With a net worth of $20 billion and degrees from MIT and UC Berkeley, mathematician and Renaissance Technologies founder Jim Simons is often dubbed the “world’s smartest billionaire.” The quantitative investor got his start trading commodities while working on his PhD at Berkeley and after two decades working in mathematics, launched his hedge fund in 1982. He has been named in Institutional Investor’s Alpha’s Rich List a record 17 times – the only person to be named in each year the list has been published. He has ranked number one the past two years and made an outstanding $1.6 billion in 2017.

Even by billionaire standards, Simons is unique. For most of his life, even while at Renaissance, he still was heavily engaged in high-level math work. Having lost two sons (Nick, who drowned in 2003 and Paul, who died after a bike accident in 1996), Simons looked at math as a kind of escape, saying, “when you’re really thinking hard about mathematics, you’re in your own world.”

Today, Simons plays a more passive role at Renaissance. He dedicates most of his time to the Simons Foundation, his philanthropic foundation he founded with his wife, Marilyn. The Foundation’s mission is to “advance the frontiers of research in mathematics and the basic sciences.” The Foundation makes grants to scientists and launched the Flatiron Institute in 2016 to conduct their own research.

Though Simons’ time is mostly spent away from Renaissance now, he still serves as an advisor and has a major voice at the hedge fund he founded nearly 40 years ago. The fund recently made a couple huge moves, dumping its entire position in both Advance Micro Devices (AMD) and Tesla (TSLA) for a combined $240 million.

A Big Step Back in Advanced Micro Devices

Though AMD’s stock price more than tripled between January and September, the stock has plummeted more than 40% since. Amid the fall, Simons and Renaissance completely exited to stock – more than seven million shares valued at nearly $230 million. While excitement is growing for its new 7-nanometer processing chip set to be released next year, worries over slowing demand for CPUs and semi-custom have sent the stock into a free fall.

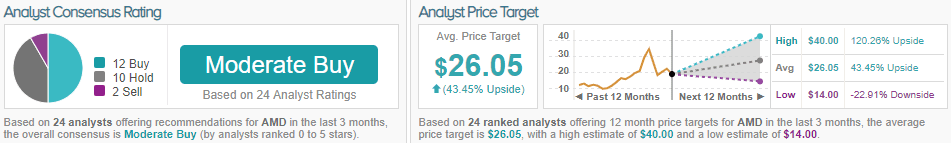

Even as investors are fleeing the stock, Wall Street analysts are still moderately optimistic about the stock. TipRanks analysis of 24 analyst ratings show a consensus Moderate Buy, with a 43% upside. Of the 24 analysts, 12 recommend Buy, ten say Hold and two recommending Sell (See AMD’s price targets and analyst ratings on TipRanks)

Simons Onloads on Tesla, Too

As Simon waves a big goodbye to AMD, he waves a smaller goodbye to Tesla. The fund fully exited Tesla, selling more than 73,000 shares for about $19.4 million. While a mere drop in the bucket for a $84 billion hedge fund, perhaps this is a sign for other investors to exit the stock, too.

Tesla’s 2018 has been mixed; while the stock is performing near market levels for the year, it has risen or fell double digits more than a dozen times. CEO Elon Musk was forced to step down as Chairman following an SEC investigation, but the company hit a few production milestones that excited investors.

While Tesla reported its best and most profitable quarter yet last quarter, the company faces new challenges in 2019. With the US Federal Tax Credit for electric cars set to decrease 50%, investors are concerned that this will contribute to a decrease in car sales, too. Analyst David Tamberrino of Goldman Sachs is also concerned that “sustainable demand for the Model 3 likely resides at the lower end of the price curve (i.e., for the not-currently-offered base price $35k variant).” Finally, Tesla continues to face rising competition from other luxury carmakers who are increasingly investing in manufacturing premium electric vehicles.

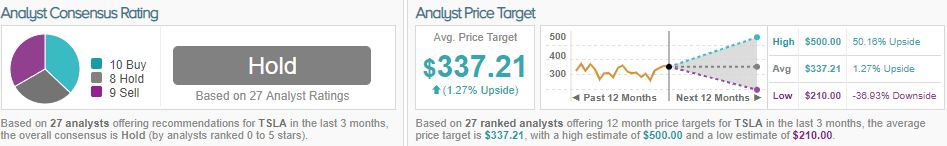

As the stock had a mixed year, it should come as no surprise that investors have mixed feelings on the company. Of 27 analyst ratings on TipRanks, there is a consensus Hold rating with 10 analysts recommending Buy, eight recommending Hold and nine recommending Sell. The analyst community is clearly perplexed what to think about Tesla, as their average price target is only 1.3% higher than the current stock price. (See Tesla’s price targets and analyst ratings on TipRanks).