Following earnings from tech giant Apple Inc. (NASDAQ:AAPL), analysts are eager to weigh in on decelerating iPhone sales and how this will impact its suppliers including Skyworks Solutions Inc (NASDAQ:SWKS).

Apple Inc.

Analyst Daniel Ives of FBR & Co. weighed in on Apple after the company released its Q1:16 results last night. The analyst is bullish on the company’s “respectable” December quarter numbers, as it posted iPhone unit sales of ~75 million, in line with Street estimates, “while exceeding the Street’s expectations on the bottom line” with EPS, iPhone revenue, ASPs and service revenue.

Ives states, “Cook finally ripped the band-aid off” in regards to March guidance, lowering estimates to reflect “softer 6s demand and a choppy macro” environment. Still, the analyst believes guidance was “better than feared.” Going forward, Ives states that the company will “have a few tough quarters ahead” until the release of the iPhone 7 in September, which he believes will take the stock “back into growth waters.”

The analyst also cites investor pressure on Cook to focus more on growth for non-iPhone products and to use the company’s $200 billion in cash for acquisitions. As a result of the “weaker-than expected uptake of the latest iPhone product cycle,” the analyst is lowering his revenue and EPS estimates for the next quarter from $55.6 billion to $52.3 billion and $2.33 to $1.97, respectively.

Daniel Ives reiterated his Outperform rating on the company but decreased his price target to $130 from $150 “to reflect [his] reduced estimates.”

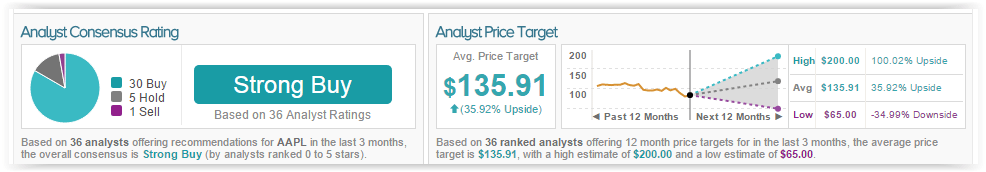

Daniel Ives has a 41% success rate recommending stocks with an average loss of -0.7% per recommendation. According to TipRanks’ statistics, out of the 36 analysts who have rated the company in the past 3 months, 30 gave a Buy rating, 1 gave a Sell rating, and 5 remain on the sidelines. The average 12-month price target for the stock is $135.91, marking a 36% increase from current levels.

Skyworks Solutions Inc

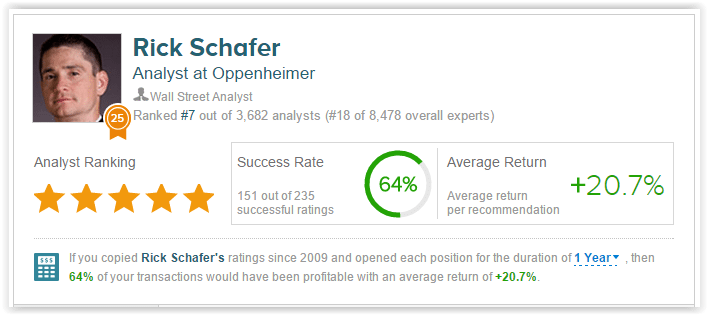

Oppenheimer analyst Rick Schafer weighed in on Skyworks ahead of its Q1:16 results, which are set to release Thursday after market close. The analyst believes the Street’s estimates of $916 million in sales and earnings of $1.58 per share remain accurate, however, analyst consensus for the next quarter has declined after other Apple suppliers, such as Qorvo and Cirrus Logic, reported a decrease in production levels.

The analysts’ estimates for SKWS’ next quarter reflect the expected 33% q/q decline in iPhone shipments. Because the company relies on Apple as its largest customer, the analyst is accounting for a 12% decline in sales this year due to decelerating iPhone sales. However, the analyst is bullish on the future of Skywork’s sales in light of increasing content for iPhones. He explains, “We estimate SWKS’ iP6s content at $5-plus and look for double digit (%) gains again in the iP7 refresh later this year. SWKS content story outside of Apple (China) appears similarly bright as handset OEMs chase iPhone performance.”

The analyst states that Apple’s March guidance, released yesterday, supports these estimates. He explains, “We view this long-discussed iPhone unit ‘reset’ as a critical overhang removed from the Apple supply chain.” The analyst expresses bullish sentiment on management’s “disciplined approach to M&A” and praises the company’s decision not to go through with the PMC-Sierra acquisition. He explains, “We continue to view SWKS as a likely acquirer of analog and/or sensor IP and expect any deal to be margin/cash/earnings accretive.” He believes that management’s decisions and “commitment to shareholder returns” in addition to “stand out growth and expanding margins” create a compelling entry point for shares.

On January 26, 2016, the analyst reiterated an Outperform rating on the company with a $120 price target.

Rick Schafer is ranked #7 out of 3,682 analysts on TipRanks. He has a 64% success rate recommending stocks with an average return of +20.7%.

Out of the 12 analysts who have rated the company in the past 3 months on TipRanks, all gave a Buy rating. The average 12-month price target for the stock is $97.27, marking a 48% increase from current levels.