Yahoo! Inc. (NASDAQ:YHOO) reported results for the quarter ended March 31, 2016.

“I’m pleased that we delivered Q1 results in line with our expectations. Our 2016 plan is off to a solid start as we continue to focus on driving efficiency, lowering costs, and improving long-term growth,” said Marissa Mayer, CEO of Yahoo. “In tandem, we made substantial progress towards potential strategic alternatives for Yahoo. Our board, our management team, and I are completely aligned on this top priority for shareholders.”

Business Highlights

- Strategic Alternatives Update

- The Board of Directors at Yahoo formed a strategic review committee of independent directors to consider strategic alternatives for the company alongside its continued consideration of a reverse spin. Since the launch of the process in February, management has worked diligently with the committee and its independent legal and financial advisors to engage with interested strategic and financial parties.

- Company Updates

- Introduced an enhanced mobile search experience making it easier for users to get the most relevant, specialized information about sports teams, players, presidential candidates and movies.

- Launched new features for Yahoo Mail Android and iOS apps that help users stay organized and get more things done quickly. New features include customizable swipe options, actionable notifications, recent attachment features, new colorful themes and 3D gestures.

- Unveiled the new Yahoo App and Homepage that allows users to more easily access related news they’re interested in, share their commentary on news they read, and stay apprised of developments with real-time notifications when stories are updated.

- As part of our commitment to delivering the best sports content experience on Yahoo Sports, we introduced Yahoo Esports, a premium destination that aims to become the most comprehensive guide for esports fans. The site features reporting, blogging, video commentary, match pages, team rosters, stats, related schedules, scores and a live chat feature where fans can connect with the community.

- Yahoo Sports continued to build on past success in live streaming events through new and expanded partnerships with professional sports organizations like the NHL,PGA and MLB.

- Announced that Yahoo Finance, the site that provides users with unparalleled access to data, analysis and insights, will host the first-ever live stream of the Berkshire Hathaway annual shareholders meeting.

- Held three well-attended Yahoo Mobile Developer Conferences in San Francisco,Taiwan and Hong Kong where Yahoo introduced new tools as part of the Yahoo Mobile Developer Suite designed to help developers grow their apps and build their businesses. New features include a redesigned Flurry Analytics platform, a new Flurry App, tvOS analytics support and direct ad serving capabilities.

- In March 2016, we appointed two new directors who each bring a strong expertise in complex business matters; Cathy Friedman and Eric Brandt. Cathy Friedman spent 23 years at Morgan Stanley as a strategic and transaction advisor. Eric Brandt brings significant financial and business management experience as a former pharmaceutical and technology executive, and was most recently involved in the acquisition ofBroadcom Corporation by Avago.

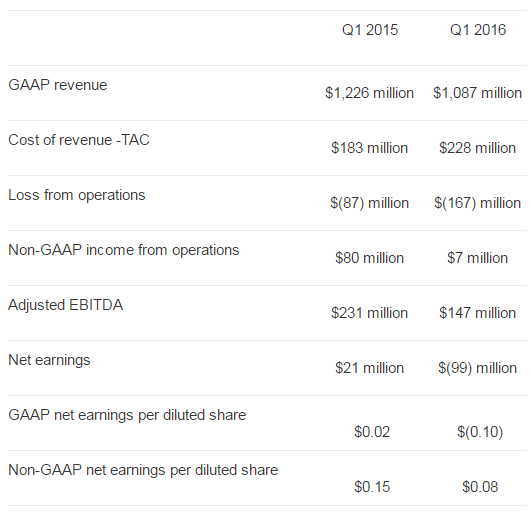

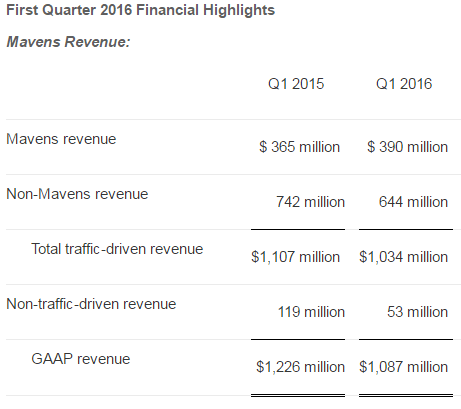

Mavens revenue represented 33 percent of traffic-driven revenue in the first quarter of 2015, and increased to 38 percent in the first quarter of 2016.

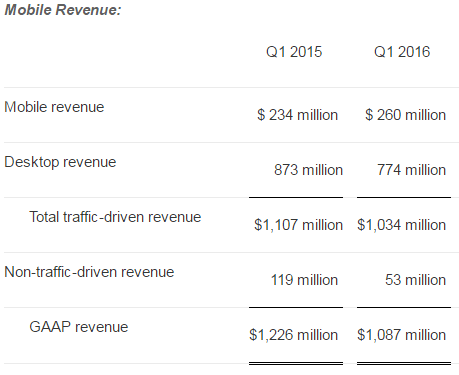

Mobile revenue represented 21 percent of traffic-driven revenue in the first quarter of 2015, and increased to 25 percent in the first quarter of 2016.

Gross mobile revenue for the first quarter of 2015 and 2016 was $391 million and $412 million, respectively.

Search Revenue:

- Gross search revenue was $820 million for the first quarter of 2016, a decrease of 15 percent compared to the first quarter of 2015.

- GAAP search revenue was $492 million for the first quarter of 2016, a decrease of 9 percent compared to the first quarter of 2015.

- Cost of revenue – TAC paid to search partners was $144 million for the first quarter of 2016, a 44 percent increase compared to the first quarter of 2015.

- The number of Paid Clicks decreased 21 percent compared to the first quarter of 2015.

- Price-per-Click increased 7 percent compared to the first quarter of 2015.

Display Revenue:

- GAAP display revenue was $463 million for the first quarter of 2016, a 1 percent decrease compared to the first quarter of 2015.

- Cost of revenue – TAC paid to display partners was $83 million for the first quarter of 2016, a 1 percent increase compared to the first quarter of 2015.

- The number of Ads Sold increased 8 percent compared to the first quarter of 2015.

- Price-per-Ad decreased 6 percent compared to the first quarter of 2015.

Cash, Cash Equivalents, and Marketable Securities:

- Cash, cash equivalents, and marketable securities were $7.1 billion as of March 31, 2016compared to $6.8 billion as of December 31, 2015, an increase of $0.3 billion.

“We delivered financial results at the high end or above our guidance ranges. We also achieved free cash flow of $297 million through improved working capital efficiencies, excellent cost controls, reduced capital expenditures and a large tax refund,” said Ken Goldman, CFO of Yahoo. “While we remain focused on the strategic alternatives process as a top priority, our employees showed their determination and commitment to Yahoo by executing on our operating plan.” (Original Source)

Shares of Yahoo! are up nearly one percent to $36.76 in after-hours trading. YHOO has a 1-year high of $45.18 and a 1-year low of $26.15. The stock’s 50-day moving average is $35.04 and its 200-day moving average is $32.77.

On the ratings front, Yahoo! has been the subject of a number of recent research reports. In a report released today, JMP analyst Ronald Josey maintained a Hold rating on YHOO. Separately, yesterday, RBC’s Mark Mahaney reiterated a Hold rating on the stock and has a price target of $33.

According to TipRanks.com, which ranks over 7,500 financial analysts and bloggers to gauge the performance of their past recommendations, Ronald Josey and Mark Mahaney have a total average return of 0.7% and 19.0% respectively. Josey has a success rate of 55.2% and is ranked #1847 out of 3807 analysts, while Mahaney has a success rate of 64.2% and is ranked #7.

Overall, one research analyst has rated the stock with a Sell rating, 14 research analysts have assigned a Hold rating and 11 research analysts have given a Buy rating to the stock. When considering if perhaps the stock is under or overvalued, the average price target is $38.20 which is 5.1% above where the stock opened today.

Yahoo!, Inc. is a global technology company, which delivers personalized search, content, and communications tools on the web and on mobile devices. The company provides a variety of products and services, many of them personalized, including search, content, and communications tools-all daily habits for hundreds of millions of users, on the Web and on mobile devices.