Display of Stock market quotes

salesforce.com, inc.

Analyst Richard Davis of Canaccord weighed in on salesforce.com,inc. (NYSE:CRM) after the company posted record Q4:2015 earnings yesterday. The analyst is bullish on the company’s solid standing and positioning, citing “literally nothing wrong” with the report or guidance. The company posted revenues of $1.81 billion, $17 million above the analyst’s estimates, and non-GAAP earnings of $0.19 per share, in line with his estimates. The company experienced record 27% y/y growth and posted $459 million in operating cash flow, marking a 38% y/y increase relative to his estimates. The company also issued above consensus guidance for both Q1 and FY2017. As a result, the analyst increased his own estimates for FY2017. However, the analyst cited that company billings guidance was on the low end of his estimates, “attributable to the increasingly pronounced seasonality of Q4 renewals, causing lower sequential growth in Q1 deferred revenue, and the accounting effects of the leap year in C2016.”

The fourth quarter marked the most transactions for the company with over 600 deals. These include the company’s largest deal ever at 9 figures, its largest renewal contract, and record Marketing Cloud relationship. The company posted accelerating growth in 3 out of 4 clouds, with only Service Cloud slightly declining to 35% y/y growth. However, the analyst notes that this growth rate is “very impressive in the context of a roughly $2b run-rate business.” Overall, he believes Salesforce is a “well-run, well-positioned [company] with talented salespeople, (and) growth is still coming in large chunks.”

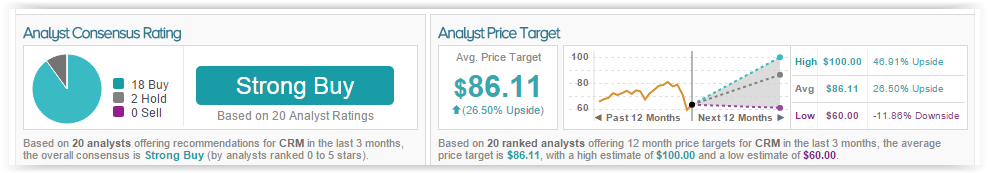

The analyst reiterates a Buy rating on the company although decreases his price target from $95 to $88 to reflect lower growth in Q1 deferred revenue. Richard Davis has a 40% success rate recommending stocks with an average loss of (1.8%) per recommendation. According to TipRanks’ statistics, out of the 20 analysts who have rated the company in the last 3 months, 18 are bullish while 2 remain neutral. The average 12-month price target for the stock is $86.11, marking a 26% upside from current levels.

Akorn, Inc.

Nomura analyst Shibani Malhotra weighed in on Akorn, Inc. (NASDAQ:AKRX) after the company announced it would report preliminary 2015 financial data and 2016 guidance on March 22. While the analyst states that the late March guidance call is later than expected, she believes the data release is a “positive step” closer to filing its delinquent 2014 and 2015 financials in order to avoid de-listing by Nasdaq. In 2015, the company did not properly file data with Nasdaq, resulting in a delinquency notice.

In the guidance call, the analyst will be watching for any delinquent filing and auditing updates. The analyst also states last week’s $200 million term loan repayment, leaving the company with a $206 million cash balance. Due to the Akorn’s $341.9 million in cash remaining at the end of 2015, the analyst believes the company generated $64 million in cash flow so far this quarter. The analyst states that the current stock price does not properly reflect the company’s true value, indicating an upside after it sorts out its financials.

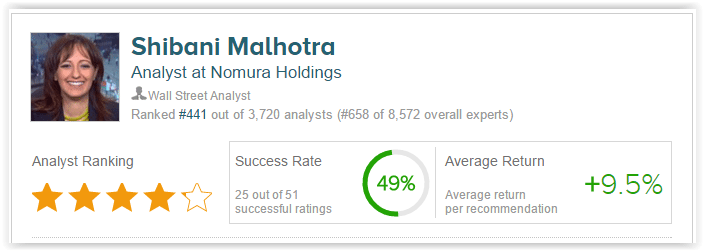

Malhotra reiterates a Buy rating on shares with a $46 price target. She explains, “We continue to view Akorn as one of the more attractive assets in the sector and believe 2016 guidance will demonstrate the company’s strong underlying fundamentals.” Shibani Malhotra has a 49% success rate recommending stock with an average return of 9.5% per recommendation.

According to TipRanks’ statistics, all 6 analysts who have rated the company in the past 3 months gave a Buy rating. The average 12-month price target for the stock is $46.33, marking an 80% upside from current levels.