by Sonya Colberg

Two eye-opening announcements over the last couple of days jumped shares of Second Sight Medical Products Inc (NASDAQ:EYES) above $6 per share.

The first boost came after the company announced its prosthetic eye will be featured in an episode of HBO’s “Vice” titled “Beating Blindness.”

Though its implantable visual prosthetic isn’t specifically mentioned in the show airing Feb. 26, EYES product appears to be visible in a preview.

The second boost came when EYES announced five-year data from its Argus II clinical trialwill be unveiled today, Feb. 24, during the 39th Annual Macula Society Meeting in Miami Beach.

EYES will of course happily accept all promotional effects.

But those 15 minutes of fame won’t change the very real issues that will drop this stock.

Here are TheStreetSweeper’s top four reasons investors should keep eyes wide open on EYES:

Dual Promotions Signal Potentially Dilutive Stock Offering

As the promotional efforts mentioned above attest, EYES has stayed unusually busy lately churning out press releases.

They’ve produced eight press releases since Nov. 24, with four of those released this month. The snapshot below highlights the company’s latest releases:

(Source: Company website)

While the “Vice” episode may be serendipitous, the vigorous promotions are not. Instead, we believe there’s a method to their madness. The company needs to push out a potentially dilutive stock offering. Read on to understand all the signals pointing that direction.

Cash Down, Losses Up

EYES has the old inverse relationship thing going on. Its cash has been shrinking down, down, down since the 4th quarter of 2014:

(Source: Bloomberg)

And its cumulative losses have been growing up, up, up to $167 million:

(Source: Bloomberg)

And management has happily reeled out the stock offerings.

(Source: Bloomberg)

EYES had about $21.7 million in cash in September that has been burned through at a rate of about $1.6 million per month. Figuring cash has dropped slightly below $13 million, it looks like the pressure on management to offer stock must be rising exponentially.

But it appears virtually all the stock will have to be bought by average investors rather than big banks.

Financial Backing

EYES failed to attract the eyes of well-known, solid institutions for its initial public offering in November 2014. So it resorted to going with MDB Capital, which takes on tech companies with extreme risk of failure to commercialize or ability to reach scale.

Running the 18-year-old company has meant heavy reliance on stock offerings and debt converted to stock ever since.

EYES has pulled off limited commercialization of its Argus II system consisting of eyewear with a built-in video camera and a prosthesis implanted in the eye of patients blinded by retinitis pigmentosa. But only 15 systems were sold in the third quarter at about $148,000 each. EYES hopes to expand the system’s use to macular degeneration patients.

TheStreetSweeper previously spoke with a family dealing with macular degeneration. The patient had extreme concerns about trying such a system.

That’s not surprising. As it turns out, patients can’t just get fitted and suddenly see like a 20-year-old. Elderly patients must learn to interpret information from the device in an ordeal so challenging the FDA user manual goes into length describing the potential problems and a long list of possible side effects.

“You will have to learn how to combine the information provided by the Argus II System with your existing assistive devices (such as a dog or cane) and with the techniques you already use to cope with your visual impairment. When you use the Argus II System, it will deliver electrical stimulation to your retina that will allow you to see phosphenes (spots of light).”

But undoubtedly the biggest disappointment is this:

“… it will not restore normal vision. The system will not slow or reverse the progression of your disease… In addition, the system will not replace your normal visual aids (such as a cane),” according to the FDA.

So patients won’t see well. They will see spots of light.

Analyst

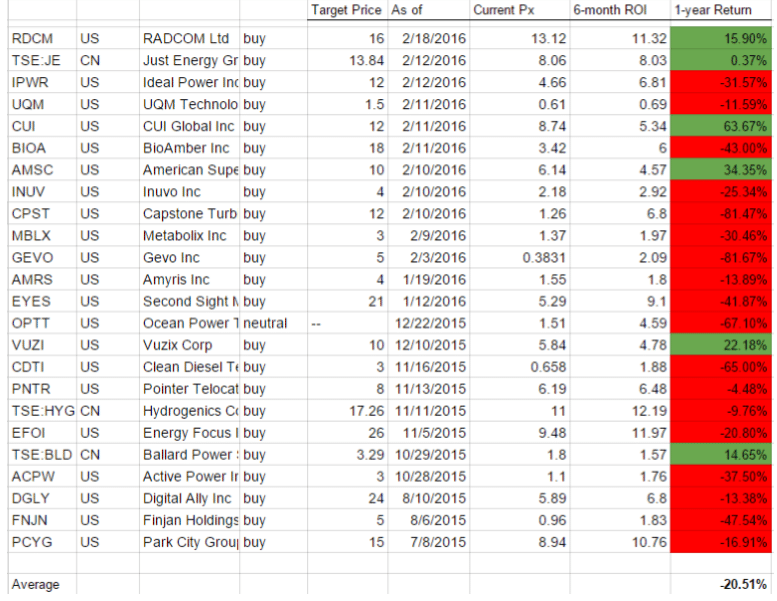

So, EYES performance hasn’t lived up to expectations, resulting in just one analyst bothering to cover the stock, offering an outlandish price target of $21. But we have no confidence in the picks of Amit Dayal, whose returns have been terrible, according to Bloomberg, as shown below.

Conclusion

With over $167 million in accumulated losses, negative cash flow through 2016 and likely beyond, along with earnings and product disappointments, EYES remains extremely risky and even more so in light of the current little stock rally. We think the stock will plunge to a reasonable valuation of $2.50 per share.

* Important Disclosure: The owners of TheStreetSweeper hold a short position in EYES and stand to profit on any future declines in the stock price.