an inventory overhang that should serve as a near-term headwind over the next two quarters. Reflecting this headwind, F4Q16 revenue guidance fell below our Street-low estimates that already reflected our assumption for an inventory correction. As we believe sales of wearable sports cameras may remain soft through the holiday selling season, we remain on the sidelines as we monitor sell-through data for wearable sports cameras. Outside of wearable cameras, we are encouraged by AMBA’s traction.”

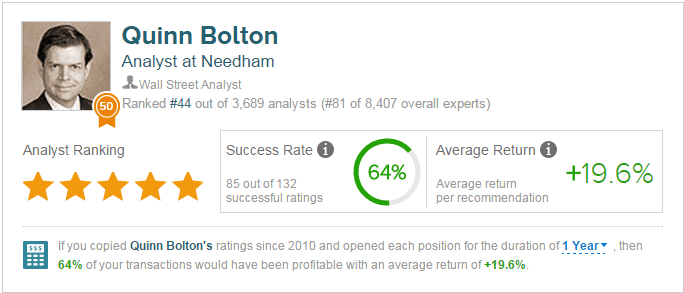

According to TipRanks.com, analyst Quinn Bolton has a total average return of 19.6% and a 64% success rate. Bolton has a 64.6% average return when recommending AMBA, and is ranked #44 out of 3631 analysts.

Out of the 14 analysts polled by TipRanks, 8 rate Ambarella stock a Buy, while 6 rate the stock a Hold. With a return potential of 59%, the stock’s consensus target price stands at $92.