David Shaw, founder of the wildly successful D.E. Shaw hedge fund, has made some risky moves in the last quarter, according to just-released 13F forms filed with the SEC. He revealed a bullish sentiment on controversial healthcare stock Valeant Pharmaceuticals International, Inc. (NYSE:VRX) and MannKind Corporation (NASDAQ:MNKD).

Computer science professor David Shaw founded one of the first quantitative hedge fund firms, D.E. Shaw in 1988. The firm’s algorithmic focus has paid off- earlier this year LCH Investments ranked the fund third in its list of the most successful hedge funds. Indeed, according to LCH, the fund has realized a whopping $25.3 billion in net gains. Interestingly, the survey pinpoints the use of sophisticated tech-based investment systems as key to the fund’s success. The fund, which recorded $43 billion in investment capital at the beginning of July, explains its key principle thus: “Our firm has been built in part by attempting to do what other companies might consider impossible, or never imagine at all. A single transformative idea that ultimately works—for a new business, a new trading model, or an improved back office process—is worth a dozen ideas that lead nowhere.”

As for Shaw himself, he is no longer actively involved in the firm’s day-to-day operations. This is perhaps unsurprising when you consider that he earned an estimated $400 million in 2016. Instead Shaw is responsible for higher-level strategic decisions affecting the investment management businesses. He has now turned his attention mainly to his role as chief scientist of D. E. Shaw Research. This involves leading an interdisciplinary research group in computational biochemistry and carrying out hands-on scientific research in this field. Indeed, Shaw is a Senior Research Fellow at the Center for Computational Biology and Bioinformatics at Columbia University and an Adjunct Professor of Biochemistry and Molecular Biophysics at Columbia’s medical school. This positions follow his own Phd from Stanford University back in 1980. Outside of his monetary gain, Shaw’s achievements have been reflected by his appointment to the President’s Council of Advisors on Science and Technology by both President Clinton and President Obama.

Bearing all that in mind, let’s now take a closer look at these two key healthcare trades:

Valeant Pharmaceuticals

In the third quarter, Shaw revealed a very bullish sentiment on controversial healthcare stock Valeant. He ramped up the fund’s VRX position by 55% with the purchase of 198,556 shares worth $8,051,000.

And according to top Stifel Nicolaus analyst Annabel Samimy this may well be a wise move. She recently reiterated her buy rating on Valeant with a bullish $35 price target. Following a dinner with VRX CEO Joe Papa she feels more confident about the stock’s outlook, saying that there was a ‘tangible state of stability’ that she had not experienced for some time. Samimy explains:

“While still prioritizing debt pay down, we also believe that VRX is in a better position to consider more balanced capital allocation that can include not only investment in its R&D pipeline and infrastructure, but also small BusDev opportunities (<$1bn), again underscoring the company’s stability and more positive outlook on its growth opportunities.”

However, it isn’t all a bed of roses for Deutsche Bank analyst Gregg Gilbert. He is also becoming increasingly optimistic on the stock but sticks with his Hold rating while lowering his price target $1 to $18. For Gilbert, VRX’s legal liabilities lurking on the horizon provide a good reason to remain cautious. “While we cannot predict the timing or magnitude of liabilities stemming from ongoing. investigations and lawsuits, we now include $500mn as a preliminary assumption (vs. none previously” Gilbert writes on November 16.

Nonetheless he adds that “we note an improving risk/reward for the stock as VRX continues to deliver on its financial expectations and proactively manage its debt load.” He also applauds the work done by the new management team in respect of returning the core franchises (Salix, Bausch+Lomb / International) to growth, and resolving some legacy legal issues.

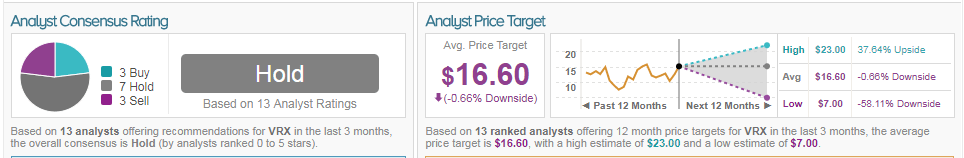

Overall Valeant has a fairly depressing outlook from the Street. In the last three months we can see that VRX has received 3 buy, 7 hold and 3 sell ratings- giving it a ‘Hold’ analyst consensus rating. Meanwhile the average analyst price target of $16.60 suggests marginal downside from the current share price of 0.66%.

MannKind

For Q3, Shaw also increased the fund’s holding in volatile biopharma MannKind. The massive 3050% rise translates into 1,188,996 additional shares for the fund worth $2,665,000.

Investors are closely tracking MNKD as the stock is on a whirlwind right now. In the last three months, prices have soared from $1.66 to an incredible $.671, before sinking back down to the current share price of $3. The stock leapt following regulation changes by the US’ regulatory body the FDA that could lead to more prescriptions. However, prices sunk once the initial elation wore off and the realization that the company’s ongoing hurdles remain.

Most of the excitement around MNKD centers on Afrezza- an ultra-fast-acting inhaled insulin that has been approved by the FDA for Type 1 and Type 2 diabetes. Afrezza is a rarity in that it ultilizes the fastest route to the bloodstream via the pulmonary arterial circulation of the lungs. Despite this, it is hard not to notice that sales have failed to deliver the volumes expected. For example for Q3, MNKD reported $3 million in sales for Afrezza- up 28% from the previous quarter- but still the company experienced a net loss of $33 million.

One big problem is that Afrezza is a relatively expensive drug, and, as it has only recently been approved, has yet to be covered by any of the major health insurers. Afrezza needs to push for coverage as quickly as possible. At the same time, the company is currently building up its marketing efforts by hiring more sales reps- but this can be a costly enterprise until results are delivered. According to the market, MNKD needs to aggressively ramp up its efforts in both these directions for the stock’s investment risk to be reduced. However, with prices back at $3 the upside potential could be compelling for some investors.

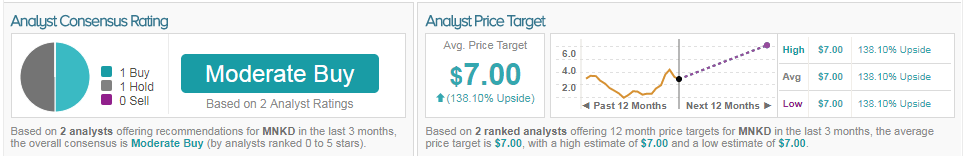

In the last three months MNKD has received just one buy and one hold rating from the Street. HC Wainwright’s Oren Livnat published his buy rating on the stock 18 days ago with a $7 price target (138% upside from the current share price).