High Holy Day Is a Low Point for Check Point

Co-founder and CEO of Check Point Software Technologies Ltd. (NASDAQ:CHKP) Gil Shwed is blaming an unusual suspect for the 8% drop in company shares on Wednesday, despite beating the Street’s expectations with 2Q revenues of $458.6 million, indicating an 8.5% year over year rise. Shwed revealed that the company usually sees heightened sales activity at the end of the each quarter. However, the Jewish high holiday of Yom Kippur will coincide with the last day of Check Point’s third-quarter book. This means that the Israeli offices will be closed for a day and a half starting from the afternoon before the 25 hour fast, which starts at Sundown on September 29th.

While many are skeptical of Shwed’s claim pointing fingers at Yom Kippur for weakness, top analyst Shaul Eyal of Oppenheimer is backing the CEO’s narrative, even going as far as to praise the short-term challenge as an “attractive entry point” opportunity for investors.

The analyst remains unconcerned over the projected loss of $30 million due to Yom Kippur, stating that “Revenue guidance for 3Q17 will be temporarily impacted.” When looking at the metrics, the analyst notes that Subscriptions for Product and Blade grew by 11.9% at $256.2 million year over year with the company doing well in Asia Pacific by raising revenue 22% year over year totaling 17% of revenue.

Observing the lack of big deals last quarter, Eyal does not believe that this had any significant impact, due to the “solid performance of small-to-midsize deals balanced CHKP’s softness in high-end deal sizes.” Furthermore, the analyst views Check Point as well-positioned to tackle the growing number of ransomware attacks, writing: “The speed of innovation in the cybersecurity industry may lead to greater adoption of more reputable technologies, which we view positively for CHKP’s higher-end packages (NGTX) and SandBlast blade.”

For 3Q the analyst forecasts continued revenue growth, citing strong estimated revenue of $448.8 million along with earnings per share of $1.23, which fell in the middle of the CHKP guided 3Q revenue range. The company guided revenue between $430-465 million and earnings per share of $1.18-1.28. Eyal believes that “CHKP’s ability to innovate coupled with near-term drivers (GDPR, ransomware attacks) position the company for a strong 2H17.”

As such, the analyst reiterates an Outperform rating on CHKP with a target price to $128 with the expectation that the company will achieve “greater levels of penetration across international markets.” (To watch Eyal’s record, click here.)

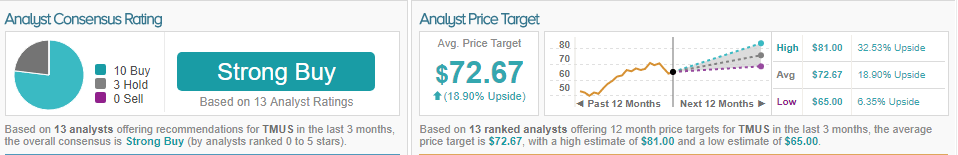

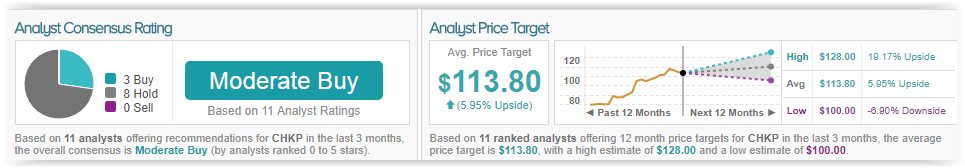

TipRanks analytics indicate CHKP as a Buy. Over the past 3 months, TipRanks polled 11 analysts regarding Check Point and has found 3 to be bullish, and 8 neutral. The consensus target price stands at $113.80, representing a nearly 6% upside from current market levels.

T-Mobile Showing No Sign of Slowdown with Significant Growth Gains

T-Mobile US Inc (NASDAQ:TMUS) reported strong second-quarter earnings, beating the Street on both share price and revenue. Company shares rose to $0.67 per share vs $0.25 a year ago, while revenue shot up to $10.21 billion vs $9.29 billion this time last year. As a result, the company’s stock also resumed movement on Wednesday, rising 0.9% and finishing at $61.97 by the closing bell. The company reported an increase of 2.2 million customers since the first quarter, which CEO John Legere attributes to T-Mobile’s unlimited data offerings. Analyst Jim Breen of William Blair notes that there is no sign of a slowdown and the company is expected to continue to gain ground in the market share race.

Breen comments that as the company readies to deploy its 600 MHz spectrum next month, he expects the company to continue to experience significant growth, praising: “T-Mobile to continue to gain market share with its strategy of creating a differentiated brand and better customer experience. As T-Mobile’s promotions have been highly successful and show no signs of slowing down, we expect the carrier to continue to gain share from the rest of the industry.”

The analyst also pointed to other factors such as the potential sale of Deutsche Telekom, which is shaking up the market and has even put a dent in the now bearish Sprint. “T-Mobile management is promoting the perspective that the wireless market is larger than four providers in an appeal to regulators,” opines the analyst, adding that the increase this quarter “was mostly attributed to a decline in churn, which was impressive given heightened competitive activity.”

As a whole, Eyal views the company’s outlook for the rest of 2017 as a positive one. As T-Mobile expects to attract an increase in postpaid subscribers with a range between 3 million to 3.6 million beating out the company’s previous expectation, Breen believes: “At current levels, we view shares as attractively valued and reiterate our Outperform rating.” (To watch Breen’s record, click here.)

TipRanks analytics indicate TMUS as a Strong Buy. Over the past 3 months, TipRanks polled 13 analysts regarding T-Mobile and has found 10 to be bullish and 3 neutral. The consensus target price stands at $72.67, representing a near 19% upside from current market levels.