Healthcare analysts weighed in on pharmaceutical companies Sarepta Therapeutics (NASDAQ:SRPT), and Relypsa Inc (NASDAQ:RLYP). With Sarepta approaching an FDA advisory committee meeting, and Relypsa facing an issue regarding a dropped M&A adviser, these companies have a lot on their plates. While analysts seem to have a neutral outlook towards Sarepta, Relypsa is generating a more bullish consensus.

Sarepta Therapeutics Inc

Jefferies analyst Gena Wang shed light on Sarepta, explaining that she continues to see risk in the company’s new experimental drug, eteplirsen. The drug is Sarepta’s lead pipeline candidate indicated to treat Duchenne muscular dystrophy (DMD), which will be discussed by the FDA’s advisory committee (AdCom) on April 25.

The analyst notes that while consensus appears positive heading into eteplirsen’s AdCom, she sees a “slim chance of approval” for several reasons. First, she points to “weak clinical/biomarker data,” which is likely to be scrutinized by the FDA. The analyst explains that while “loss of ambulation” could be the strongest data point for the company, it may not be sufficient enough on its own to support approval. Moreover, Wang explains that “selection of proper controls would continue to be a key debating topic.”

Second, Wang explains that the FDA makes “data-driven decision” regardless of advocacy, which is relevant in this case because the DMD community has been very visibly advocating for the drug. Wang elaborates on this issue claiming, “the open letters from 36 [key opinion leaders] and congress representatives may provide some pressure to the FDA. However, the FDA likely will follow the same principle for BMRN’s drisapersen (complete response letter) and PTCT’s ataluren (refuse to file letter).”

Lastly, Wang points out that no new information has been submitted to the FDA since the New Drug Application was submitted. She elaborates, “Although the new briefing doc likely will include discussion questions (vs. none previously), we see low probability to include voting questions based on the briefing doc for drisapersen.”

The analyst touches on a upside risk, explaining, “The stock likely would react positively on the day of briefing doc release and there might be a positive panel vote at AdCom.” However, she continues, “the FDA’s comments in the afternoon discussion should be the key focus to gauge ultimate approvability even with a positive AdCom outcome.”

Wang reiterates a Hold rating on SRPT, with a price target of $14.00.

According to TipRanks.com, which measures analysts’ and bloggers’ success rate based on how their calls perform, analyst Gena Wang has a yearly average return of -17% and a 27% success rate. Wang is ranked #3541 out of 3795 analysts.

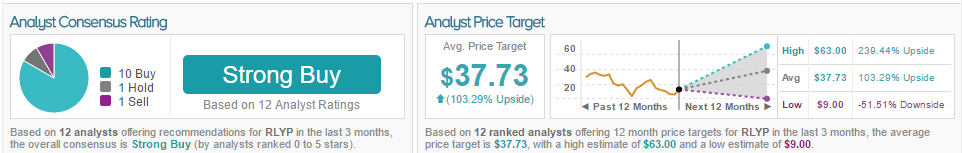

The overall consensus for SRPT is Moderate Buy, as 38% of analysts are bullish, 50% are neutral, and 12% are bearish. The average 12-month price target is $31, marking a 50% potential upside from current levels. Gena Wang has a 27% success rate with a (-16.7%) average return.

Relypsa Inc

Brean Capital analyst Difei Yang weighed in on biotech company Relypsa after the company updated its March and Q1 monthly prescription numbers through the 8-K. Relypsa’s lead drug is Veltassa, used to treat elevated potassium levels.

The analyst notes that, “while the [prescription] data did not blow investors away, it met our expectations; as such, we are keeping our Q1 and full-year estimates intact.” The data from the March and Q1 data revealed that the company reported 1,277 units of free starter-supply; a 75% increase from the month prior, and 706 retail units, marking a 102% increase from the month prior. Yang elaborates on these figures, explaining, “With the numbers meeting our expectations, we are keeping our full year sales estimates the same,” restating her 2016 sales estimate of $29.7 million, well below the consensus of $39.4 million. However her first quarter sales estimates of $7.3 million are in-line with consensus.

Yang explains, “Given significant unmet needs for hyperkalemia, we assume a conservative revenue forecast at a 7% discount rate. Our estimates assume a slow market acceptance of Veltassa and imminent approval of ZS-9.”

Further, Benzinga reported late last week that Relypsa has dropped Centerview as its M&A advisor, though Relypsa has declined to comment on this. In light of this, Yang comments, “Though Centerview is now out of the running as the M&A advisor, we still believe that a deal may materialize.” Further, the analyst assures, “We still view a take out as being probable due to strategic fit with a larger pharma company.”

Despite the analyst’s conservative outlook, Yang reiterates a Buy rating on the stock with a $26.00 price target.

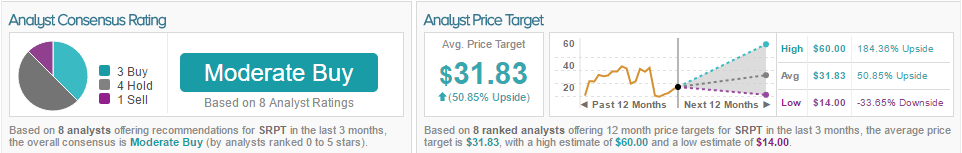

According to TipRanks, Yang has a 32% success rate, with an average loss of (–13.9%) per rating. The overall consensus for RLYP is Strong Buy, with 84% of analysts bullish, 8% of analysts neutral, and 8% of analysts bullish. The average price target for the stock is $37.73 with an upside of 103.79%.