The biotechnology sector remains busy at the midpoint of the fourth quarter. This week, analysts remain bullish on Valeant Pharmaceuticals Intl Inc (NYSE:VRX) due to positive prescription data, and on Depomed Inc (NASDAQ:DEPO) as the company buys the rights to a new drug.

Valeant Pharmaceuticals Intl Inc

In a research report issued yesterday, Neil Maruoka of Canaccord reiterated a Buy rating on Valeant Pharma with a price target of $170, as a mid-quarter check proved “no precipitous decline in retail” prescription data. Valeant has been under fire for fraud accusations and recently cut ties with its specialty pharmacy, Philidor, to help clear the air.

The analyst notes that in general, drug production tends to slip when management is dealing with a crisis, as Valeant has been busy with meetings and conference calls in the wake of fraud accusations. However, Maruoka notes, there have been “no major downward inflection points in any of the key products in the retail channels and hence [the analyst is] not overly concerned there could be more downside in the stock.” He qualifies that the exception is revenue derived from Philidor, which many believe will drastically impact Valeant’s dermatology products.

Valeant is currently predicting fourth quarter earnings between $4 and $4.20, though the analyst consensus is $3.61. The analysts notes that management will provide updated guidance next month, though he warns that the stock will react to the inevitable bad headlines still to come. He adds, “If the company guides in December to anything close to $14.00 in EPS for 2016, the stock will work from there.”

Lastly, the analyst stresses Xifaxan, Valeant’s approved drug for IBS. Maruoka explains, “We emphasize that far too little attention is being paid to the rapidly accelerating growth of Xifaxan, which does NOT go through Specialty Pharmacy channels and has NOT had any price increases since Valeant closed the Salix transaction in April.” Weekly data shows that year-over-year prescriptions for the drug have increased and the analyst estimates it could be a $1.7 billion drug in 2016.

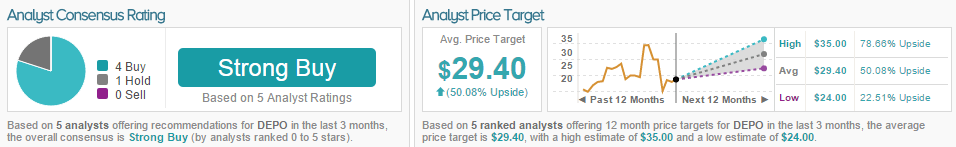

According to the 19 analysts polled by TipRanks in the last 3 months, 13 remain bullish on Valeant, 1 is bearish, and 5 are on the sidelines. The average 12-month price target for the stock is $170.82, marking a 131% potential upside from current levels.

Depomed Inc

Following Depomed’s announcement that it acquired a pipeline drug from Grunenthal, analyst Scott Henry of Roth Capital reiterates a Buy rating on the biopharmaceutical company with a $24 price target. Depomed acquired the U.S. and Canadian rights to cebranopadol, a ready pain treatment, for $25 million in cash. The analyst notes that this acquisition took Depomed’s pipeline “from 0 to 60 overnight.”

Henry believes Depomed acquired the drug for a “favorable price” as the drug has peak sales potential of over $500 million. He adds, “Importantly, we believe that DEPO was in a preferred position when negotiating for cebranopadol since it was the only company that could clear up ongoing litigation.” Depomed expects to start phase 3 testing for the drug in 2017 with an expected New Drug Application filing in late 2018 or early 2019.

Overall, Henry is bullish on this deal because of its low risk nature with potential for major reward. He concludes, “In our opinion, this event prepares the company for long-term success as an independent company.”

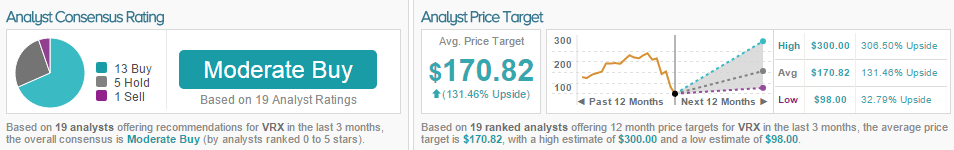

According to the 5 analysts polled by TipRanks in the last 3 months, 4 are bullish on the biopharm company while 1 analyst remains neutral. The average 12-month price target for the stock is $29.40, marking a 50% potential upside from current levels.