Once a code-breaker for the military, Jim Simons is a known Wall Street numbers wizard for creating algorithms that spin numbers into billions and results that beat out the market. The 80 -year-old is a genius quant investor with a Ph.D. in math from Berkeley who founded private hedge fund titan Renaissance Technologies in 1982 to retire in 2009. That said, Simons continues to act as the fund’s non-executive chairman and advisor. As of February, the net worth for this numbers man was said to tower at $20 billion, by Forbes’ reckoning. Even following his retirement, Simons reaped $1.6 billion alone in 2016, which beat out his hedge fund peers that year. As of this year, the firm has hit $84 billion in assets under management.

Notably, the tech sector has captured Simons’ interest in the first quarter, where the billionaire’s firm placed a new bullish bet on Micron Technology, Inc. (NASDAQ:MU) and raised the stake on Tesla Inc (NASDAQ:TSLA).

The guru got his start running later in life, in his 40s when he founded the firm that has won him his life’s fortune. Simons is not one to hedge his bets, guiding Renaissance Technologies to bite into holdings in thousands of stock picks. Though the statistics might indicate it a pipe’s dream to realize 30% in yearly returns, this firm crunches numbers and has scored $55 billion in profits, even withstanding soaring fees. For this reason, Wall Street pays attention to Simons’ portfolio moves.

Let’s take a closer look into the hedge fund billionaire’s key tech plays in the first quarter:

Micron Entices New Vote of Confidence

The guru of profit-making algorithms has made a strong bullish leap toward one of Wall Street’s leading chip giants. Simons led Renaissance Technologies to jump right into Micron with a new position of 228,536 shares worth $11,916,000.

J.P. Morgan analyst Harlan Sur echoes the numbers wizard’s upbeat first quarter play with enthusiasm of his own, having juiced up his expectations on the chip giant on back of a stellar Analyst Day. After all, the chip giant unleashed excitement with a robust capital return reveal for a $10 billion buyback program.

Giving kudos standout execution floating above a backdrop of “solid demand” coupled with “disciplined supply,” the analyst reiterates an Overweight rating on MU stock while bumping up the price target from $80 to $82. This implies a 37% upside from current levels. (To watch Sur’s track record, click here)

“Micron is executing well on its production roadmaps and steadily closing the cost/competitive gap with its main competitors in a constructive supply/demand environment that is leading to strong free cash flow generation, resulting in the team instituting a strong capital return program,” highlights Sur in some of his main insights following the event.

Before Micron held its Analyst Day in New York, the semiconductor leader had already preannounced it third fiscal quarter results with revenue and earnings that surpassed the Street’s expectations. This is a company tracking to steam right towards roughly $10 billion in free cash flow this year, and Sur finds “confidence in industry fundamentals remaining constructive on disciplined supply bit growth and solid demand led by cloud/enterprise customers in particular.”

Micron’s management continues to be self-assured in fueling gains down the line while lifting capital expenses and R&D- and dishing out robust free cash flow generation. Accordingly, in addition to the company’s bold intent in unveiling a $10 billion share repurchase program, MU likewise intends to return more than 50% of free cash flow to shareholders. This is “a capital returns program that exceeded most investors’ expectations,” asserts Sur. The analyst continues to bet on Micron as he anticipates sustained favorability in memory fundamentals and is bullish on his calls for “solid technology, product and manufacturing execution by the Micron team,” with execution generating stellar free cash flow growth. Cash flow generation that can be sustained in turn boils down to stellar capital returns. On another positive note, the industry backdrop for DRAM and NAND looks “constructive,” from where Sur is standing.

For context, the MU team has raised its third fiscal quarter guide from a range of $7.2 to $7.6 billion in revenue up to $7.7 to $7.8 billion and for EPS from a range of $2.76 to $2.90 per share up to $3.12 to $3.16. Consider that this trounces the Street’s expectations looking for $7.47 billion in revenue and $2.84 in EPS.

“Micron is well on its way to becoming a systems provider vs. a component supplier of years past as a result of strong technology and product roadmap execution,” continues the analyst, impressed with a team that is pulling of quicker mature yields that assist to almost “close the cost gap in DRAM” with its main rival. Meanwhile, in NAND, Micron is serving up “cost leadership” in the arena of 64-layer products for 2018. The tech leadership is key, as it enables MU to prioritize “higher value add applications” from server and “low-power” mobile in DRAM to enterprise and cloud SSDs in NAND. With a product mix growing stronger and encouraging operational execution, the analyst sees a chip giant in good standing to “withstand ebbs and flows in memory and storage markets.”

The chip giant indicated DRAM wafer starts throughout the scope of the industry are rising, but in the bigger picture, bit output is anticipated to hover close to 20% annually. In terms of NAND, MU management calls for bit supply to hit 40% to 45% throughout the upcoming three to four years while estimates for bit supply gains align with those exhibited in 2017- even with more expensive headline capital expenses.

For the balance of the year, Micron is set to keep paying down its roughly $4.7 billion debt load and cash settle convertible debt, which reached $1.2 billion through the second fiscal quarter- and is anticipated to rise through the third and fourth fiscal quarter. The analyst accordingly angles for MU to lock a gross debt standing of around $4.6 billion, “solidly” in a net cash position closing out the year. Bottom line, “With investor focus on supply, industry demand drivers, especially from cloud service providers, remain underappreciated,” contends Sur.

Additionally, the analyst is lifting his expectations for 2018, dialing up revenue from $29.1 to $29.6 billion and EPS from $11.04 to $11.60. For 2019, the analyst sets new 2019 estimates, calling for $31.2 billion in revenue and $12.05 in EPS.

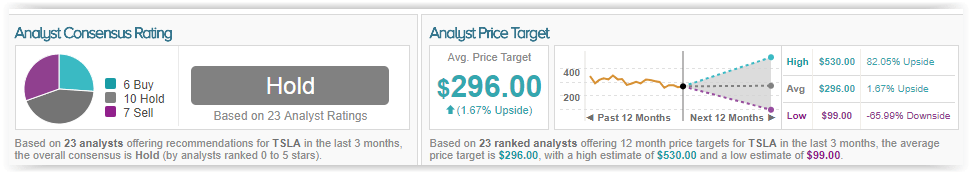

TipRanks exhibits a largely confident analyst consensus surveying the chip giant’s market opportunity. Out of 23 analysts polled in the last 3 months, 18 are bullish on MU stock, 4 remain sidelined, while 1 is bearish on the stock. With a return potential of 30%, the stock’s consensus target price stands at $77.50.

Tesla Draws a Rev Up

Tesla earns a powerful 318% boost from Simons’ Renaissance Technologies, which purchased an added 279,700 shares in the last quarter. This brings the hedge fund titan’s holding in TSLA up to 367,792 shares worth $97,880,000.

Guggenheim analyst Rob Cihra sounds off from the bulls as well, rooting for the electric car giant’s mass-market Model 3 vehicles to speed over 5,000 per week by the third quarter of this year. Once the company pulls this rabbit out of the hat, Cihra then expects the company could yield the gross margin leverage it needs to turn the switch on the losses seen in the first half of this year over to profits by the back half of 2018.

Even amid skeptical cries on the Street buzzing about hellish Model 3 production, the analyst has a Buy rating on TSLA stock with a price target of $430, which suggests a close to 46% upside from current levels. (To watch Cihra’s track record, click here)

While Tesla is clearly a master in the world of sciences, Cihra finds it high time for CEO Elon Musk’s brainchild to “prove” that it has its math together as well. This could be solved in bringing to the table positive gross margin leverage on the Model 3, especially “as production volumes ramp to absorb the big fixed-cost structure the company has been building,” writes Cihra, adding: “We think a PROFITABLE Tesla could enable a much more positive stock narrative.”

Cihra understands June is a pivotal month at play for the electric car giant but sees TSLA seemingly pacing to at last ramp Model 3 production to the 5,000 per week goal that has been in the works to kick off the third quarter. In fact, the company has “already” shot past 3,000 per week in Gigafactory battery module manufacturing last month, which once was the company’s worst culprit for opening bottlenecks. From then, TSLA has pivoted its attention to Fremont general assembly. Cihra keeps angling for Tesla to produce a peak of 35,000 Model 3s in the second quarter of 2018 and shipping 29,000, indicating a rise from the only above 8,000 hit in the first quarter and less than 2,000 achieved in the fourth quarter of 2017.

“Although 6 months later than projected, we see that 5K/week bogey nonetheless remaining critical since it is the point around which we forecast Tesla’s overall model flipping from sizeable cash-burn in 1H18E to profitability in 2H18E,” notes Cihra, who sees Model 3 volumes triggering a substantial driver for upside in revenue, margin, and free cash flow leverage from 2019 to 2020 from the large fixed-cost structure the company has been cultivating. Accordingly, the analyst is more bullish than the Street for both 2019 and 2020 to the tune of $9 to $10 more in EPS expectations.

The analyst maintains his call for Model 3 gross margins to see a rapid-fire jump in fixed-cost absorption, from his forecast of -23% in the first quarter to -2% in the second quarter to a whopping +14% come third quarter and +20% by the fourth quarters, especially once volumes run past 5,000 each week. Though the analyst comments that Tesla ultimately created its Model 3 from the beginning to reach a 25% gross margin, those margins continue to be under fire this year from “elevated startup costs.” This includes the new labor needed to bring about a full ramp. That said, the analyst is unfazed, finding a portion of these added costs will “prove temporary” and sink approaching the beginning of next year, with that balance to be swallowed by bigger units.

For Tesla shares, the analyst bets that should the Model 3 gross margin circle even close to 20% by the close of the fourth quarter, this can be celebrated as a victory, as it provides “more than enough” power to push quarterly EPS to over $2. In his calculations, Cihra foresees Model 3 gross margins tracking to achieving 25% by the middle of next year and also with the ability to “realistically” rise past 25% in the back half of 2019; especially as the giant dials up its phase-2 production nearer to 10,000 units per week.

Overall, “Because Tesla makes so much of its cars in-house (e.g., from Li-ion battery packs, inverters and electric motors, through to multiple unique components and sub-assemblies, to software, stamping, assembly, painting, etc.), we believe its proportion of FIXED costs and overhead per vehicle are particularly high, and so are driving much of its meaningful operating losses and cash-burn TODAY. The flip-side, however, is that once Model 3 volumes ultimately ramp, we believe their fixed-cost absorption should make Tesla’s LEVERAGE that much higher,” concludes Cihra.

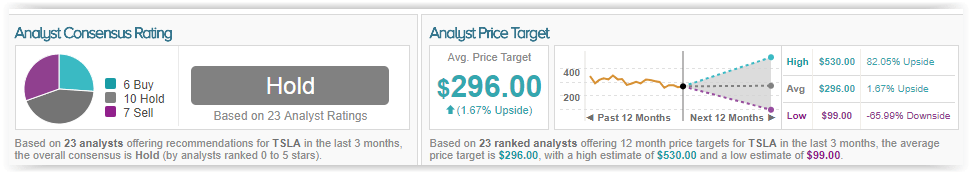

TipRanks indicates caution hangs over this auto empire. Out of 23 analysts polled in the last 3 months, 6 are bullish on TSLA stock, 10 remain sidelined, while 7 are bearish on the stock. With a return potential of just under 2%, the stock’s consensus target price stands at $296.00.