Analysts from Oppenheimer and BTIG weighed in today on GoPro Inc (NASDAQ:GPRO) and Paypal Holdings Inc (NASDAQ:PYPL), commenting on strategic positioning and upcoming earnings, respectively. While one analysts is neutral on GoPro, believing they should better focus their strategy, anther is bullish on PayPal citing past earnings success.

GoPro Inc

Analyst Andrew Uerkwitz of Oppenheimer weighed in on GoPro, commenting on the company’s strategic positioning after shares plunged 25% last week. Uerkwitz reiterated his Perform rating on the stock without a price target. The analyst believes that in order for GoPro to become successful, it must provide a clearer strategy of which segment it belongs in, as “what the company is and where it’s going has been poorly articulated and seemingly has changed often.” Similarly, the analyst believes better levering of its brand will also benefit the company. Due to a shrinking capture market, Uerkwitz believes GoPro should “focus on new experiences, not replacement cycles” by entering new markets such as drones and lifelogging. He also expresses concern over rising competition.

The analyst expresses bearishness on the company’s lack of media events, a limited market for action cameras, and its slow pace of innovation. While the company did promise software updates, they “[remain] elusive.” He also lowered his revenue and EPS estimates based on decreased management guidance. He does, however, believe the company will start to turn around. He concludes, “We do believe GoPro is starting to “get” it…but has been very slow to execute. Until we see clearer signs of a sound strategy (horizontal products, possible acquisitions, instantaneous sharing app, even a media event), we will remain sidelined.”

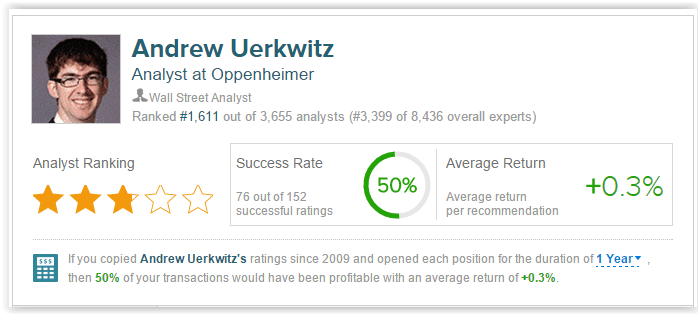

Analyst Andrew Uerkwitz has a 50% success rate recommending stocks with an average return of +0.3% per recommendation.

Paypal Holdings Inc

Ahead of PayPal’s Q4 earnings report next week, analyst Mark Palmer of BTIG weighed in on the company. The analyst cites investor caution regarding PayPal’s spinoff from eBay last summer, as they fear that “the company’s growth trajectory could flatten somewhat as a result of competition in the payments space.” The analyst states that in addition to macro-environmental factors, competition from other pay platforms such as Apple Pay, Samsung Pay, Android Pay, and platforms from Walmart and Target also contributed to a falling stock price.

Despite these concerns, the analyst believes recent initiatives to gain market share have not hurt the company. In fact, the company posted better than expected Q3 earnings and raised guidance for its full year 2015 revenue and EPS. The analyst believes investors are looking for a “show me” story regarding the upcoming earnings until the company proves itself a key player among competition. As a result, he states “the market reaction to those results may be outsized.” The analyst reiterated a Buy rating on PayPal with a $48 price target.

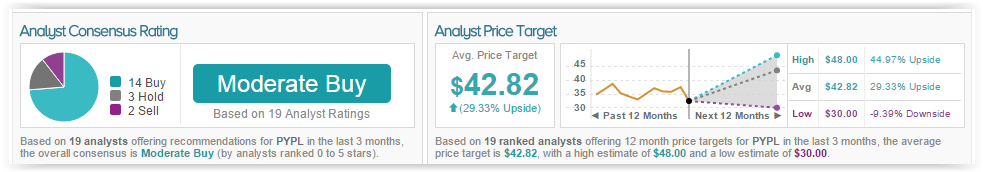

According to TipRanks, 19 analysts have rated the company in the past 3 months. Out of those 19 analysts, 14 rated the company a Buy, 2 rated it a Sell, and 3 remain on the sidelines. The average 12-month price target for the stock is $42.82, marking a 29% upside from where shares last closed.