Healthcare analysts were out this morning with research reports on Valeant Pharmaceuticals Intl Inc (NYSE:VRX) and ACADIA Pharmaceuticals Inc. (NASDAQ:ACAD). The analysts reflect on Valeant’s near-term overhangs, and ACADIA’s Parkinson’s drug following FDA briefing documents release.

Valeant Pharmaceuticals Intl Inc

Rodman & Renshaw analyst Raghuram Selvaraju is bullish on VRX, reiterating a Buy rating and a 12-month price target of $118. The analyst recently weighed in on the company’s patents, asset values, and accounting statements in regards to his positive standpoint, mentioning that “several of these aspects are not well understood.”

Valeant’s relatively new Rifaximin, a drug intended to treat irritable IBS-D (Irritable bowel syndrome with diarrhea) was approved by the FDA in May 2015. According to Selvaraju, a competition drug, Paragraph IV produced by Allergan, will not falter Rifaximin’s progression. The analyst explains, “Rifaximin patent estate provides multiple layers of protection. We note that, in the wake of Allergan’s Paragraph IV challenge to Xifaxan® , certain commentary has suggested that a generic version of rifaximin could be launched as early as next year. We consider this fallacious.”

The analyst bases this speculation on several reasons. Namely, he mentions that based on Hatch-Waxman rules, the filing of Paragraph IV would trigger an automatic 30-month stay which would only expire in 2H 2018. Further, the Xifaxan® patent estate has historically proven to be a resilient barrier, and there are no remaining generic drugs for this on the market. Finally, the analyst explains Valeant currently possesses 17 total patents that would potentially provide combined protection for Xifaxan® molecule until 2027 and method-of-use patent protection for the hepatic encephalopathy, traveler’s diarrhea, and irritable bowel syndrome indications until 2029.

The analyst mentions that the only issue at hand regarding the hold-up for the 10-K filing is asset impairment. However, Selvaraju remains optimistic that the possible delay will not hinder the company’s value substantially, and that the 2015 10-K should be filed before the end of April 2016. The analyst elaborates noting, “We believe that Valeant’s auditors, PwC, may be focusing the bulk of their time on determining the extent of asset impairment. These could include some of the company’s recent acquisitions that have not been performing well, particularly firms such as Obagi Medical Products and Solta Medical. However, we do not expect the impairment charges Valeant may have to take to be so significant as to substantially reduce the firm’s equity value. In addition, we believe that the company should be able to file its 2015 10-K in a timely manner.”

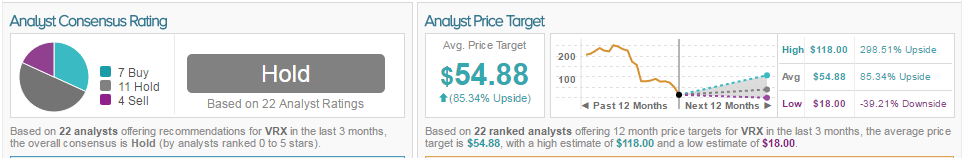

According to TipRanks, VRX is rated Hold, based on 22 analysts offering recommendations for VRX in the last three months. The average price target is $54.88 with a 76.52% upside.

ACADIA Pharmaceuticals, Inc.

ACADIA Pharmaceuticals, Inc.’s newest innovation drug Nuplazid (pimavanserin), has the potential of becoming the first approved drug in the US for psychosis associated with Parkinson’s disease. Tomorrow, March 29th, the AdCom panel will commence in order to discuss the potential approval of the drug. This Friday, the briefing documents were released for the panel, and analysts from HCW have something to say about it. Andrew Fein of H.C. Wainwright is bullish on the stock reiterating a Buy rating and a price target of $50.00.

The discussion tomorrow is anticipated to be centered on clinical meaningfulness of the 3-point improvement on the SAPS-PD, (Scale for the Assessment of Positive Symptoms for Parkinson’s disease) and risk/reward in light of safety signals. Also expected to be included in the discussion, will be potential risk of mortality and approximate doubling of SAEs.

Recently, the FDA has shown some concern after conducting an analysis of the cumulative distribution of the product. Findings have shown that CGI (Clinical Global Impression) improvement has resulted in a large percentage of patients having “no change” or “worsened”, and achieved a 3-point improvement on the SAPS-PD. Due to this reason, the FDA has suggested moving the bar for clinical meaningfulness to a >5-point improvement.

Standing up to this challenge, Nuplazid managed to meet this new threshold with flying colors. The drug accomplished a statistical significance for percentage of patients achieving both a 5-point (58.6% vs. 34.9% PBO p=0.0018) and 7-point (47.1% vs. 27.9% PBO p= 0.0093) improvement on the SAPS-PD. According to Fein, even if the FDA does raise the bar for what they would define as “clinically meaningful,” efficiency for the drug will still be supported. When further discussing this matter, the analyst explained “we were comforted that the data set stood up to several exploratory analyses by FDA biostatisticians, including the proportion of patients achieving >5 and >7-point change on the SAPS-PD.”

Fein reiterates confidence in approval for Nuplazid, affirming that even in the presence of a black box, he believes the benefits will still outweigh the risk, mentioning, “We reiterate our view that even in the presence of a black-box label due to the increased mortality risk, Nuplazid is still competitively positioned in light of its demonstrated clinical efficacy, absence of approved alternatives and overall improved safety profile relative to atypical antipsychotics.”

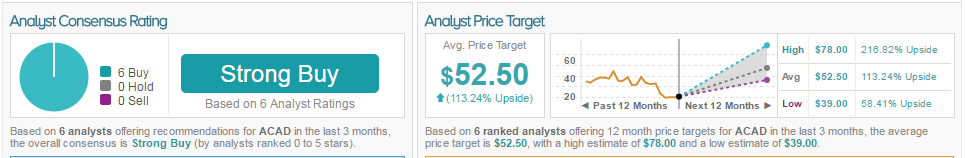

Currently, according to TipRanks, ACADIA has an average price target of $55.00 with a 170.88% upside. Based on 5 analysts offering recommendations for ACAD in the last 3 months, 5 analysts have rated the stock a Buy, with the overall consensus being a Strong Buy.