Analysts from Oppenheimer and William Blair weighed in on the renewable energy company TerraForm Power Inc (NASDAQ:TERP) and network control company Infoblox Inc (NYSE:BLOX), as the companies’ shares rose sharply yesterday.

TerraForm Power Inc

TerraForm shares jumped nearly 33% yesterday after the billionaire hedge fund manager David Tepper disclosed yesterday that his fund, Appaloosa Management, owned a stake in TerraForm through a rare public letter to the company’s board. In addition, Oppenheimer analyst Colin Rusch upgraded shares of TerraForm from a Perform to an Outperform rating, with a price target of $10, which represents a potential upside of 9% from where the stock is currently trading.

The analyst believes that the stock is undervalued relative to the asset portfolio and states and that the risk/reward ratio is skewed to the upside. He continues by stating that the current share price does not include the investment-grade cash flows which the company’s product portfolio is generating, even with no growth going forward for the platform. The analyst also states that acquisition resources are limited because of TERP/SUNE’s acquisition of Invenergy and another acquisition of Vivint solar. Because of this, his “run –off scenario provides an appropriate base case for investing in the stock.”

The analyst continues by acknowledging recent investor concern related to management changes, stating “With recent management changes, we believe many investors have rightfully identified concerns about arm’s-length dealing between TERP and SUNE despite the formal arrangements to ensure fairness. While we are somewhat cautious on this issue, we believe TERP remains a strategic asset to SUNE.” Despite investor concern, Rusch believes that the drop in share price related to these management changes is exaggerated, and that investors should purchase the stock while the price is low.

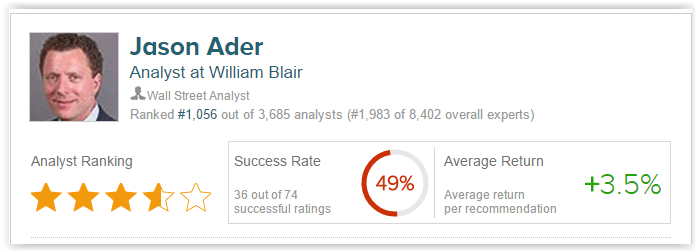

According to TipRanks’ statistics, analyst Colin Rusch has a 49% success rate commending stocks with an average return of 13% per recommendation. Out of 4 analysts who have rated TERP in the last 3 months, 3 gave a Buy rating and 1 gave a sell rating. The average 12-month price target for the stock is $11.33, marking a 23% upside from where shares last closed.

Infoblox Inc

Analyst Jason Ader of William Blair weighed in on InfoBlox after the company posted Q1/2016 earnings on Monday. Counteracting investor and analyst doubt, the company posted revenues and operating margin that were well above street expectations, highlighting a 61% y/y increase in product revenue an continued growth in security. The company also announced a $100 million buyback program, “exhibiting its confidence in the company’s longer-term business prospects”. Management attributed this stellar quarter due to strong security growth as a well as consistent upgrade cycles. In the report, management commented on the “positive impact of security on overall deal sizes, noting that two of the three largest deals in the quarter contained a security element.” Management also offered positive sentiment on the company’s DNS security produces, stating that they are differentiated from their competitors.

In the report, managements stated a decline in customer acquisition as well as a low percentage of upgrade-related transactions (25%). However, this was due to the company focusing on larger new accounts and upgrading existing accounts, which did not adversely affect revenue for the quarter. The analyst believes the company can sustain growth “despite expected periods of difficult comps” towards the end of 2016 and continuing into 2017. He believes the company is “well aligned with secular trends (security, hybrid, cloud)” and highlights new management’s success which resulted in this better than expected quarter. The analyst reiterated an Outperform rating with no price target and states, “From our perspective, the new management team is quickly making its mark, executing a near-flawless quarter and delivering a well-timed response to bearish naysayers. The principle pushbacks to the Infoblox story—true growth rates following the upgrade cycle and poor operating leverage—were answered emphatically, with management substantially raising margin expectations and implying double-digit growth even past the upgrade cycle. On top of the strong outlook, the buyback exhibits management’s confidence in the company’s prospects and also helps offset previously troublesome share dilution.”

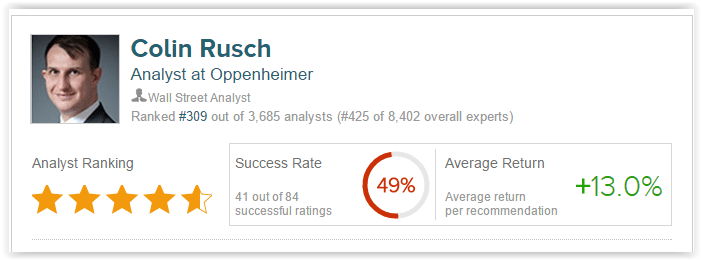

According to TipRanks’ statistics, analyst Jason Ader has a 49% success rate recommending stocks with an average return of 3.5% per recommendation. Out of the 8 analysts who have rated BLOX in the last 3 months, 4 gave a Buy rating, 1 gave a Sell rating, while 3 remain on the sidelines. The average 12-month price target for the stock is $26.17, marking a 43% increase from where shares last closed.