By Ophir Gottlieb

Roku Inc (ROKU) has only had four earnings releases since going public, but in that short-time, a pattern has emerged that has never been broken.

The Bullish Option Trade Before Earnings in Roku

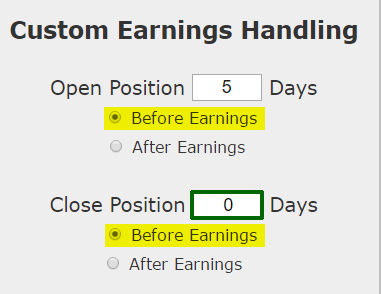

We will examine a back-test of getting long a two-week, out of the money (30 delta) call option in Roku Inc 5 trading days before earnings and selling the call before the earnings announcement.

Here’s the set-up in great clarity; note that the trade closes before earnings, so this trade does not make a bet on the earnings result because ROKU releases earnings after the market closes.

Results

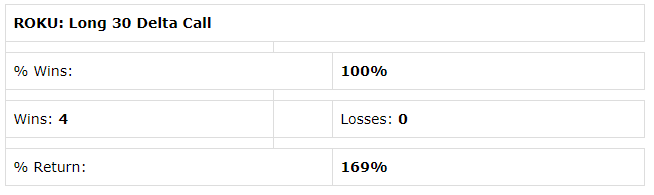

Here are the results over the last one-year in Roku Inc:

Tap Here to See the Back-test

The mechanics of the TradeMachine® are that it uses end of day prices for every back-test entry and exit (every trigger). ROKU isn’t due to have it’s next earnings release until early November, but you can set an alert for 5-trading days before the event, below:

We see a 169% return, testing this over the last 4 earnings dates in Roku Inc. That’s a total of just 24 days (6-days for each earnings date, over 4 earnings dates).

Setting Expectations

While this strategy had an overall return of 169%, the trade details keep us in bounds with expectations:

➡ The average percent return per trade was 68.4%.

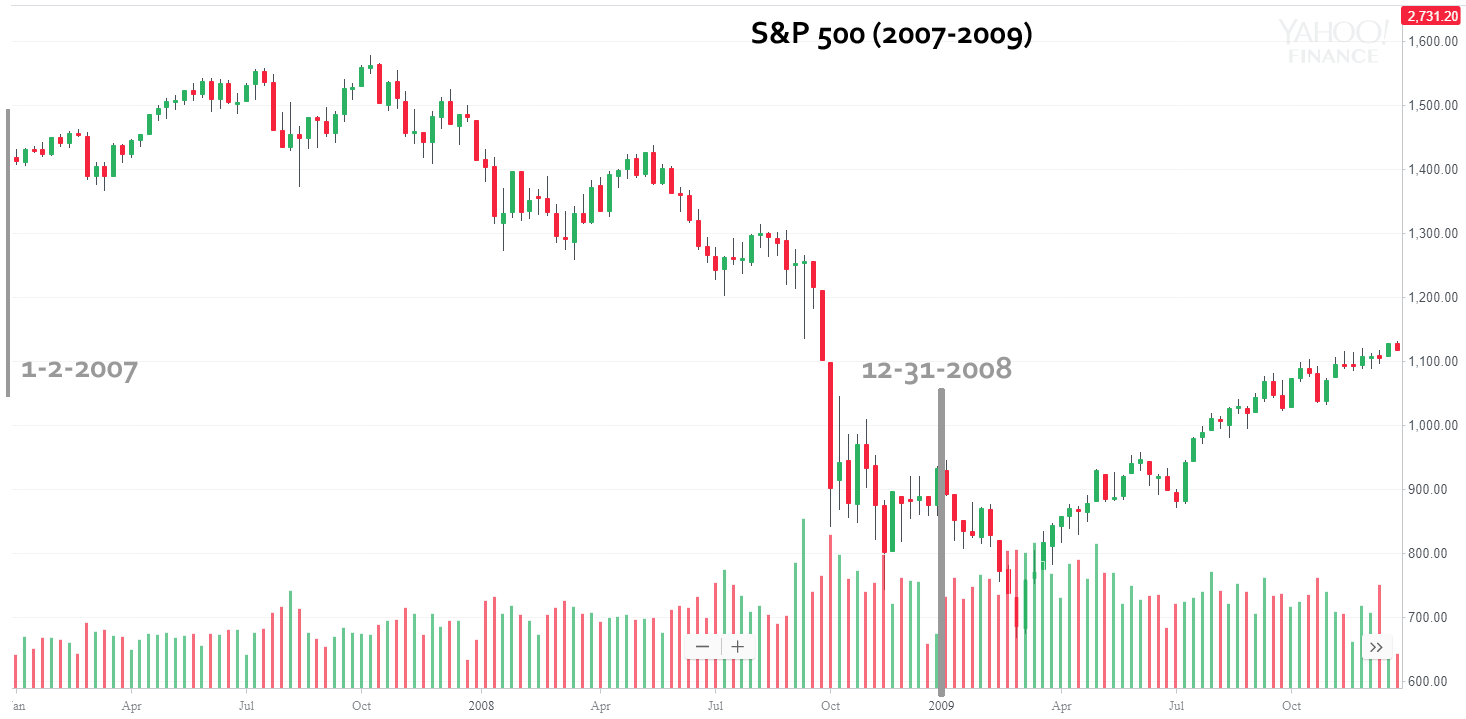

Is This Just Because Of a Bull Market?

It’s a fair question to ask if these returns are simply a reflection of a bull market rather than a successful strategy. It turns out that this phenomenon of pre-earnings optimism also worked very well during 2007-2008, when the S&P 500 collapsed into the “Great Recession.”

The average return for this strategy, by stock, using the Nasdaq 100 and Dow 30 as the study group, saw a 45.3% return over those 2-years. And, of course, these are just 8 trades per stock, each lasting 7 days.

There’s a lot less luck to successful option trading than many people realize.

Disclaimer: The author has a Long position in ROKU. The author is not receiving compensation for this article. This article is intended for informational and entertainment use only, and should not be construed as professional investment advice.