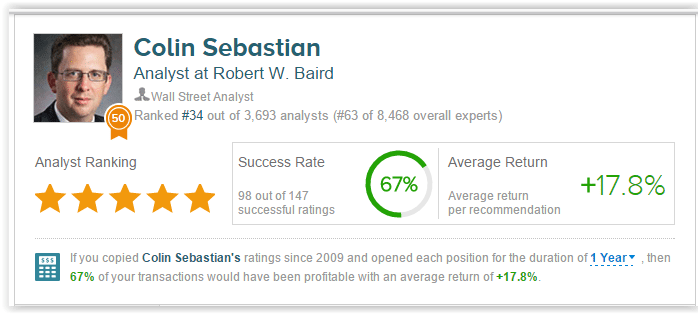

Analyst Colin Sebastian of Robert W. Baird weighed in on Chinese e-commerce giant Alibaba Group Holding Ltd (NYSE:BABA) and social media giant Facebook Inc (NASDAQ:FB), expressing bullishness for both. The analyst initiates a positive rating for Alibaba due to overall market share and capitalizing on further opportunities, and is optimistic regarding yesterday’s Oculus Rift launch for Facebook. According to TipRanks, analyst Colin Sebastian has a 67% success rate recommending stocks with an average return of 17.8% per recommendation.

Alibaba Group Holding Ltd

Sebastian weighed in on Alibaba, expressing bullish sentiment about the company’s overall health and positioning. The analyst predicts “significant ongoing revenue growth and free-cash-flow generation”, citing the company’s leadership position in the e-commerce market. According to Sebastian, Alibaba is “a high quality and differentiated e-commerce platform” and has the “world’s largest digital ecosystem”, allowing it to expand internationally. The analyst notes that although China has some macro environmental issues, it is still “the largest market for internet users” while still in the developing stages. Similarly, the analyst points to an increase in the consumer class.

The analyst is also upbeat on other opportunities for growth, such as cloud computing, its recent deal with YouKu for online video, and advertising initiatives. The analyst also believes that exaggerated GMV reports will not have a major effect the company’s revenues or cash flow

The analyst believes underperforming shares represent a compelling entry point and is initiating an Outperform rating on the company with a $94 price target.

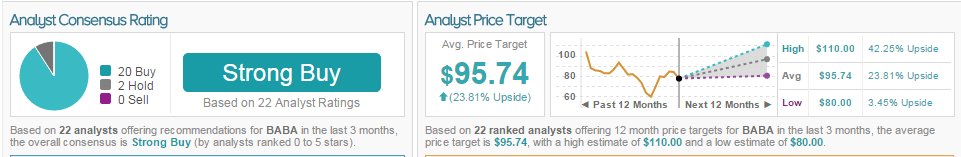

Out of the 22 analysts polled by TipRanks in the last 3 months, 20 rate Alibaba stock a Buy, while 2 rate the stock a Hold. With a return potential of 23.81%, the stock’s consensus target price stands at $95.74.

Facebook Inc

The analyst weighed in on Facebook yesterday following the start of pre-orders for its Oculus Rift Virtual Reality platform, expected to ship in March. The analyst notes a favorable supply/demand ratio and states the site is projecting orders around May. He also cites that the device’s $599 price point is at the high end of his expectations, although the company indicated that “pricing might not target the mass market.” He continues by stating that in order to own the device, a consumer would need a compatible, high-end PC with the headset which would run them upwards of $1500. As far as the overall VR trend, the analyst believes mobile VR will gain popularity first, as only “early adopters” will initially buy the expensive headsets. He believes these products will only “penetrate the mass-market” in 2017-18, when prices reach below $400. Sebastian then comments on Street estimates, believing they are too high and only achievable given Facebook lowers prices by the next holiday shopping season.

The analyst expresses optimism regarding Facebook’s lower than expected subsidization on Rift, which will mitigate “any negative impact on gross profit margins.” The analyst also states that the company will release over 20 exclusive VR games in Oculus’ initial launch, followed by another 100 games and VR apps this year. He states, “We believe this is reflective of the healthy development ecosystem for rift” and anticipates details regarding the “Facebook for Oculus” app.

The analyst reiterated his Outperform rating on the company with a $116 price target.

According to TipRanks, most of the analysts covering Facebook remain bullish on the company’s stock. A total of 34 analysts currently provided ratings in the last 3 months; 33 of them suggest a Buy, while 1 recommends a Hold rating. The 12-month consensus mean price target for the stock is $125.33, reflecting a 21.72% upside over yesterday’s closing price.