On back of more than two decades running, multi-billion-dollar hedge fund firm Marshall Wace knows how to combine systematic knowhow with quantitative insights to trade wisely in long and short global equity investments. In a third quarter bullish turn, Marshall Wace pulled the trigger on Momo Inc (ADR) (NASDAQ:MOMO), leaning into a new holding, while bumping up his enthusiasm on Alibaba Group Holding Ltd (NYSE:BABA).

Of the leading hedge funds across the globe, Marshall Wace investors have given the firm high praise thanks to the firm’s rewarding risk management mindset coupled with the likes of transparency and infrastructure that instill assurance in each quarterly place. Worthy of note, while chairman and chief investment officer Paul Marshall and chief executive officer Ian Wace were in a position divided by a contentious Brexit, their London-based firm was a rare one to collect gains even in the aftershock of Brexit.

Let’s take a closer look at the Chinese tech stocks that grabbed the attention of Marshall Wace to the tune of millions in third quarter activity:

Momo Draws a New Bite

Momo enticed the London hedge fund firm manager to step into a new stake of 667,278 shares worth $20,686,000. However, how does Marshall and Wace’s new vote of confidence in the Chinese tech player measure up against the word of the Street, and has the new million-dollar position paid off?

Yesterday, Marshall and Wace may have been gritting their teeth as Momo shares plummeted almost 19%. While the Chinese social media stock may have outclassed third quarter expectations, the stock fell prey to disappointed investors when revenue forecasts shortchanged estimates on flat growth for paying users of the company’s live video-streaming business.

While some investors have run for the hills, the drop in share price could present a compelling opportunity to buy into the stock for a company that has been evolving from a mere location-based social network app for dating and video to a full-on user entertainment platform.

With user base that continues to fire up as the Chinese tech player steps into a new role as both a social and entertainment platform, Momo boasts roughly 91 million monthly active users. Between a live streaming feature akin to Facebook Live, a short video feature that allows the company to boost its average revenue per user by veering users to checkout, and a popular role-playing social game called Werewolf that puts monetization where lofty engagement is, Momo knows how to play the Wall Street game- and both Marshall and Wace seem to recognize that with their firm’s shrewd initiation move.

Meanwhile, Momo has position strategies weighing in its favor despite rivalry and Chinese government regulations on license and content. While some rivals have failed to meet strict requirements to score licenses like the Internet Culture Operation License and LOTAP, this Chinese social media stock has grabbed these two licenses, securing an upper hand over competitors.

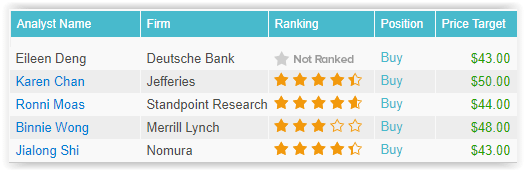

Therefore, even if the tech player is experiencing a rocky aftermath from its third quarter performance, this will not ultimately detract from the momentum that drew new bulls Marshall and Wace to the table. According to TipRanks, out of 5 analysts polled in the last 12 months, all 5 are bullish on Momo stock. With a return potential of nearly 82%, the stock’s consensus target price stands at $45.60.

Alibaba Gets a Bullish Rev Up

Alibaba hooked a 36% boost in holding from the billionaire hedge fund Marshall Wace in a positive third quarter move, where the stake rose 81,204 shares to a total holding of 308,055 shares worth $53,293,000. It seems both Paul Marshall and Ian Wace stand among good company, with two of the best performing analysts on the Street backing the upbeat investment.

In one corner of the bullish camp towers top analyst Colin Sebastian at Baird, who notes that after China’s take on an anti-Valentine’s Day shopping holiday that gives deals to singles in place of roses, the Chinese e-commerce king sailed beyond $25 billion for the event. In other words, Sebastian notes that after magnetizing the attention of a record number of singles shopping in just the span of a weekend, the company’s 40% in year-over-year gross merchandise value (GMV) gains have solidified good momentum for its third fiscal quarter performance ahead.

Notably, the analyst rates an Outperform rating on BABA stock with a price target of $210, which represents a 12% increase from current levels, highlighting that Singles Day “spotlights Alibaba’s data advantage to drive omni-channel growth.”

Keep in mind, Sebastian writes, “While offline-influenced sales are still likely a small portion of overall volume, Alibaba’s persistent knowledge of consumer purchase/viewing/browsing activity can be utilized to drive instore traffic to merchant partners and to Alibaba ‘pop up’ stores.”

Angling for robust long-term advantage, the analyst contends, “For perspective, we note that the $25B in GMV represents ~7x the online sales volume in the US on Cyber Monday, and is roughly 30% the size of eBay’s GMV for the entire year. We believe Singles Day benefits from Alibaba’s increasing focus on ‘omni-channel’ commerce (online + offline), and while promotional periods could pull forward holiday sales to a degree, the strong outcome provides additional visibility for our F3Q China commerce revenue growth estimate of ~48%. On a broader level, we continue to view Alibaba as well positioned for long-term strong growth, not only from core commerce, but also less-developed opportunities in Cloud and Media,”

Colin Sebastian has a strong TipRanks score with a 77% success rate and a high ranking of #17 out of 4,735 analysts. Sebastian realizes 26.3% in his yearly returns. When recommending BABA, Sebastian yields 47.1% in average profits on the stock.

Top analyst Youssef Squali at SunTrust echoes the bullish chorus with lofty expectations on back of the record-high Singles Day showcase, betting on upside as long as retail revenue trajectory continues to rocket forward.

This annual anti-Valentine’s Day certainly “lived up to its hype,” opines Squali, who praises a company as it “shatters” its “old record,” agreeing that beating out his 29% to 35% growth estimate “bodes well” for a robust third fiscal quarter performance for 2018.

“Strong Chinese consumer buying, 4x growth in global brands, strength in cross border trade, rise of New Retail and ubiquity of mobile drove this outsized performance, and bode well for the company’s Dec. quarter,” explains the analyst, who predicts that if “this momentum [can be] sustained,” upside is underway.

With mobile trends jumping “higher,” this only helps Alibaba’s momentum further, especially considering: “While mobile was already a big driver of prior years’ GMV growth, the percentage of Mobile GMV as a percentage of total GMV this year increased to 90%, versus 82% and 69% in 2016 and 2015, respectively. Beyond being a tailwind to growth in GMV, this trend is especially a tailwind to revenue growth as mobile take-rates have exceeded desktop take-rates in the last year,” Squali underscores.

“At this year’s Singles’ Day, brands were more ready, and better able to engage customers and improve shopper experiences to drive engagement and sales,” one of Wall Street’s top performing analysts surmises, believing macro trends will serve Alibaba gainfully “as more users get online in China and their spending rises with the growing middle class.”

Youssef Squali has a very good TipRanks score with a 72% success rate and a high ranking of #74 out of 4,735 analysts. Squali garners 19.4% in his annual returns. When recommending BABA, Squali earns 29.1% in average profits on the stock.

This Chinese tech player likewise has captivated a unanimous bullish vote on the Street, earning one of the best analyst consensus ratings in addition to the new millions from the Marshall Wace firm. Consider that TipRanks analytics reveal BABA as a Strong Buy. Based on 15 analysts polled by TipRanks in the last 3 months, all 15 rate a Buy on Alibaba stock. The 12-month average price target stands at $208.69, marking a nearly 12% upside from where the stock is currently trading.