On the heels of a solid fiscal first quarter beat from Alibaba Group Holding Ltd (NYSE:BABA), analyst Jason Helfstein of Oppenheimer is becoming increasingly bullish on the e-commerce giant’s prospects, commending core commerce rapidly on the rise and strength in the company’s cloud business.

In reaction to the robust quarterly earnings showcase, the analyst reiterates an Outperform rating on BABA stock while raising the price target from $165.00 to $190.00, representing a 9% rise over current trading levels. (To watch Helfstein’s track record, click here)

Notably, the giant beat out the Street on a range of metrics from total revenue to international retail revenue to EBITDA margins. While the BABA management team has maintained its revenue guidance for fiscal 2018 between 45% to 49% year over year growth, the analyst nonetheless ventures, “we believe investors are undervaluing the potential growth outlook for F18- 20.”

“We believe data-driven personalization will continue to drive users/traffic growth while increased stake in Lazada will improve Int’l retail revenue,” adds Helfstein, elaborating, “Though still small in size, Hema’s becoming a revenue-generating business (moved from Innovative Initiative to Core Commerce) opens the door for gaining share in the $180B (by 2020E) China online grocery market.”

For the first fiscal quarter of 2018, the giant brought in 56% year over year RMB total revenue growth, outperforming the analyst’s expectations by 5% and the Street by 4%. International retail revenue once again experiences triple digit year over year growth, lifting international commerce 19% above the analyst’s forecast and 13% ahead of the Street. Additionally, China Commerce outclassed the analyst by 3% and the Street by 2% while EBITDA margins also did better than expected, rising by 710bps quarter over quarter, beating both the analyst’s and the Street’s forecasts of 624bps and 497bps, respectively.

Helfstein also underscored a number of other business developments which contributed to the strong quarter, including: “Cloud business reached 1M paying users, while ARPU growing; BABA now rebating users to adopt merchant services using commission revenue; Hema exited incubation stage and reclassified in China commerce retail revenue; Lazada launched subscription-based membership in Singapore, offering free shipping and Uber VIP services; Kering’s IP lawsuit against BABA dismissed.”

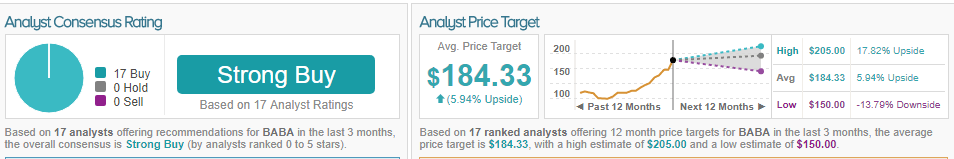

TipRanks analytics demonstrate BABA as a Strong Buy. Currently, all 17 analysts polled by TipRanks in the last 3 months are bullish on Alibaba stock. The 12-month average price target stands at $184.33 representing a near 6% upside from current trading levels.