Analysts from Oppenheimer and Drexel Hamilton weigh in on cybersecurity software maker FireEye Inc (NASDAQ:FEYE) and data analytics software firm Tableau Software Inc (NYSE:DATA), as both companies are set to release earnings this week. Let’s take a closer look:

FireEye Inc

In anticipation of earnings on May 5th , Oppenheimer analyst Shaul Eyal reiterates an Outperform rating on FireEye, Inc. and provides a price target of $35.

Based on recent checks, Eyal expects FireEye to deliver “solid” 1Q16 results meeting at least the mid-point revenue guidance of $172M (up 37% YoY). According to Eyal, International execution has been improving driven by recent sales realignment in the EMEA/APAC regions and a recovering in the EU economies. Following FTNT and CHKP’s strong earnings, Eyal expects FireEye to experience similar results.

FireEye is responding well to evolving industry requirements with the debut of Mandiant services for law firms following Panama Papers breach in addition to developing a product line that “rides the wave of security efficacy and automation.” Further, with a rounded end solutions platform from serving a growing TAM of $100 billion, FireEye could continue to enhance its focus on improved profitability. Eyal views the LPS estimates for FY 16 ($1.24) and FY17 ($0.25) as “highly feasible targets with room for further improvement driven by better volumes and internal efficiencies.”

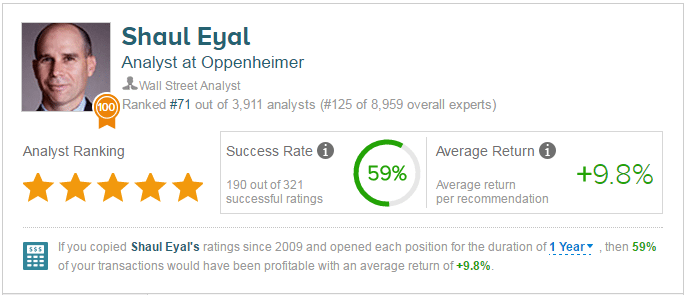

According to TipRanks which measures analysts’ and bloggers’ success rate based on how their calls perform, analyst Shaul Eyal has a yearly average return of 9.8% and a 59% success rate. Eyal is ranked #71 out of 3911 analysts.

Out of the 13 analysts polled by TipRanks (in the past 3 months), 5 are Bullish on FireEye stock, while 8 remain Neutral on the stock. With a potential upside of 34.45%, the stock’s consensus target price stands at $23.18.

Tableau Software Inc

Drexel Hamilton analyst Brian J. White provides an update on Tableau Software, as the company about to release earnings on Thursday, May 5th. White reiterates a Buy rating on the stock and provides a price target $75.

In light of the company’s disappointed start this year as shown in Tableau’s setback in February, White believes the market will approach the report with greater caution. White continues to believe that Tableau has an opportunity to become a “must have tool” for information workers and an attractive play on the Big Data movement.

White estimates that Tableau will exceed his 1Q:16 revenue forecast of $157.1 million (up 21% YoY) and slightly beat the Street (at $163.9 million). Because of weakening macro environment trends in February Tableau provided a 1Q:16 outlook that called for sales of $160-165 million. To put the poor February in perspective, the stock is now down 45% YTG and significantly underperforming the nearly 5% decline for the NASDAQ.

Tableau exited 4Q:15 with a little more than 39,000 customers and White believes the company could exceed 42,000 customers at the end of 1Q:16 Further, White estimates that the company closed 250-270 transactions with sales greater than $100K during 1Q 16, which is seasonally down from 414 transactions in 4Q:15.

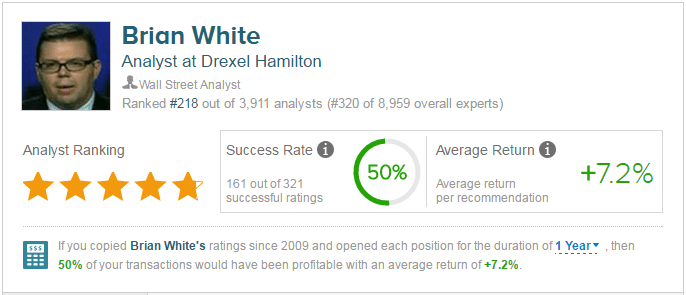

According to TipRanks which measures analysts’ and bloggers’ success rate based on how their calls perform, analyst Brian J. White has a yearly average return of 7.2% and a 50% success rate. White is ranked #218 out of 3911 analysts.

Out of the 19 analysts polled by TipRanks (in the past 3 months), 9 rate DATA a Buy, while 10 rate the stock a Hold. With a potential upside of 27.31%, the stock’s consensus target price stands at $66.38.