Rob Citrone’s mentor, legendary Julian Robertson trailblazed the present hedge fund industry with his firm Tiger Management back in 1980. Robertson’s protegees have earned the nickname “Tiger Cubs,” founding hedge fund firms that would go on to take Wall Street by storm- including Rob Citrone. This “Tiger Cub” has amassed a monster $1.11 billion to his name as of last April, and now owns a cut of the Pittsburgh Steelers, thanks to his own savvy hedge fund moves. Nearly two full decades after Tiger Management’s first days, Citrone went on to found his own hedge fund firm Discovery Capital Management – a firm that prioritizes emerging markets. In the first quarter, Citrone led Discovery Capital to take a new bet on Micron Technology, Inc. (NASDAQ:MU) while cutting close to a third of the firm’s holding in Advanced Micro Devices, Inc. (NASDAQ:AMD).

The once high school wrestler knows how to grapple with an ever-changing economic backdrop. Notably, the Connecticut-based macro and long-short equity firm had hooks in over $12 billion in assets under management by the close of 2013. Discovery Capital pays attention to liquidity, valuation multiples, as well as past and future growth prospects when eyeing stock plays, pivoting to the following sectors: tech, services, basic materials, as well as financial. This sharp strategy helped Citrone’s flagship Discover Global Opportunity Partners fund to garner 27.5% in its returns five years ago and earn roughly 17% in annualized returns since its founding.

Let’s take a closer look into Citrone’s fresh Q1 shake-ups in the chip sector:

Micron Draws a New Bullish Gamble

Micron is looking good to Citrone, with the American hedge fund billionaire jumping to initiate a new position in the chip giant. Based on the latest SEC filing, Discovery Capital bought 473,838 shares worth $24,706,000. Micron has jumped 103% year-to-date, and clearly a brilliant trader like Citrone is taking notice.

For context, tech investors were hit with wildfire fears closing out 2017, with whispers that DRAM memory weakness was bound to hit this year. This especially holds relevance to MU investors, with Micron towering as one of the giant three companies taking a slice of the total DRAM market as of 2012, along with SK Hynix and Samsung. These three as of 2012 took over a 90% piece of the DRAM picture, a far change from the mid-1990s when 10 tech companies represented 80% of the total market. Therefore, Wall Street naturally got scared and MU was hit with some share volatility. That said, Micron has overall leapt in growth over the course of the last year and enough bulls argued to buy on weakness for the stock giant.

With many experts looking to artificial intelligence (AI) as revolutionizing the future, Micron has been wise to revamp its products to capture the profits here. After all, the company landed a deal with fellow chip giant Intel to team up on 3D XPoint Memory technology, which boasts 1) better memory capacity than DRAM to the tune of 10 times the density 2) endurance outclassing NAND by 1,000 times 3) speed trouncing NAND by 1,000 times the pace. MU has been smart to secure this alliance with technology primed for the AI era as well as machine learning and Big Data. The MU team angles for a 3D XPoint products launch next year. This is not even including MU’s other stellar products from 3D NAND to NOR flash drives.

While MU stares at about $8.2 billion in debt, most of this is balanced by a solid $8 billion in cash. After all, this is a tech player that knows how to bring forth colossal cash flow that continues to rise. In the second fiscal quarter, MU posted an impressive $2.2 billion and has unleashed plans for a $10 billion share buyback plan that left the Street upbeat on this chip giant’s prospects. Though buying into Micron also means buying into volatility, the upside here seems to offset any dips down the line.

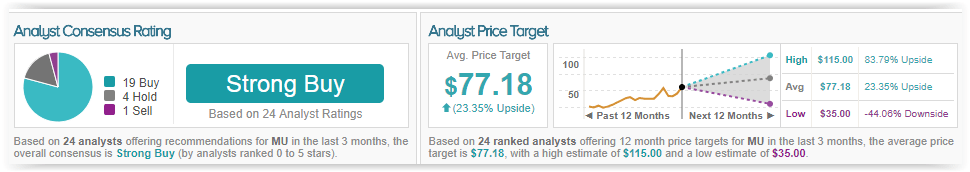

TipRanks indicates this chip giant is a Wall Street favorite. Out of 24 analysts polled in the last 3 months, 20 are bullish on MU stock, 3 remain sidelined, while 1 is bearish on the stock. With a return potential of nearly 23%, the stock’s consensus target price stands at $76.65.

Advanced Micro Devices Gets 5 Million Kicked Out

Advanced Micro Devices is a less hot stock pick these days from Citrone’s eyes, with Discovery Capital’s leader lowering the stake by 32%, selling off 5,149,492 shares in the company. Now, Discovery Capital’s holding in AMD stands at 11,143,673 shares worth $111,994,000, indicating Citrone still has a healthy amount of confidence left in the chip giant- despite the retreat.

Though the company’s short-term expectations face obstacles, especially with cryptomania volatility circling overhead for the remainder of 2018, perhaps Wall Street is underestimating AMD’s challenges. Keep in mind, the AMD team has kept its GPU revenue expectations veiled, perhaps due to the crypto headwind factor. Presenting a clear picture to investors is important, and those betting on AMD’s long-term gains will not be swayed by the near-term challenges.

AMD’s Vega leapt twice over quarter-over-quarter from the middle of its third quarter launch and meanwhile, Ryzen could be gaining double digits in growth quarter-over-quarter, translating to a prospective GPU range between $50 to $90 million in growth quarter-over-quarter. Yet, consider that the AMD team posted a flat guide for the back half of 2018, and that is withstanding its Epyc ramp. The GPU market is primed for weakness and it could be safe to anticipate dipping console growth, considering Sony’s recent commentary. Even the bulls should be anticipating the back half of the year poses downside risk potential to Street-wide expectations.

Meanwhile, competition roars with intensity, considering just last year chip giant rival Nvidia ruled the markets, from high-end gaming to workstation to datacenter. Before the crypto craze fired up Wall Street, the company’s mainstream PC gaming prospects with the Radeon 400 and 500 series simply did not measure up against Nvidia’s lineup. Then crypto enthusiasm skyrocketed through Wall Street, giving a huge boost to the company’s Polaris cards on back of last year’s alt-coin frenzy, with demand fueled practically solely on crypto enthusiasm ever since.

It is worthy of note to draw a distinction between blatant crypto mania and the actual value proposition of AMD’s chips. What comes up must come down, and when the crypto headwind hits in the back half of this year, AMD’s margins will get pressured in the process. Perhaps Citrone sees the writing on the wall for the crypto bust, ultimately bracing for impact with his backtrack in the chip giant.

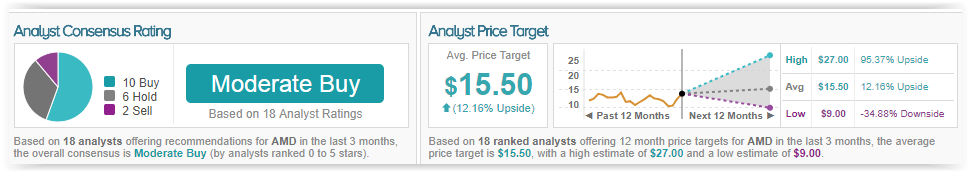

TipRanks highlights optimism circling AMD stock when it comes to sell-side analysts’ majority opinion. Out of 18 analysts polled in the last 3 months, 10 are bullish on AMD stock, 6 remain sidelined, while 2 are bearish on the stock. With a return potential of 12%, the stock’s consensus target price stands at $15.50.