Earnings from SolarCity Corp (NASDAQ:SCTY) and Qorvo Inc (NASDAQ:QRVO) raised concerns among investors as the companies missed estimates and reported disappointing guidance, respectively. However, analysts explain why they remain optimistic about the long-term future of both companies.

SolarCity Corp

SolarCity has fallen more than 30 percent since releasing earnings on Tuesday. Colin Rusch of Oppenheimer weighs in on the company amid the selloff, assuring investors that this volatility is not related to the company’s fundamentals. He comments, “We believe investors are concerned about access to and cost of capital, but believe both are trending well, with investment grade debt holding up well despite macro headwinds and a growing pool of project buyers whose appetite remains in excess of available supply.”

The company installed 272 MW in the fourth quarter, falling short of guidance between 280 to 300 MW and also falling short of Rusch’s estimate of 290 MW. The company posted non-GAAP loss per share of ($2.37), slightly narrower than the analyst’s estimate of ($2.50). Many point to the company’s disappointing guidance as the trigger for the selloff, as SolarCity guided 180 MW installations in 1Q16, as opposed to the analyst’s prior guidance estimate of 228 MW. In light of this revision, Rusch is lowering his 1Q16 installation estimate to 180 MW.

However, the analyst notes several reasons to remain positive on SolarCity. Rusch points to “Medium-term plans to generate cash welcome.” He explains, “SCTY continues to maintain access to the ABS markets, completing its fifth securitization last month. We expect loan-to-value rates to increase and spreads vs. interest rates to narrow on future offerings.”

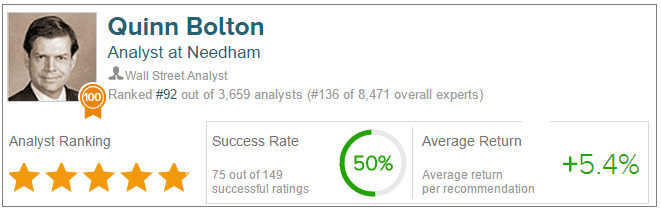

Despite the stock volatility, Rusch reiterates an Outperform rating on the stock but lowers his price target from $58 to $54. According to TipRanks, most analysts remain bullish on SCTY. Out of the analysts polled in the last 3 months, 7 are bullish, 1 is bearish, and 4 remain neutral. The average 12-month price target between these 12 analysts is $52.50, marking a 181% potential upside from current levels.

Qorvo Inc

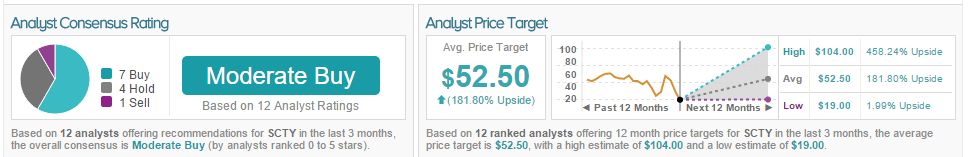

Qorvo reported Q4 earnings last week that were in-line with the company’s estimates. Quinn Bolton of Needham explains that the company posted F3Q16 revenue of $619.7 million, in-line with the January announcement estimate of $620 million. Revenue derived from Apple, one of Qorvo’s most significant customers, fell 15% quarter-over-quarter, which the analyst attributes to “inventory reductions in the China market.”

However, the company posted disappointing earnings that did not meet the pre-announcement estimates. Qorvo guided F4Q16 revenue of $600 million, down from the previous estimate of $620 million.

Bolton explains that Qorvo attributes the guidance miss to “lower smartphone build rates and a shift in timing in the launch of a flagship smartphone platform at a major customer.” Although the analyst is disappointed, he is “not entirely surprised by the conservative near-term outlook.”

Although near-term outlook is weak, the analyst remains confident in Quorvo, citing increasing dollar content. Bolton explains, “management expressed confidence the company would increase its dollar content on next generation flagship platforms at each of its three largest smartphone customers in 2016.”

In light of this long-term potential, Bolton reiterates a Buy rating on QRVO but slightly lowers his price target from $55 to $54. Bolton has a 50% success rate recommending stocks with a +5.4% average return per rating. According to TipRanks, 10 analysts are bullish on Qorvo, 1 is bearish, and 3 remain neutral. The average 12-month price target between these 14 analysts is $58, marking a 64% upside from current levels.