Hedge fund legend David Einhorn is feeling the pressure right now. In the second quarter his Greenlight Capital fund ditched a large chunk of its Micron (NASDAQ:MU) and Apple (NASDAQ:AAPL) holdings. The crucial question now is: Will these big bear moves bring the fund better luck going forward?

Greenlight Capital is a “long-short value-oriented hedge fund.” The fund lost 5.4% in Q2, bringing its year-to-date loss to a whopping 18.3%. By contrast the market was up 2.6% in the first two quarters. Even Einhorn admitted to investors that “over the past three years, our results have been far worse than we could have imagined, and it’s been a bull market to boot.” Unsurprisingly, several investors have given up on the fund and sold out (details unknown).

In fact, the fund has performed so badly that it now holds approximately $5.5 billion in assets under management as opposed to about $12 billion back in 2014. The hedge fund manager blames the fund’s loss-making on missing Amazon, to large investments on Brighthouse Financial and General Motors- both of which have posted losses year-to-date.

“Right now the market is telling us we are wrong, wrong, wrong about nearly everything,” Einhorn wrote. “And yet, looking forward from today we think this portfolio makes a lot of sense.”

It wasn’t always this way- Einhorn’s fund generated 16.5% annualized return for investors from 1996 to 2016. And bear in mind he started with just $900,000 back in 1996. Plus the New Jersey-native isn’t doing too badly for himself. Forbes estimates his net worth at $1.52 billion (as of February 2018) making him the 18th highest-earning hedge fund manager in the world.

Einhorn is ranked #126 out of 202 hedge fund managers on TipRanks, with a 12-month average loss of 11.62%.

With this in mind, let’s now take a closer look at his most recent trades:

Micron: History Suggests Bear Turn Is Coming

Goodbye Micron. In Q2, Einhorn slashed the fund’s MU holding by 92%. He sold off 3,071,500 shares, leaving the fund with 275,500 shares valued at $14.477 million.

Given that the outlook from the Street is so bullish on MU right now, it’s worth considering what turned Einhorn so bearish on the stock’s outlook. According to the Street, Micron is a ‘Strong Buy’ stock with 18 recent buy ratings vs only 4 hold ratings.

These analysts have an average price target on MU of $83. From current levels that indicates robust upside potential of over 60%. Plus shares have been performing very well recently- year-to-date shares are up 27%, and this figure rises to 72% on a one-year basis.

However, there are fears that Micron stock is riding a very cyclical wave when it comes to memory pricing and demand. And this wave has to break soon. Stock skeptics point to the fact that Micron is at peak EBITDA margins. Following the historical pattern, this indicates a potential fallback 12 months down the line after EBITDA peaks. This is because once EBITDA reaches a high- supply adjusts accordingly with new capacity coming on line.

At the same time the current attractive valuation could be a sign of caution. On a forward EV/EBITDA basis, the stock trades at just 2.6x. But this raises the key question of whether investors are purposefully taking a back seat due to the current unsustainable EBITDA levels. No doubt Einhorn feels he has already benefitted from the stock’s recent growth spurt- and it’s best to sell before the cracks really show.

Already GS has put out a note suggest that NAND flash is oversupplied, and the outlook for NAND pricing is weaker for 3Q18 than currently. Also worrying, the note also that pricing could also soften for DRAM- a key source of chip stock revenue which has so far proved extremely lucrative (right now it accounts for about 2/3 of the company’s revenue). DRAM prices could ‘negatively inflect’ in 1H19 says GS as US hyperscale customers own more inventory. This means they can be more selective in their purchases going forward rather than simply buying without question.

Indeed, it is interesting to note that Einhorn isn’t the only hedge fund changing track on this red-hot chip stock. Hedge funds have drastically reduced MU ownership over the last 2 quarters.

Apple: The Smartphone Market Is in Decline

In Q2 Einhorn extended the bearish sentiment to Apple. He sold a whopping 486,000 shares in the consumer giant, effectively reducing the fund’s AAPL position by 78%. The remaining holding now stands at 142,100 shares worth $26.304 million.

He isn’t the only one feeling cautious about the trajectory of one of the world’s biggest stocks. Top Maxim Group analyst Nehal Chokshi has a Hold rating on AAPL. This comes with a price target of just $200- suggesting that shares can plunge by almost 8% from current levels. Apple doesn’t deserve an above peer multiple of over 15x argues Chokshi.

He made the call following Q2 earnings that revealed a worrying signal. While iPhone average selling prices (ASP) increased 20% y-o-y to $724, underlying key metrics for iPhone unit sell-out and normalized services q/q growth both came in on the weak side.

“Guidance implies iPhone unit sell-out on path to deteriorating to mid- to high- single-digit y/y declines” predicts Chokshi. In the meantime, one more quarter of high teen iPhone ASP growth should drive strong overall revenue growth. As a result, this top analyst has now lowered his iPhone sell-in estimate for the September quarter by 7% to 46.5M units (flat y/y) and sell-out estimate to 44.6M (down 2% y/y).

And longer-term the picture worsens. This is because he believes that a declining smartphone market (due to longer lifetime cycles and decreasing incremental users) will also herald the decline of iPhone selling prices. “Specifically, iPhone units & ASP will be in decline in FY19, resulting in our projection that iPhone revenue will be down 12% y/y” sums up Chokshi.

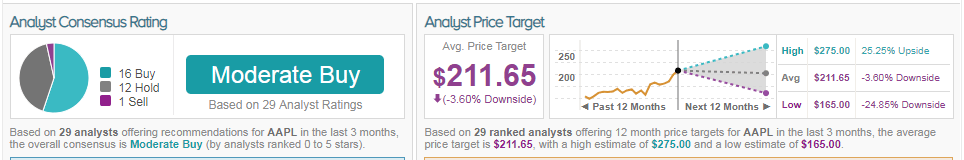

Overall, the stock sports a Moderate Buy analyst consensus rating. This breaks down into 16 Buy ratings, 12 hold ratings and 1 sell rating all within the last three months. The average analyst price target of these ratings works out at $212- just over 3% downside from the current share price.