Analysts are bullish on Valeant Pharmaceuticals Intl Inc (NYSE:VRX) and Celldex Therapeutics, Inc. (NASDAQ:CLDX) as Valeant’s CEO has returned from sick leave and Celldex is developing the next big therapy for GBM cancer.

Valeant Pharmaceuticals Intl Inc

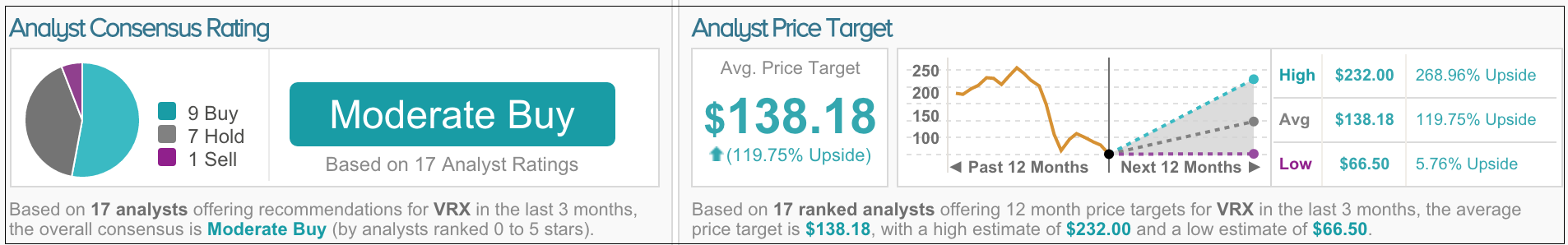

Rodman & Renshaw analyst Raghuram Selvaraju reiterates a Buy rating on Valeant Pharmaceuticals with a price target of $150.00, following the news that Mike Pearson, CEO of Valeant, has returned after he took medical leave since December 2015 due to severe pneumonia.

Selvaraju believes the return of Pearson will bring positive long term development to Valeant as the company was “built according to his strategic design.” Selvaraju believes that no one else has “as fundamental an understanding of the firm’s business.”

Furthermore, Valeant elected to withdraw its financial guidance for 2016 and canceled a courtesy conference call with sell-side analysts supposed to take place yesterday afternoon. Valeant canceled the call due to the call’s timing and purpose being leaked to Bloomberg. Additionally, Valeant disclosed an investigation by the SEC aimed at its involvement with Philidor Rx Services LLC. Selvaraju writes that yesterday’s poor stock performance can be attributed to these developments. He believes the firm should provide updated forecasts for 2016 within the coming days and believes The SEC inquiry to be limited in scope since Valeant is no longer connected to Philidor.

Valeant disclosed an Abbreviated New Drug Application (ANDA) filing by Actavis on one of its bestselling drugs, Xifaxan. Selvaraju does not believe this challenge automatically ensures “generic competition for Xifaxan near-term.”

According to TipRanks, which measures analysts’ and bloggers’ success rate based on how their calls perform, analyst Raghuram Selvaraju has a yearly average return of 0.5% and a 41% success rate. Ramsay is ranked #1559 out of 3741 analysts.

Celldex Therapeutics, Inc.

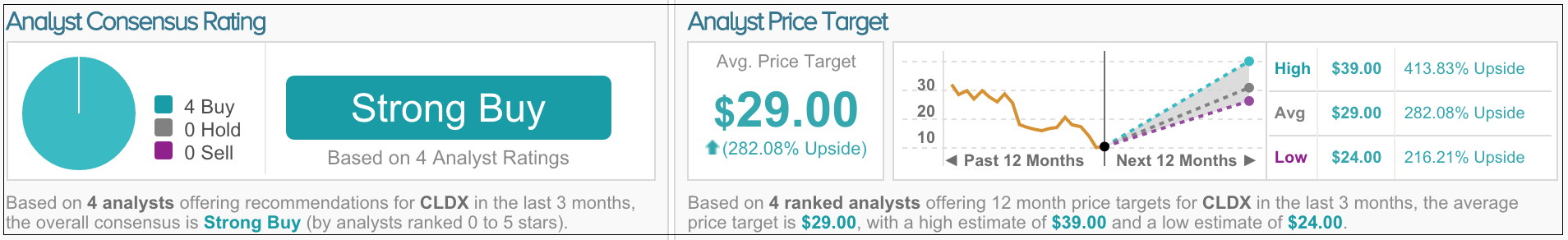

Swayampakula Ramakanth of H.C Wainwright initiated coverage on shares of Celldex Therapeutics, with a Buy rating and $25 price target.

Celldex Therapeutics is developing novel immunotherapies to fight cancer. Rintenga, the company’s lead product candidate, is the only immunotherapy able to show significant survival benefits for recurrent Blioblastoma multiforme (GBM) patients and is the only granted breakthrough designation by the FDA for treatment of GBM.

Ramakanth noted that the ongoing Phase 3 trial of Rintega should provide interim results in 1Q16 and final top-line results before the end of 2016. Ramakanth believes the study has a 75% probability of success and a positive result could boost the stock’s performance. If developed successfully, the drug could reach the market in early 2018. Ramakanth anticipates revenues for Celldex to grow from $4.5 million in 2016 to $1.24 billion in 2025.

Beyond Rintega, Celldex has important pipeline products such as glembatumumab vedotin and varlilumab, drugs used to treat triple negative breast cancer. Glembatumumab vedotin is currently in a phase 3 pivotal study for treatment of triple negative breast cancer, which Ramakanth writes has little treatment options. If the study is successful, Ramakanth believes Glembatumumab vedotin could reach market in late 2018 and achieve risk adjusted revenues of $168 million by 2025. Further, varlilumab could be used as a monotherapy for specific lymphomas and in combination with immunotherapy agents for tumors. According to the analyst, varlilumab could reach the market in 2022 and achieve risk adjusted revenues of $438 million by 2025.

According to TipRanks, which measures analysts’ and bloggers’ success rate based on how their calls perform, analyst Swayampakula Ramakanth has a yearly average loss of 30.2% and a 13% success rate. Ramakanth is ranked #3655 out of 3741 analysts.