The world-famous hedge fund tycoon David Shaw is mixing up his chip stock holdings. According to newly-released 13F forms filed with the SEC, he is now doubling down on Advanced Micro Devices (NASDAQ:AMD), while reducing the fund’s exposure to Intel (NASDAQ:INTC). This matters because Shaw is one of the most respected hedge fund minds out there- and when he acts, investors listen.

Indeed, Shaw founded the D.E. Shaw & Co fund back in 1988, following a PhD from Stanford and a teaching appointment at the computer science faculty of Columbia University. Under his direction, the fund has exploded from just $28 million to assets under management (AUM) of over $51 billion. This splits into $28 billion in alternative investments (strategies that focus on absolute returns, with low correlation to traditional assets like equities) and $23 billion of long-oriented investments focusing on major, tradeable asset classes.

Similarly, from a founding group of just six, the fund now has over 1,200 employees around the globe. This has enabled Dr Shaw to dedicate the vast majority of his time on his chief passion: science. He is chief scientist of D. E. Shaw Research, LLC, where he leads a research group in computational biochemistry. As if that wasn’t enough to keep him busy, Shaw is also a Senior Research Fellow for Computational Biology and an Adjunct Professor of Biochemistry and Biophysics at Columbia university.

Let’s take a closer look at the fund’s two recent moves now:

Advanced Micro Devices: A Historic Window of Opportunity

In the second quarter Shaw made the controversial decision to boost the fund’s AMD holding by 43% with the addition of 1,247,592 shares. Post-purchase, the fund now holds a total of 4,163,558 shares valued at $62.412 million. Bear in mind shares in AMD are already up 145% year-to-date (and even 29.5% in the last month).

Not that this troubles top Rosenblatt Securities analyst Hans Mosesmann. He has just boosted the firm’s price target on the chip maker from $27 to a Street high $30. That now indicates 19% upside potential from the current share price of $25.17. (To watch Mosesmann’s stock picks, click here)

Because of our renewed conviction post-meetings of a multi-year double digit growth profile for AMD we are raising our price target” Mosesmann wrote in an investor report. He made the move following a meeting with institutional investors that revealed a revived interest in the stock after ‘many years of disregard.’

And most crucially, AMD now has a historic window of opportunity over long-time rival Intel. This is due to an unexpected delay in Intel’s 10nm chip development. As a result, Intel will only be releasing its 10 nanometer chips in the holiday of 2019 vs the launch of AMD’s 7 nanometer chips later this year. Smaller chips are typically faster and more power-efficient. “We believe AMD has a multi-year advantage vs. Intel in CPUs with 7nm and a 6-month plus advantage vs. Nvidia in GPUs for the datacenter” the analyst cheers.

But for now, top MKM Partners analyst Ruben Roy is staying sidelined. Although he has boosted his price target from $13.50 to $20, he believes that high expectations are already baked in to the current share price- and that the stock is now trading at fair value. (To watch Roy’s track record, click here)

Nonetheless he does cite a number of bullish developments for the stock: “We are raising our estimates and price target on AMD as PC and data center end market trends remain strong and, admittedly, our previous estimates did not reflect the company’s new product momentum” explained Roy. He is now assuming a 30x multiple on our new 2019 EPS estimate.

Specifically, Roy points to positive results at Intel, HP and Lenovo as indicating continued momentum in the PC market (for example, in Q2, Intel’s PC unit sales increased on a year-over-year basis for the first time in 6 years). Plus, on the data center side, NVDA’s recent July quarter results for that segment beat expectations. He concludes “We believe that the overall demand environment across data center end markets will remain strong over the next several quarters.”

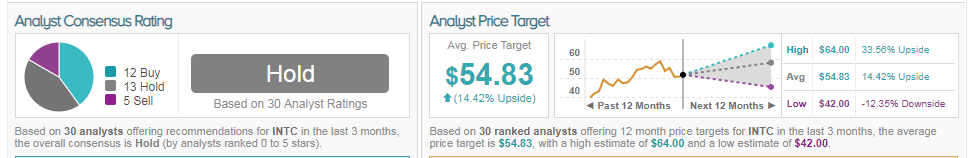

Overall this stock has a cautiously optimistic ‘Moderate Buy’ rating- with analysts split between 9 Buy ratings, 9 Hold ratings and even 2 sell ratings. Meanwhile, the average analyst price target stands at $19.35, indicating that the stock could plunge by as much as 23%.

Intel: Besieged by Problems

While AMD received Shaw’s seal of approval, Intel wasn’t so lucky. In the second quarter, Shaw drastically reduced the fund’s INTC position by 73% with the sale of 894,145 shares. As a result, the fund now has just 343,213 shares in Intel, valued at $17.061 million.

This is certainly the right way to go according to both Goldman Sachs and Northland Securities. Both these firms have a Sell rating on INTC shares, with bearish price targets of $44 (17% downside) and $46 respectively (5% downside).

Goldman Sachs’ Toshiya Hari downgraded the stock back in August, while reducing his price target from $49 to $44. He is disturbed by the company’s delay in its 10nm process technology- the exact delay that is turning the market increasingly bullish on AMD. “We see Intel’s struggles with 10nm process technology having ramifications in terms of its competitive position – across a broad set of products,” wrote Hari. (To watch Hari’s track record, click here)

Most troublingly, he is concerned that the delay in the 10nm could be reflective of deeper-rooted manufacturing issues. This could result in a long-term effect on both the company’s market share as well as spending levels in order to compete with Taiwan Semiconductor Manufacturing Company, the world’s largest dedicated independent semiconductor foundry.

And it doesn’t stop there. Top Northland Securities analyst Gus Richard spies three key issues with INTC right now. In fact, while the delays are the most prominent issues right now, Richard is more concerned about the company’s culture. “INTC’s culture is characterized as political, arrogant and disjointed by people in and around the company” he writes. Plus the design environment is in significantly worse shape than its manufacturing arm- and a ‘large impediment’ to the company’s success.

For this reason, it is crucial for the company to choose the right CEO- indeed Richard refers to this as one of the ‘most important’ decisions the company can make. Intel needs a very strong CEO to navigate these issues and focus the company. Out of all three candidates, Richard is placing his faith in Mr Tan as the only candidate that has demonstrated he can turn around a failing company. “While it is easy to succeed when dealt a winning hand, it is far more impressive to snatch victory out of the jaws of defeat” Richard wisely notes.

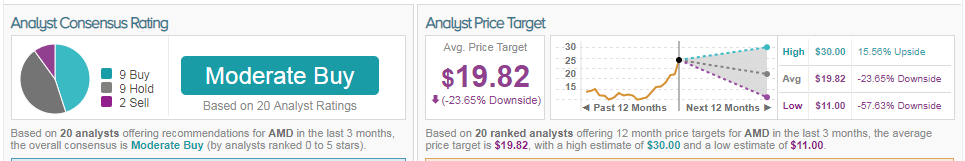

As we can see from TipRanks, the overall analyst consensus of ‘Hold’ reflects the bearish sentiment on Intel right now. Over the last three months, 12 analysts have published buy ratings on the stock, with 13 hold ratings and- most tellingly- 5 sell ratings. This comes with an average analyst price target of $54.83, indicating 13% upside from the current share price. (See INTC’s price targets and analyst ratings on TipRanks.)