Citron has been spot-on on Twitter (NYSE:TWTR) two times already in 2018, both in a big way:

- January 26, 2018 Citron recommended TWTR at $22 with a price target of $35. On March 14 TWTR hit $37.

- March 26, while TWTR was trading at $32 Citron predicted the stock would trade down to $25. A week later, the stock traded to $26 catalyzed by the Facebook privacy scandal, as we called.

And now we present our most bold and confident analysis to date on Twitter. $TWTR will hit $52 within a year. Citron will tell the story that is hiding under Wall Street’s nose.

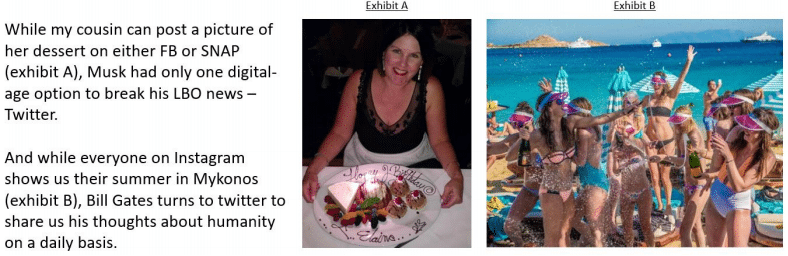

While many view Twitter solely as the preferred form of communication for the POTUS, it has become all things media and an irreplaceable part of the global dialogue. This past week, Elon Musk announced the potential for the largest LBO ever on Twitter (source), and while people were debating the quality of the financing, no one was debating the medium of the news – Twitter. No press release or Wall St. Journal article, just Twitter.

Toutiao?

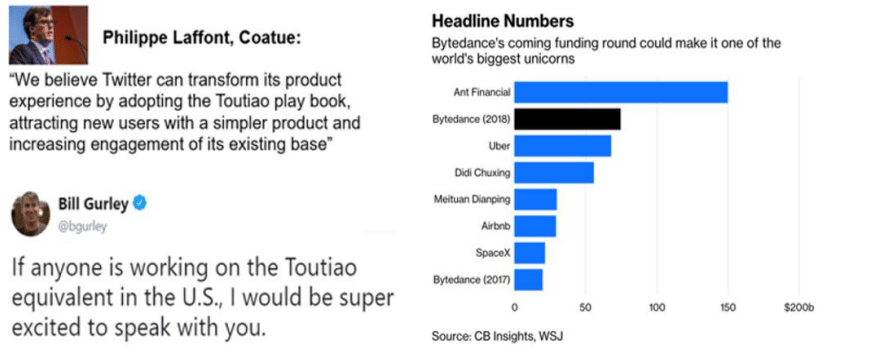

To truly understand Twitter’s potential, look no farther than Toutiao, the second largest private company in the world.

Toutiao (which is the Chinese word for headlines) is a Beijing-based news and information platform powered by artificial intelligence. Bytedance (Toutiao’s parent company) is targeting a valuation of ~$75B in its latest round of funding, a valuation larger than Uber ($68B), and second only to Ant Financial ($150B).

Twitter’s renewed focus on “headlines” was acknowledged recently, as the company redesign’s the app to give breaking headlines news first: Twitter Breaking News. This, alone, will make Twitter completely irreplaceable.

TWTR’s largest hedge fund shareholder has recently acknowledged the similarities between Twitter and Toutiao. “AI Will Transform Twitter into a $100-$200B Company” – Phillipe Laffont

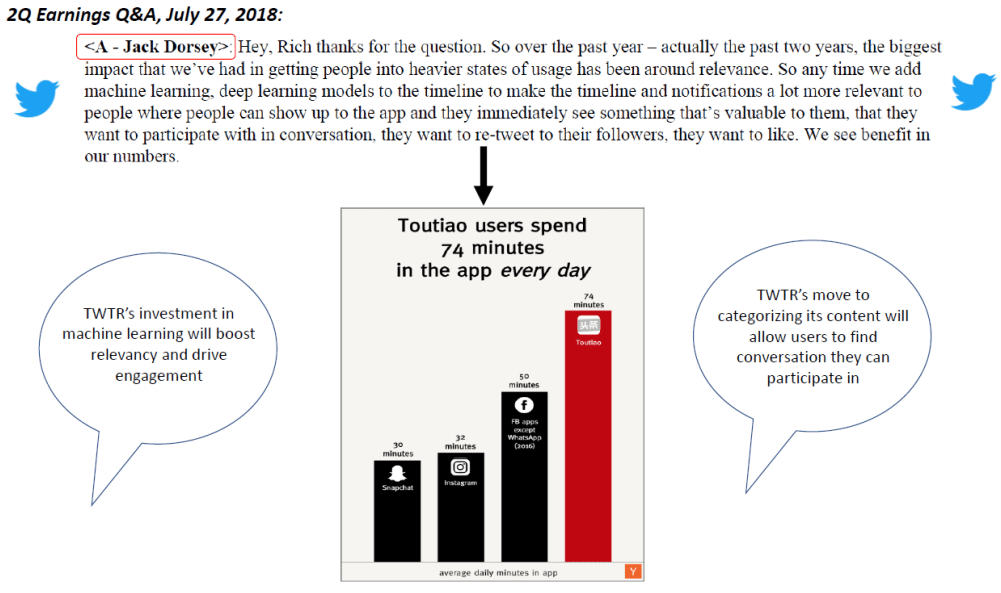

Tautiao’s success has largely been attributed to the platform’s ability to deliver personalized content via a simple user interface, something Jack and his Twitter team has been very focused on…

What has investors most excited about Tautiao is their dominance in short-form video, something that Twitter has been dedicated to as well.

The media has started to acknowledge the value in TWTR’s video content, with Barron’s featuring the company on this week’s cover:

While we believe the value of Toutiao is most certainly stretched at $75B, the mere existence of this

company will force investors to reconsider the value of TWTR’s core business, with video now making

up more than 50% of Twitter’s advertising revenue.

Twitter: All Things Media and Communication

On the surface, TWTR was a quiet part of last week’s loudest news (Tesla/Musk LBO).

But in the midst of worrying about FB’s privacy, SNAP’s relevancy and TSLA’s credibility, the Street missed an even larger story.

Most all of 2018’s most important news in finance, sports and politics has broken on TWTR! Equally as important, the ensuing conversations continued on TWTR for days, even weeks and months.

While TWTR is commonly bucketed with FB and SNAP, Citron believes TWTR actually sits alone, with no direct competitor in the exchange of thoughts. Active tweeters span from Pope Benedict to Ronaldo to Bill Gates to, yes, even the Kardashians, who would not be relevant without a Twitter feud between the two sisters this weekend. The exchange of thought has never been more relevant and the money is following.

Nothing unites the world more than music and sports. And Twitter is at the forefront of sports conversations. Just this past weekend, the media could not stop checking twitter, excited about Baker Mayfield’s debut and Tiger Woods’s chance for number 15.

Besides streaming deals with the NFL and MLB, Twitter has found ways to monetize sports video as shown through the World Cup.

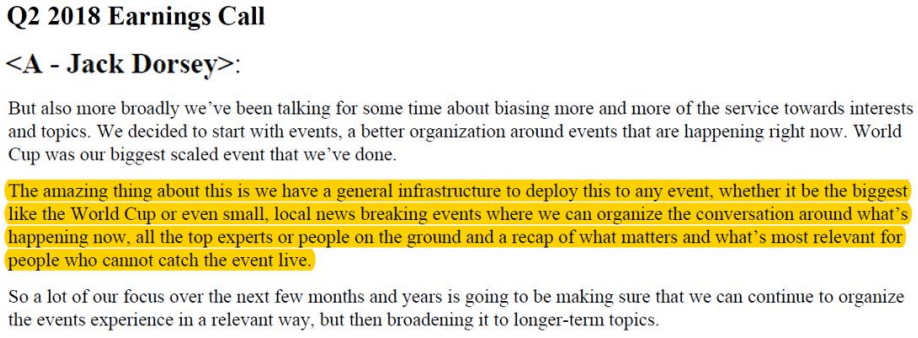

With real-time highlights, player interviews, pre and post-match press conferences, a trial program realized $30M in revenue from one event. And the infrastructure that enabled TWTR’s World Cup coverage is easily scalable. Revenue from these events will multiply as the company scales its infrastructure and masters its approach. If you don’t believe Citron, do you believe Jack? …

Lastly, Corporations are now turning to twitter as an alternative to stale customer-complaint webpages as they are looking for instantaneous responses: TWTR rocks at customer service, and analysts on the Street have failed to factor this revenue opportunity into their models.

*From this writer’s perspective, my son’s 3rd grade teacher established a twitter feed for the class to keep parents updated on homework and “what your child learned today”. Simple, but effective.

The Street Has Overly Punished TWTR

TWTR is down 33% since they reported numbers on July 27. While we understand the Streets concern over MAU growth and the cleansing of the user base, we believe much of the selloff was due to collateral damage from FB 2Q earnings, which cased FB to suffer the largest one-day decline in market cap in history.

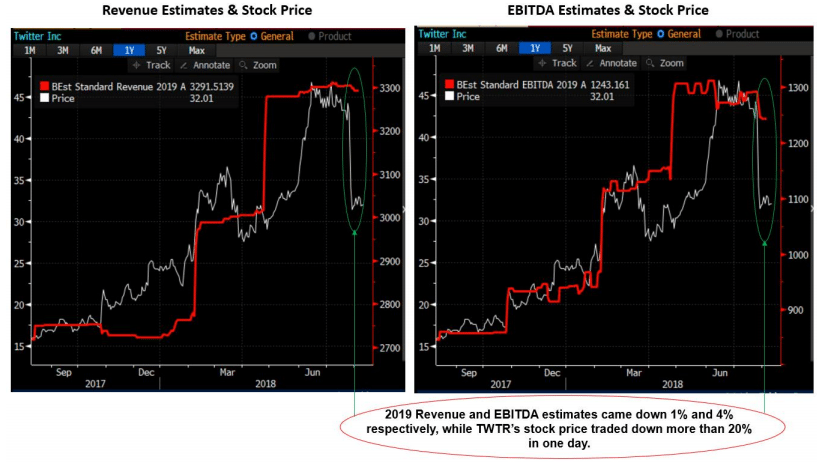

Despite beating Revenue and EBITDA estimates, and 2018 Street Revenue and EBITDA estimates coming down only ~1% and ~4%, respectively, TWTR’s stock traded down more than 20% in one day and another 3% since.

Goldman Sachs, who was TWTR’s lead left IPO advisor and who’s equity research analyst has had a call on the stock, has a $48 price target for good reason:

“[We arrive at our $48 price target by valuing TWTR on] 26x 2019E EV/EBITDA … we see disproportionately higher potential for upside to both revenue and profits as Twitter benefits from investments in the platform and leverages the optionality that exists in Twitter’s influence, data, and user base.”

Citron has a $52 price target, valuing TWTR using a 28x 2019e EV/EBITDA multiple.

Citron is not concerned about the last q and either is Dorsey. Twitter has been reorganizing the company for the next decade and the cleansing of the site is part of the process. As stated in a CNBC interview (twitter-is-restructuring):

“The change organizes Twitter into functional groups, such as engineering, instead of around

individual products, which Dorsey said in a series of tweets would help the company be quicker and

more creative over the next decade.”

Conclusion

Our earlier concerns about privacy have been quelled. FB, AMZN, and GOOG have many more privacy concerns than TWTR does. Now we can focus on what is important.

Twitter has never been more relevant than now and money follows relevancy. It is everything but a one trick pony and we are excited to watch this company evolve.

Citron still believes that Twitter has become such a part of the fabric of global communication with limited competition that it is only time before a Google, Apple, or Microsoft would like to put it in basket.