Morgan Stanley analysts are bullish on internet giants Alphabet Inc. (NASDAQ:GOOGL) and Alibaba Group Holding Limited (NYSE:BABA). Let’s see why the firm takes a positive stance on these two companies and evaluate whether or not they could be a good buy for your portfolio.

Alphabet Inc.

Following his recent conference call with online market research group Merkle-RKG highlighting slowing Google paid search spending, Morgan Stanley analyst Brian Nowak weighed in on Alphabet, the parent company of Google. Though the analyst modestly reduces his revenue forecast for the company, he still believes that it remains a strong and attractive investment.

The analyst notes that as paid search spending slows for Google, he modestly reduces his 2016 GOOGL website revenue estimates by about 1% for FY16. Nowak explains, “We now expect 22% ex-FX Websites growth in 2Q:16,” down from his previous estimate of 24%. The analyst believes that the largest contributing factor to this decrease is the lapping of the increased minimum bid requirements on branded keywords. He explains, “branded costs per click rose ~30% between 1Q:15 to 2Q:15… with a 74% r-squared between KG’s results and reported GOOGL advertising revenue growth we choose to take a more conservative stance.”

Despite the deceleration in click spending, the analyst believes that Google’s innovation-based drivers are still very much intact. Nowak elaborates, “we are 3% ahead of 2Q:16 adjusted EPS,” highlighting multiple undervalued Google services such as expanded text ads, desktop search, and Maps. A 50% increase in text ad size had seen a boost in advertiser click rate upon implementation in May, and the analyst also believes that desktop search is about to take off with brute acceleration in time to come. In addition, Nowak maintains that Google Maps monetization will add about $1.5 billion to website revenues in 2017.

Though the analyst lowers his 2016 GOOGL expected gross revenues in 2016, he states, “Google has a strong history of innovation to improve monetization and ad revenue growth…and we don’t see that changing going forward.”

Nowak reiterates an Overweight rating on Alphabet with a price target of $865.

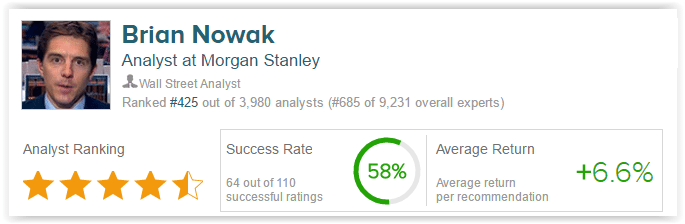

Brian Nowak is a top ranked analyst on TipRanks, with a success rate of 58% and an average return of 6.6%.

According to TipRanks, 97% of analysts maintain a Buy rating for GOOGL, while the remaining 3% issue a Hold rating for the stock. The average price target is $911.27, marking a 31.83% upside from current prices.

Alibaba Group Holding Limited

Following Alibaba’s recent investor day, Morgan Stanley analyst Robert Lin weighs in on the stock and addresses some frequently asked questions about the company.

Alibaba’s first investor day since its IPO offered a lot of information as to what exactly the company is, what it does, and where it’s going, according to Lin. “Alibaba is not a pure eCommerce company and its value extends beyond pure transactions,” explains the analyst.

The company plans to hit its gross merchandise volume of $1 trillion by F2020 with three strategies surrounding Big Data/Cloud Computing, Rural Development, and Globalization. Lin notes, “As a data company, Alibaba leverages Big Data and Cloud to enable better user experience and improve customers’ economics.” This $1 trillion target would be the equivalent of the top 3 Chinese provinces’ GDP combined.

The analyst also explains the strategic mindset Alibaba employs for its M&A and investments. Alibaba focuses on synergies, rather than financials, when deciding on investments and maintains highly disciplined capital deployment. The analyst adds, “According to our estimate, Alibaba had spent over US$24bn to acquire and invest in leading businesses.”

The analyst notes that China’s Infrastructure as a Service Cloud industry is expected to reach $7.8 billion by CY2018, growing at 135% CAG in the next three years. AliCloud has approximately 500,000 paying customers as of March 2016 and is continuing to grow rapidly with the analyst explaining, “About 50% of the top 35 ‘billion dollar unicorn’ Chinese Internet companies adopt AliCloud.” In addition, the analyst sees rural China as a potentially lucrative untapped market for Alibaba, and the company seeks to penetrate 54% of countries by F20e.

Lin reiterates an Overweight rating for BABA with a price target of $119.00.

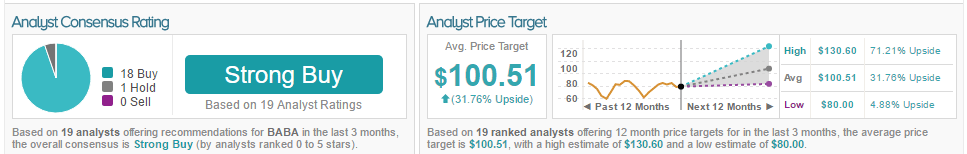

The average price target for BABA, according to TipRanks, is $100.51, marking a 31.76% upside from current prices. 95% of analysts maintain a Buy rating for BABA, while the remaining 5% issue a Hold rating for the stock.