Credit Suisse analysts commented recently on Sunedison Inc (NYSE:SUNE) and Palo Alto Networks Inc (NYSE:PANW) following a court’s decision to block an injunction and strong Q2 earnings, respectively. For Sunedison, the analyst remains on the sidelines, stating that while the decision eased liquidity concerns, he is unclear about the judge’s reasoning. On the other hand, Palo Alto’s strong Q2 earnings indicate a successful business model, despite lowered margin guidance.

Sunedison Inc

Credit Suisse analyst Patrick Jobin weighed in on Sunedison following a judge denying an injunction order. Last month, David Tepper, manager of hedge fund Appaloosa Management LP, filed an injunction to stop the company’s yieldco, Terraform Power, from acquiring some of Vivint’s assets after it completes the acquisition. The hedge fund manager was adamant about the company’s actions, claiming they were not in the best interest of shareholders. Specifically, Tepper alleged that Vivnt’s assets would significantly increase TERP’s debt and change the company’s business model.

The analyst believes the decision in SUNE’s favor will facilitate the acquisition and transfer Vivint’s operating assets to TERP rather than keeping them on its “constrained” balance sheet. As a result, he believes an asset sale “is no longer a necessity,” although it is still “possible given the aversion TERP shareholders have for residential solar assets.”

The analyst reiterates his Neutral rating for Sunedsion with a $3.00 price target. He explains, “We are unaware of the rationale for rejecting the injunction request or any potential subsequent motions (or suits) that could be brought. Clearly, SUNE shares were very strong throughout the day (+36%), potentially driven by short covering ahead of the order or perhaps the judge’s position was more widely disseminated than the official docket would suggest.” Patrick Jobin has a 24% success rate recommending stocks with an average loss of (19.5%) per recommendation.

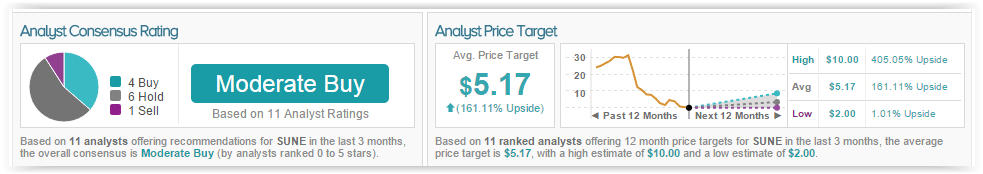

According to TipRanks’ statistics, out of the 11 analysts who have rated the company in the past 3 months, 4 gave a Buy rating, 1 gave a Sell rating, and 6 remain neutral. The average 12-month price target for the stock is $5.17, marking a 161% upside from where shares last closed.

Palo Alto Networks Inc

Last week, Palo Alto reported its fiscal Q2 earnings, posting revenues of $334.7 million and earnings of $0.40 per share, beating consensus estimates of $318.3 million and $0.39, respectively. Deferred revenue also surpassed consensus at $928.8 million vs $902.9 million.

Analyst Philip Winslow of Credit Suisse attributes the company’s strong earnings to y/y growth in product revenue, “continued success in Wildfire and Traps,” and new customer acquisitions. According to the analyst, “These data points highlight Palo Alto’s ability to upsell into its installed base and sell additional services, which remains core to [his] positive thesis.” While a higher than expected subscription rate caused management to lower its operating margin guidance for FY16, as a result of higher in-period sales commissions relative to ratable revenue, management stated an expected 40% increase in FCF margin in the second half of 2016. Despite this “disappointing” margin guidance, the analyst believes “the company’s long-term margin structure has not changed” and will look for updates in the company’s analyst day.

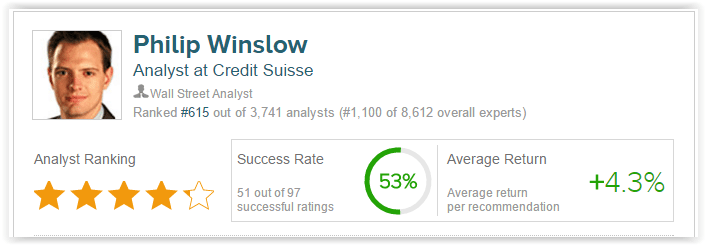

Winslow reiterates his Outperform rating on the company with a $225 price target. He explains, “We continue to believe that Palo Alto Networks’ unique technology platform position the company to continue to gain share in the network security market—driving strong, sustained revenue growth.” Philip Winslow has a 53% success rate recommending stocks with an average return of 4.3% per recommendation.

According to TipRanks’ statistics, out of the 22 analysts who have rated the company in the past 3 months, 20 gave a Buy rating while 2 remain neutral. The average 12-month price target for the stock is $190.45, marking a 31% upside from where shares last closed.