Glu Mobile Inc.

Analyst Michael Graham of Canaccord Genuity constructed a bottom-up revenue analysis of the mobile game publisher Glu Mobile Inc. (NASDAQ:GLUU), following recent iOS and Android app store data. Graham believes this analysis affirms that Q1 bookings will reach mid-point guidance. The analyst reiterates a Hold rating on Glu with an unchanged $4.00 price target.

Graham views his results in a positive light as his bottom-up analysis provides numbers that kicks 1Q16 off on a good foot. He states, “We use iOS and Android app store rankings to analyze individual game performance in the quarter and construct an alternative bottom-up revenue build for GLUU. Our analysis suggests Q1 bookings are likely to hit the midpoint of guidance.” He continues, “We are reasonably confident that GLUU will generate ~$47M in bookings in Q1 (which is the mid-point of guidance).”

The analyst suggests that the company’s latest celebrity genre game release, Kendall & Kylie, contributed to Q1 with an estimated $4.6M, and Glu’s future game portfolio for 2016 looks impressive. He states, “We believe the portfolio will look more complete and robust in the future, without a single game making up more than 15% of total bookings. A more diversified portfolio should be a positive for the company that could possibly insulate it from the volatility the industry has historically faced.” However, Graham adds a caveat, commenting, “Our bottom-up revenue build by game for full year 2016 gets us to ~$250M in bookings, which is the low end of guidance. We have made several assumptions around timing of game launches that may not be correct.”

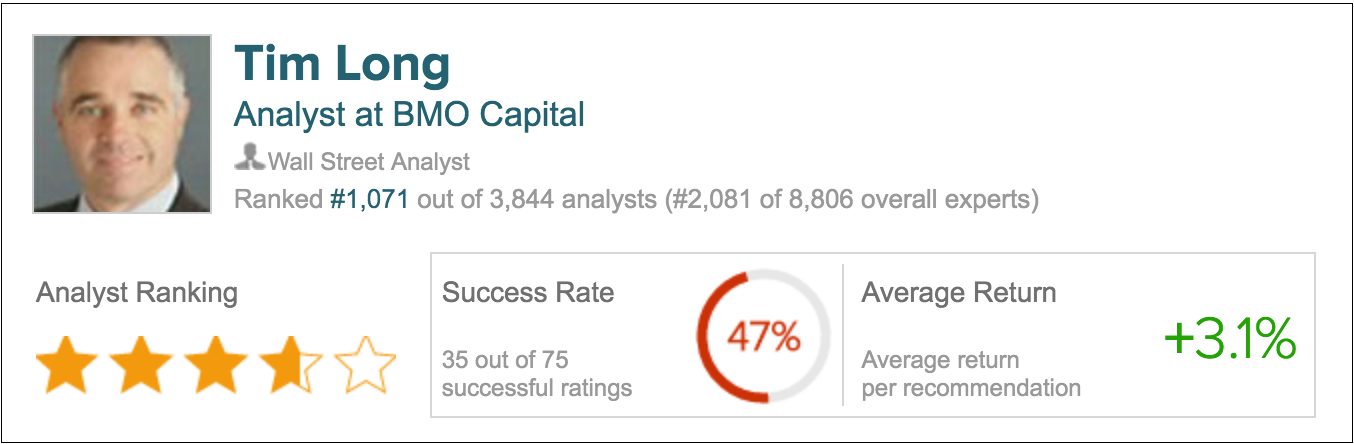

According to TipRanks, 53% of Michael Graham’s predictions are profitable and he delivers a 6% average rate of return. While Graham remains on the sidelines, four other analysts gave GLUU a Buy Rating. The average 12-month price target for the stock is $4.30, marking a 53.57% upside from where shares last closed.

BlackBerry Ltd.

BlackBerry Ltd. (NASDAQ:BBRY)’s earnings results, released late last week, turned out to be different than what analyst Tim Long of BMO Capital predicted. Revenues came out to be lower than the analyst estimated yet he retains an optimistic view on the company in terms of BlackBerry’s software sector. Long reiterates a Market Perform rating with an unchanged price target of $8.

The analyst admits to an overestimation of handset revenue but remains optimistic. He states, “Revenues were well below our estimates owing to a big miss in handsets, while other segments were in line. The mix shift toward software/services, however, led to a beat on gross margins. Combined with lower opex, the results drove a beat on EPS.” Long goes into detail on the damage, adding, “Our FY2017 EPS estimate goes from ($0.31) to ($0.28), and we are establishing an FY2018 EPS estimate of ($0.24).” On a more positive note, the analyst adds, “Management guides to 30% software growth in FY2017, approximately in line with our prior thinking. We remain on the sidelines, looking for upside opportunities in software and a more predictable handset business.”

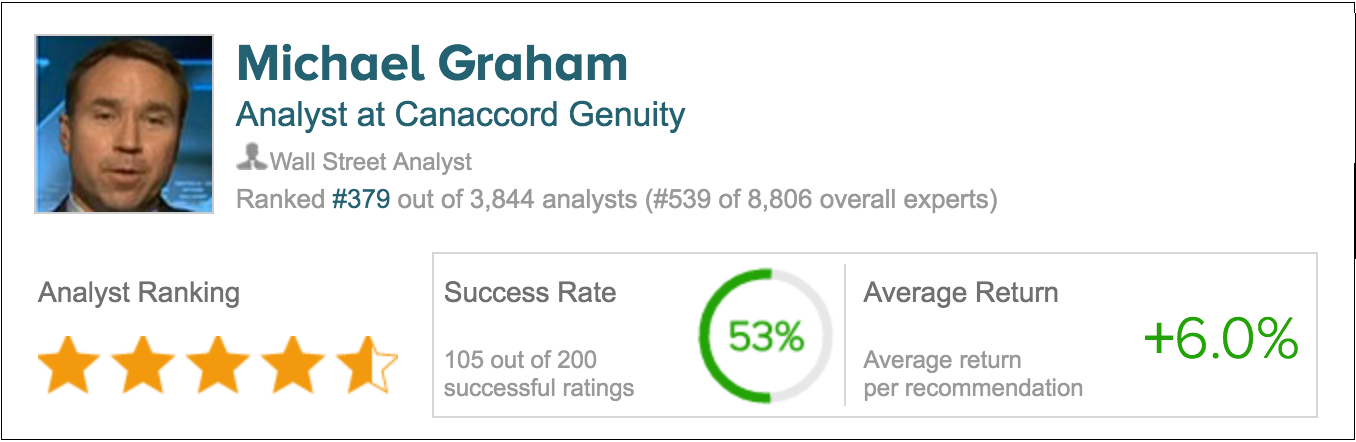

According to TipRanks, Tim Long has a 47% success rate, delivering an average return per recommendation of 3.1%. In addition to Long, in the past three months, six analysts remained on the sidelines as well, and one analyst gave the stock a Sell rating. Overall the 12-month price targets average at $7.21, marking a (3.61%) downside from where shares last closed.